|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

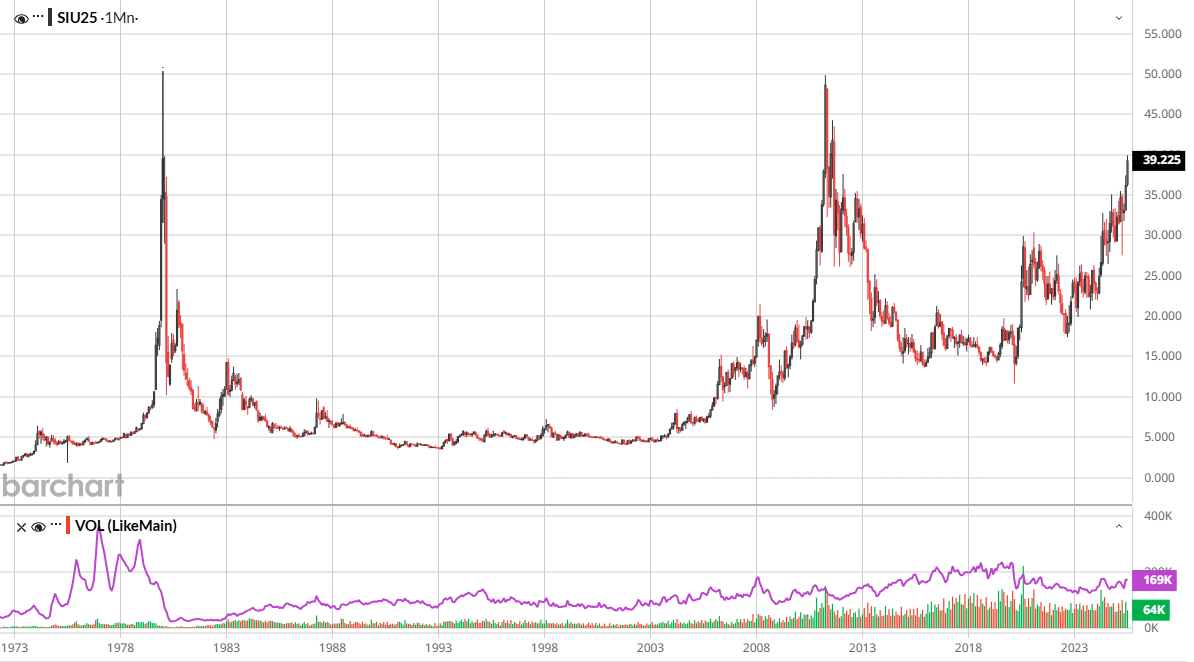

Walsh Pure Metals - Pure Hedge Division

The S&P 500 has continued to rally to new all-time highs after making a V-shaped recovery off the April low. Momentum in the stock market appears to be declining, as the S&P 500 has not had a gain of more than 1% since June 24. The stock market tends to be seasonally weak towards the latter part of summer, starting around Labor Day. At some point, the stock market will take a breather, and more money will inevitably flow into silver and gold. Both metals are already up 30% on the year. A weaker dollar and falling treasury yields have been supportive for metal prices. Looking at the silver chart, there’s a 40+ year cup and handle pattern, with the cup forming from the 1970’s to 2010 and the handle from 2010 to today. Friday’s COT showed managed money traders increased their silver position by 300 contracts to a net long position of 43,000 contracts. September silver settled at $39.503 on Wednesday. It’s pretty clear that silver will make an explosive move and test the previous highs made on April 28, 2011 at $49.50, and January 17, 1980 at $49.95, the question is when.  If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list The next Fed meeting is scheduled for July 30. CME’s FedWatch tool shows a 4.7% chance that the Fed will ease interest rates by a quarter-point, meaning there’s 95.3% chance there will be no change in interest rates. However, interest rate traders are pricing in a 60% probability of a quarter-point cut at the September meeting. An interest rate cut, or multiple cuts, this year would be bullish for metal prices and could provide a catalyst for new all-time highs. President Trump has made his disapproval of the Fed Chair, Jerome Powell, widely known. On Wednesday, July 16, there was a rumor that Powell was going to be fired, sending S&P futures lower quickly and spiking the gold market by 37 points. Managed money increased their net long gold position, on the latest Commitment of Trader’s report (COT), to 143,000 contracts, up 4,000 contracts from the previous week. For the week ending July 1, managed money was long 136k contracts. Platinum has seen rising demand due to rising industrial applications and green energy technology. Production has been sluggish despite demand, as South Africa supplies greater than 70% of the global platinum supply at ~120,000 kg for 2025, followed by Russia, which has produced ~23,000 kg this year. South Africa has faced political challenges along with electricity shortages, labor problems, and declining ore grades at its mines. Trump’s trade threats against the EU have caused supply to tighten significantly. Last week, more than 500,000 ounces of platinum flowed into U.S. warehouses, which is the second-highest inflow to NYMEX facilities on record. Borrowing costs in the London spot market have spiked to nearly 40%, when normally that rate is near 0%. If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list On July 9, the White House announced a 50% tariff on copper imports, after excluding copper from the trade barrier in April. Copper futures exploded to a new high after the announcement. Platinum is exempt from this tariff, but still has significantly increased tariff risk. The funds decreased their platinum position slightly to a long position of 14,000 contracts. LME Copper stock levels are in a downtrend from the peak made in February at 270,900 tons, compared to 124,850 tons thus far in July. The U.S imported roughly 6 months of copper supply in early 2025. As current copper supplies fall, domestic users will need to pay up for more copper under the 50% tariff. In copper, the funds added just shy of 1,000 contracts, bringing their net long position above 37,000 contracts. As of July 1, the funds were long 31,000 copper contracts. Please consider the following bullish strategies:

October silver was settled at $39.66. The maximum risk is $2,965/Trade Package, profit is $12,035 if silver closes above $45.0 by expiration. August gold settled at $3,397.60. October gold settled at $3,426.20. October platinum settled at $1,453.8. The maximum risk is $3,100/contract. Your maximum profit is unlimited. September copper settled at $5.8195. The maximum risk is $687.50/Trade Package. The maximum profit $1,250/Trade Package. September Palladium settled at $1,326.90. ALL TRADES USING WEDNESDAY'S PRICES We are looking for good risk to reward ratios using option spreads for low cost to entry, for the goal of catching bigger protracted moves in the underlying futures in our opinion.“ The discussion of potential maximum profit or gain does not imply the probable outcome of these trades.” The risk is the price paid for the call or call spreads plus all commissions and fees. If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list If you’re ready to start trading, click the link below to open an account with Walsh Trading, Inc. Hans Schmit, Walsh Trading Direct 312-765-7311 Toll Free 800-993-5449 hschmit@walshtrading.com www.walshtrading.com Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member. Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

||||||||||||||||||||||||

|

|