|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Should You Grab This Growth Stock Before It Surges 46%?/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

Like most growth stocks riding the artificial intelligence (AI) wave, Datadog (DDOG) has come into the spotlight because it is rapidly growing, sticky, scalable, and capitalizing on strong industry trends in cloud and software. While the stock is down 2.4% year-to-date, it has soared 29.2% over the last six months. Datadog stock has even earned a “Strong Buy” rating on Wall Street. Let’s find out why.

About DatadogValued at $48 billion, Datadog is a cloud monitoring and observability platform. It gives companies a single place to watch over their entire technology stack — servers, databases, apps, and security systems. As a result, companies can quickly spot issues, improve performance, and keep things running smoothly. Datadog is mainly a software-as-a-service company, which means it generates recurring subscription revenue through the use of its platform and tools. Usage Growth and Retention Are ImpressiveOne of the most intriguing aspects of Datadog is its excellent retention rate. Once a company starts using Datadog’s platform and tools, it rarely leaves. In the most recent second quarter, gross revenue retention remained in the mid- to high-90% level. This emphasizes Datadog’s status as a mission-critical platform amidst ongoing cloud migration and digital transformation tailwinds. CEO Olivier Pomel stated that usage patterns in Q2 exceeded expectations, particularly among AI-native customers that are rapidly scaling on Datadog’s platform. The company has been gaining traction, owing to widespread client adoption, rapid increase in AI-native cohorts, and ongoing platform expansion. Notably, at the end of Q2:

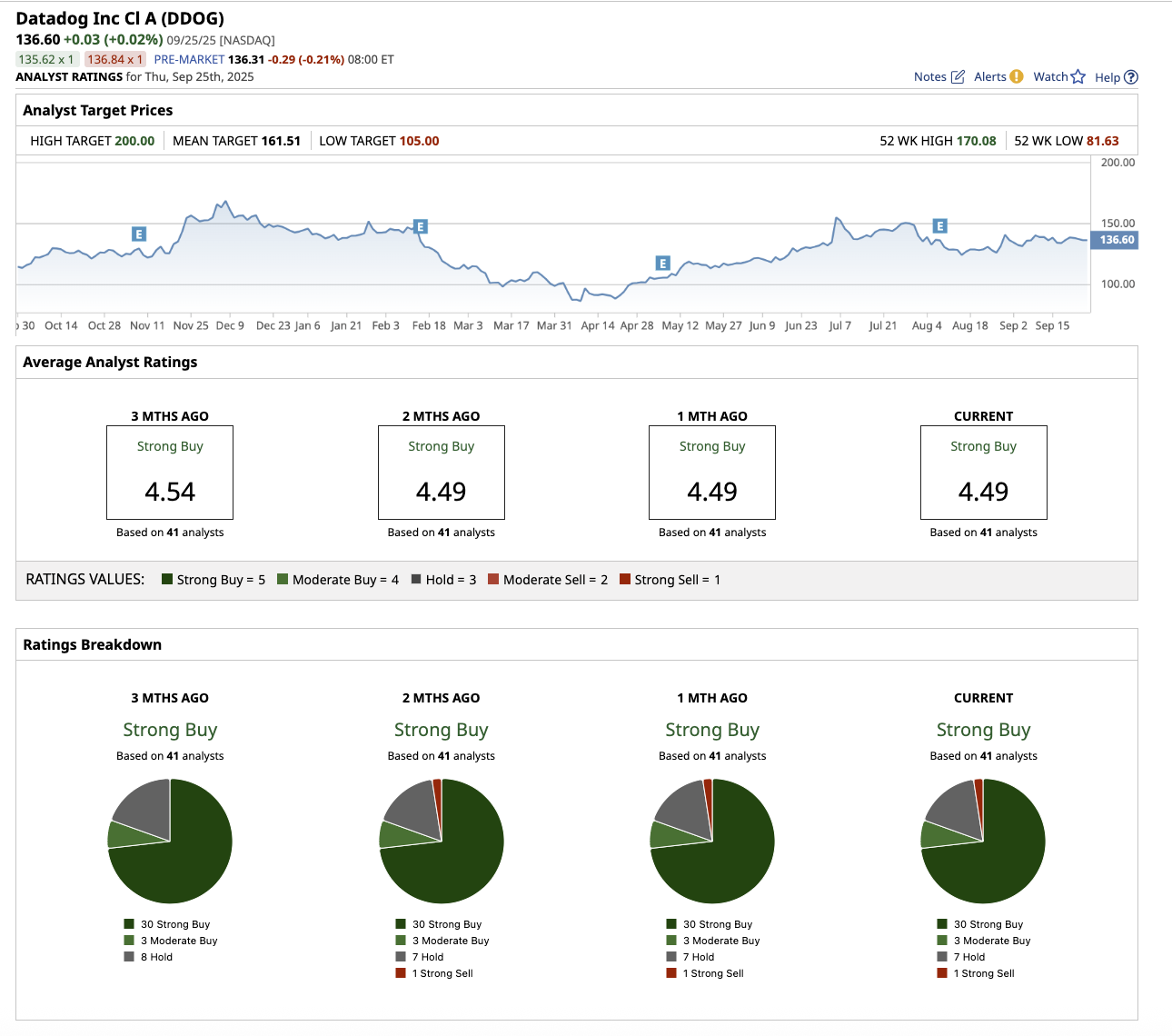

Total revenue in the quarter reached $827 million, up 28% year-over-year and above the high end of guidance, while adjusted earnings came in at $0.46 per share. Billings increased by 28% year over year to $852 million, while remaining performance obligations (RPO) rose by 35% to $2.43 billion. Large client adoption has also surged, with 3,850 customers producing more than $100,000 in annual recurring revenue (ARR), up from 3,390 last year. These high-value customers accounted for approximately 89% of ARR, demonstrating the company’s reliance on enterprise-scale accounts. Datadog ended the quarter with around 31,400 customers, up from 28,700 the previous year, which includes new additions from its Eppo and MetaPlane acquisitions. Furthermore, security is becoming a substantial contributor, with the security suite exceeding $100 million in ARR and rising at a rate in the mid-40% range year-over-year. The company announced over 125 new products and features at its DASH user conference in June. These included Bits AI Agents, AI Voice Agent, GPU Monitoring, AI Agent Console, and many more. Financially, the company remains in a strong position to fund its growth strategies. Datadog ended the quarter with $3.9 billion in cash and securities and free cash flow of $165 million. For the full year, management expects 23% to 24% revenue growth, which is impressive for a SaaS company of this size. Adjusted EPS could range between $1.80 and $1.83, in line with 2024. Analysts expect earnings to further increase by 17.3% in 2026. Valued at 63 times forward 2026 estimated earnings, Datadog stock is trading at a premium now. What Is the Target Price for Datadog Stock?Overall, Datadog stock is rated as a “Strong Buy.” Among the 41 analysts that cover the stock, 30 rate it a “Strong Buy,” three say it is a “Moderate Buy,” seven say it is a “Hold,” and one recommends a “Strong Sell.” Based on its average target price of $161.51, the stock has upside potential of 16% from current levels. Plus, its Street-high estimate of $200 implies the stock has upside potential of 44% from current levels.

The Bottom Line on Datadog StockDatadog’s aggressive innovation pipeline, notably in the areas of AI observability and autonomous agents, reinforces management’s confidence that AI is a multifaceted growth engine for the company. While near-term volatility from AI-native customers may have an impact on growth patterns, Datadog sees broad-based AI adoption as a generational opportunity that positions the company for sustained momentum. I agree with Wall Street’s opinion that this growth stock is an appealing stock to buy and hold now. However, given the stock is trading at a premium, risk-averse investors might want to wait for a favorable entry point. On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|