|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

1 ‘Strong Buy’ Growth Stock to Grab With 60% Upside

GitLab (GTLB) stock has earned a “Strong Buy” rating on Wall Street, which signals that analysts anticipate it will outperform the broader market or its sector in the near to medium term. Valued at $7.8 billion, GitLab is a DevOps platform company that offers capabilities for the whole software development lifecycle in a single application. Its all-in-one DevOps platform enables organizations to plan, build, protect, and deploy software rapidly and efficiently. GTLB stock is down 20% year-to-date (YTD), lagging the overall market gain of 13.5%. Nonetheless, its high target price implies the stock will deliver close to 60% returns over the next 12 months. Let’s find out why Wall Street believes so.

Strategic Objectives: Building a Generational CompanyWall Street’s optimism for GitLab probably stems from the company’s strengthening financials, which show strong revenue growth, improving profitability, and accelerating momentum in enterprise adoption of its DevSecOps platform. At the start of its fiscal year 2026, GitLab identified three key objectives:

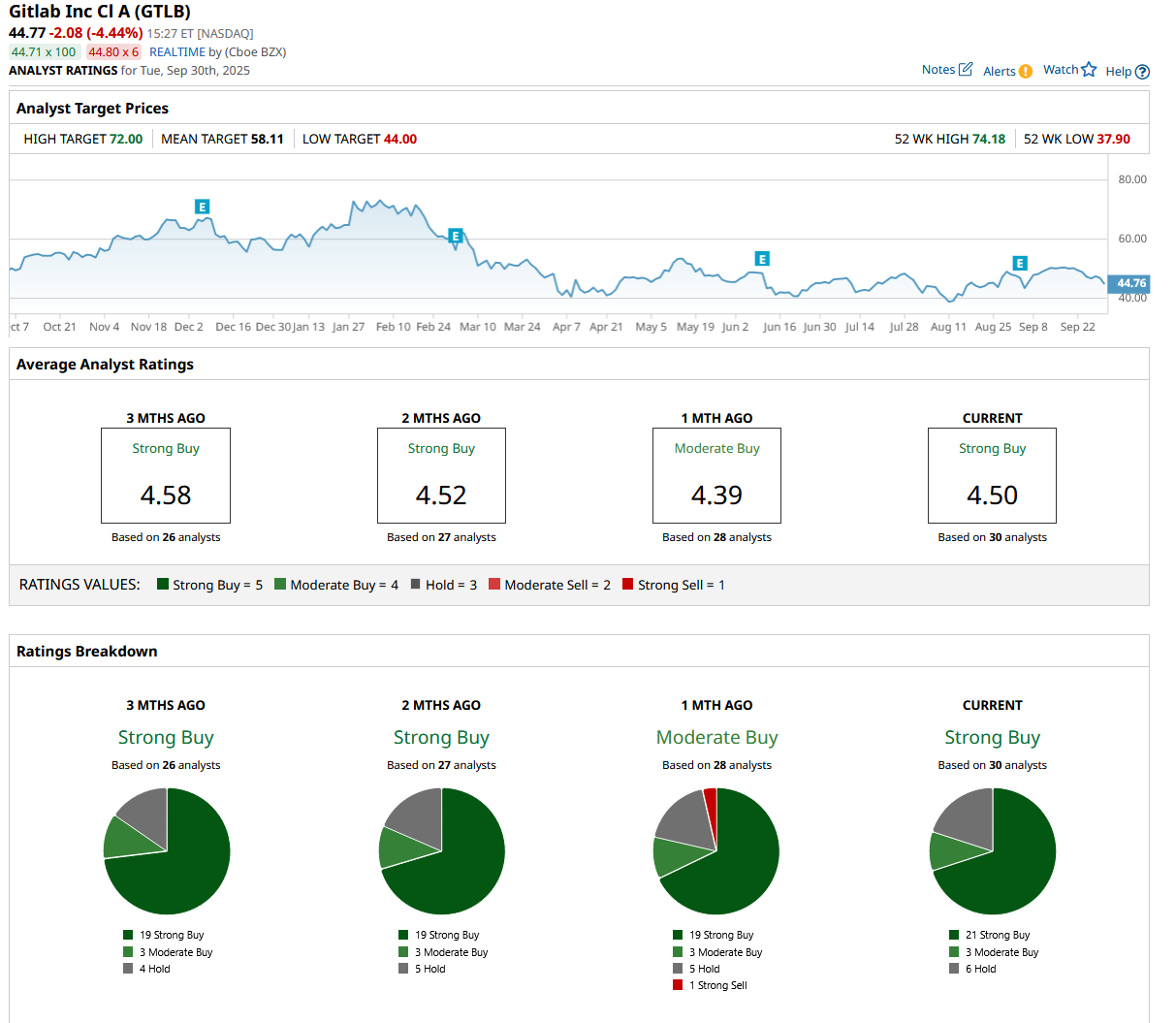

GitLab is implementing a dual-track strategy that combines both sales and product-led initiatives in order to reach more customers and ensure these customers maximize value. In addition, the company has released 72 new features across its paid tiers in recent months, including DevOps, security, and compliance. Management emphasized that GitLab's updated perspective on small business performance, combined with new leadership in its go-to-market strategy, improved the company's ability to balance growth and profitability. AI Momentum and Customer AdoptionArtificial intelligence (AI) was a recurring theme throughout the second quarter. GitLab is positioning its Duo Agent Platform as a differentiator against competitors. Management stated that customers, such as Emirates, selected Duo Enterprise over alternatives like GitHub Copilot, citing GitLab’s integrated AI capabilities. CEO William Staples underlined that GitLab's growth is still primarily driven by seat expansion (more than 70% of revenue growth), with AI and platform adoption opening up additional monetization opportunities. The company is currently transitioning from seat-based licensing to a hybrid of seats and usage-based monetization, charging for work completed by GitLab's or partners' AI agents. The Duo Agent Platform will have a customizable price structure when it launches. Customers will receive some usage included in their standard subscriptions, and they can pay as they go or commit in advance for better pricing. The company has also announced agentic collaborations with Google (GOOG) (GOOGL), Amazon (AMZN), Anthropic, OpenAI, and Cursor. In the quarter, the company also announced a CFO transition with Brian Robins stepping down to pursue another opportunity. Meanwhile, James Chen, Vice President of Finance, will serve as interim CFO. Management highlighted that ex-CFO Robins played a central role in scaling GitLab by improving margins and free cash flow. Investors will have to watch how the leadership transition works in the company’s favor. The company is confident in its ability to scale sustainably while providing shareholder value. The company generated $46 million in free cash flow during the quarter. While keeping its sales prediction, GitLab increased its profit forecast for fiscal 2026, noting solid operating leverage and controlled growth amid ongoing softness in the small-business segment. For the full fiscal year 2026, GitLab expects a 24% increase in revenue to range between $936 million and $942 million, while adjusted earnings could land between $0.82 and $0.83, a significant increase over $0.74 in fiscal 2024. Analysts who cover GTLB stock expect revenue to be in line with management’s forecasts but earnings to be slightly higher at $0.84 per share for fiscal 2026. Revenue and earnings are further expected to increase by 20.7% and 17.3% in fiscal 2027. GitLab stock is trading at a premium of 47x forward estimated earnings, reflecting the company’s long-term growth potential. By expanding AI partnerships, introducing usage-based pricing, and strengthening its leadership bench, the company aims to sustain both growth and profitability while capturing long-term value in an increasingly competitive AI software market. What Is the Target Price for GTLB Stock?The average target price of $58.11 implies GTLB stock can climb by 30% from current levels. Plus, its high price estimate of $72 suggests the stock has an upside potential of 60% over the next 12 months. Of the 30 analysts covering the stock, 21 rate it a “Strong Buy,” three say it is a “Moderate Buy,” and six rate it a “Hold.”

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|