|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

These 3 Biotech ETFs Have Gone Viral, and They All Offer Traders a Cure

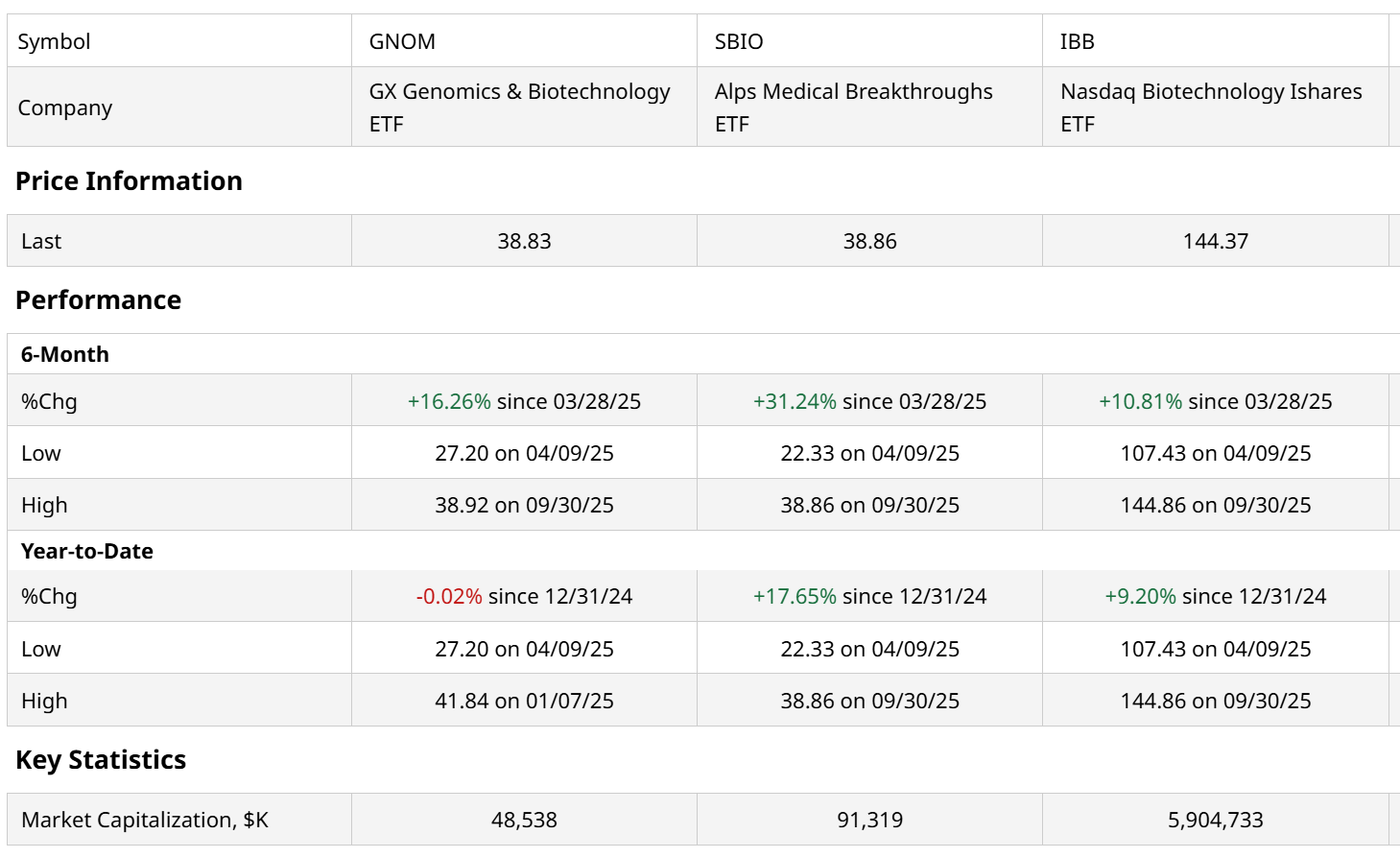

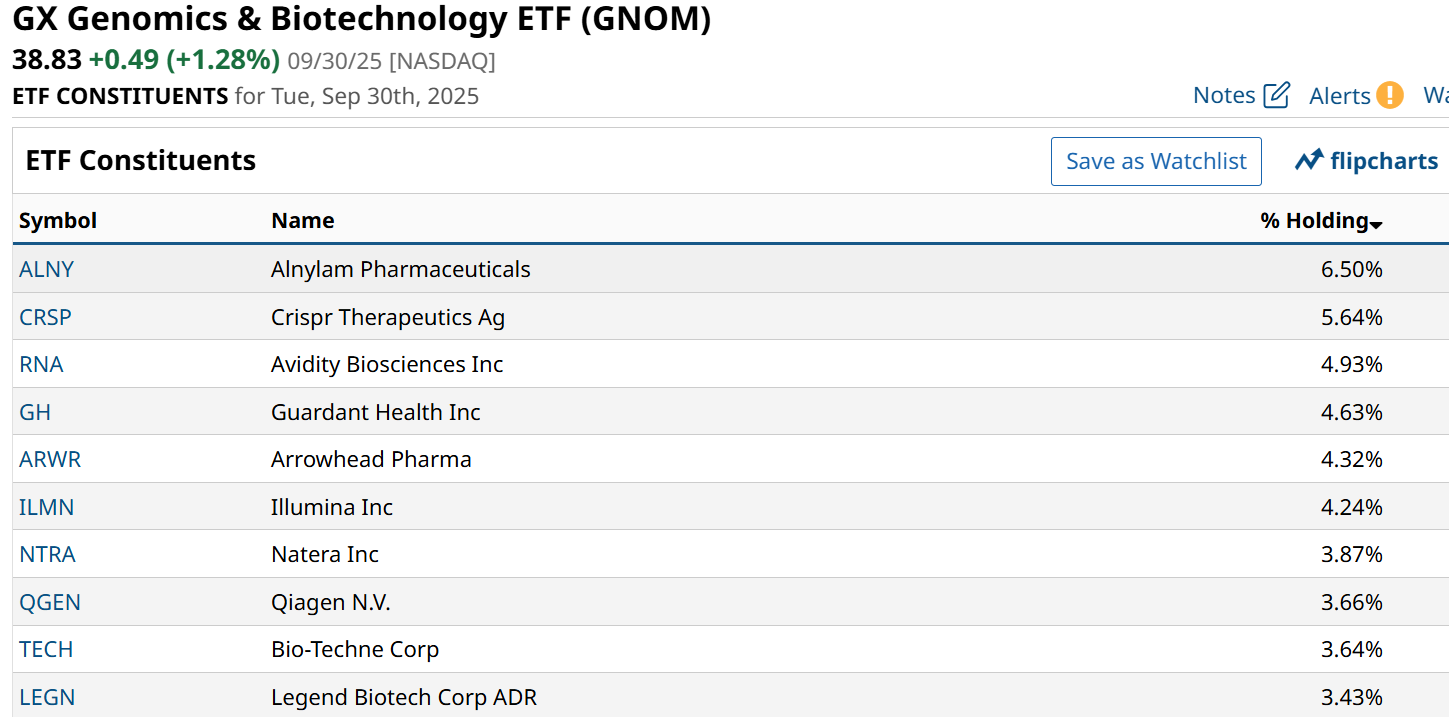

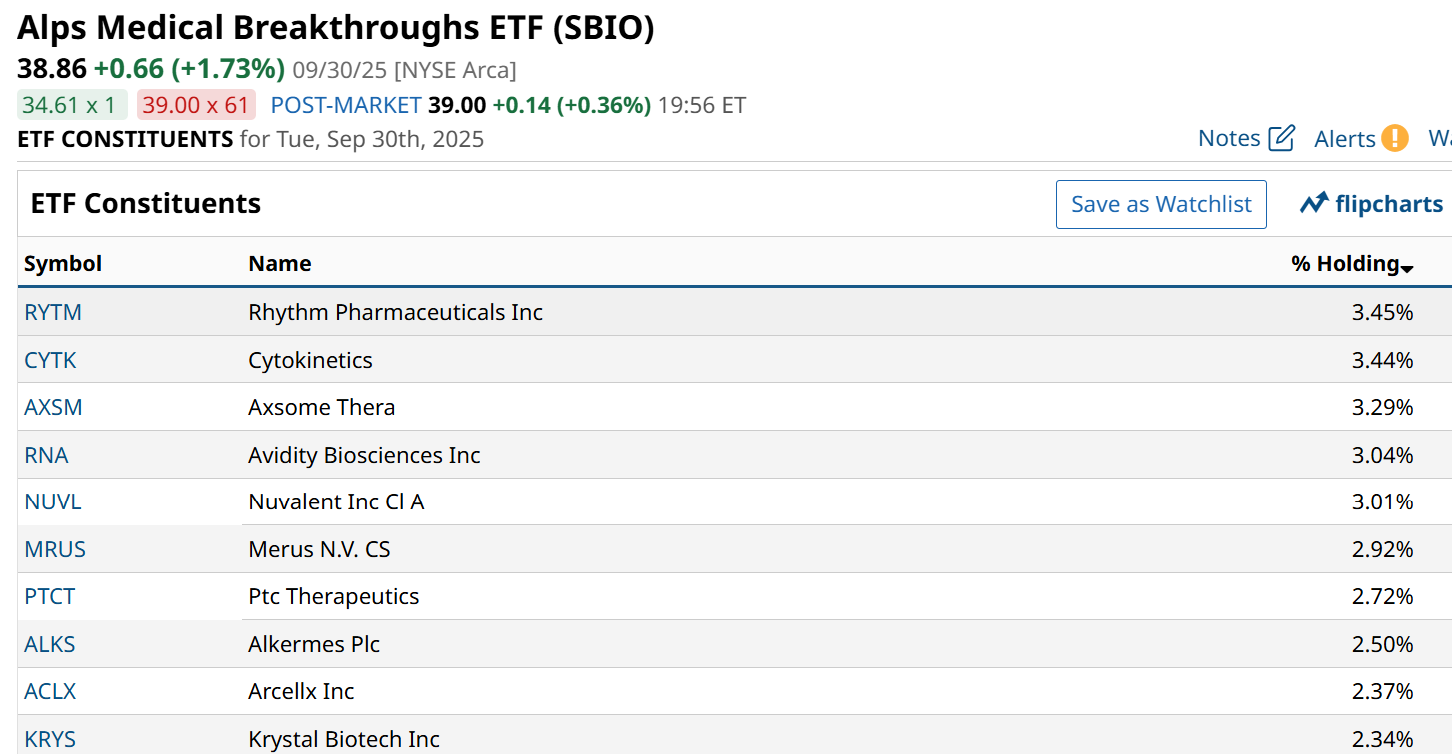

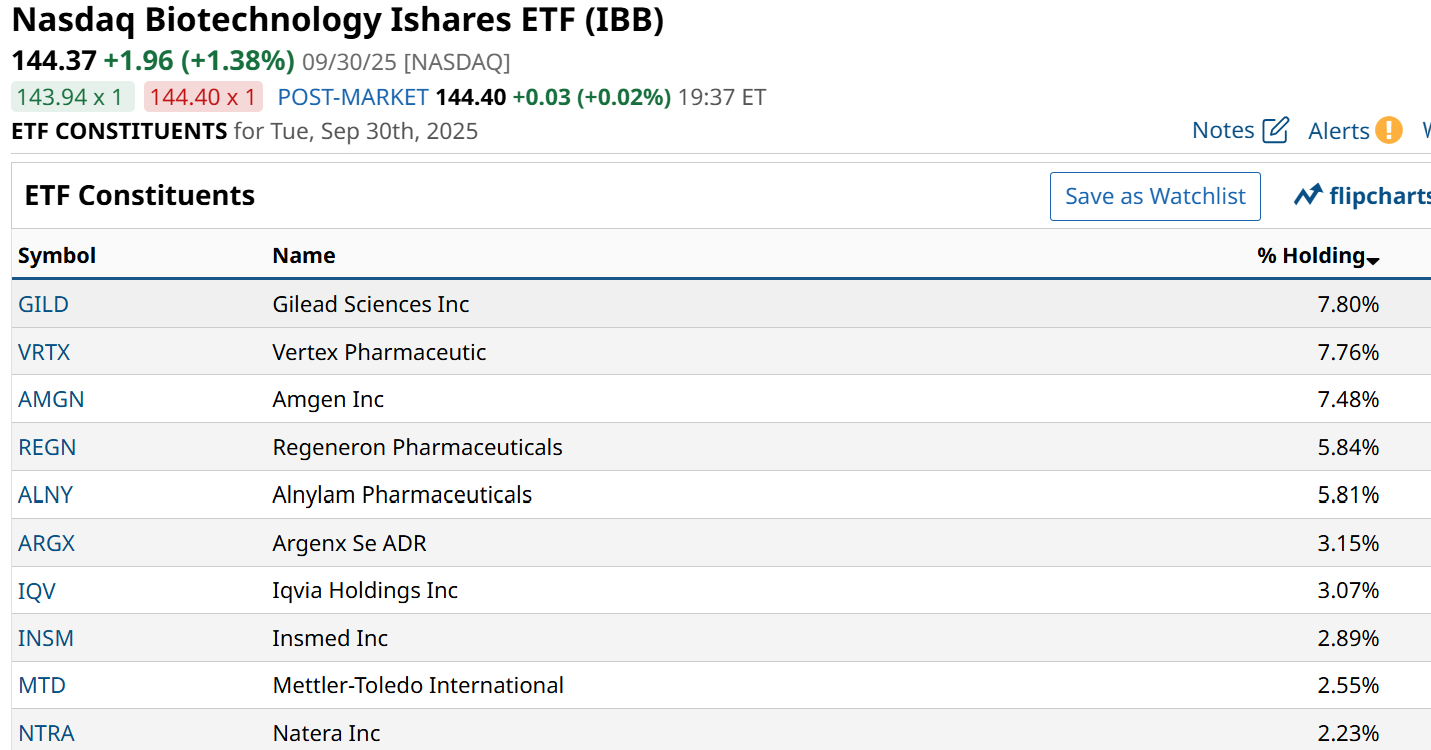

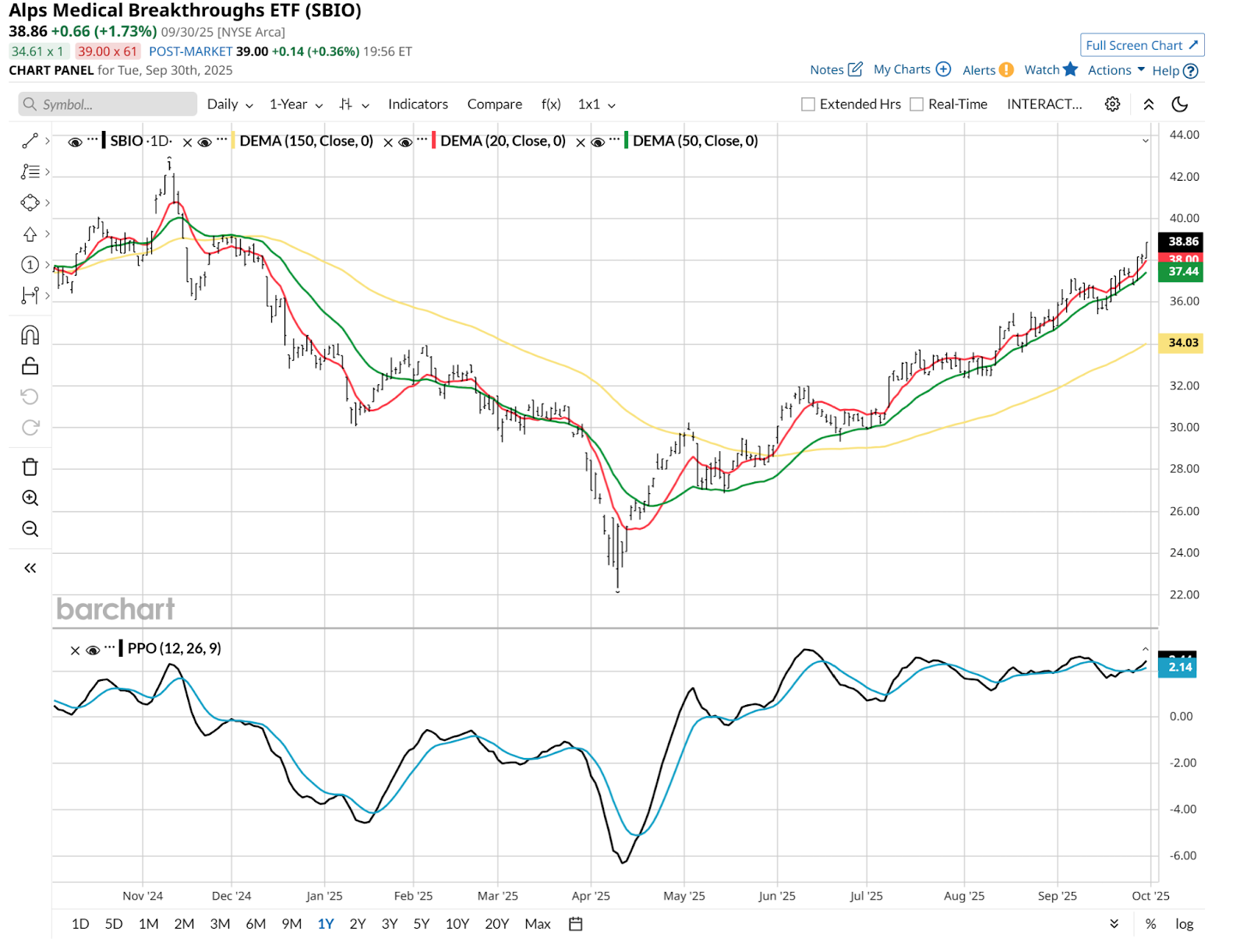

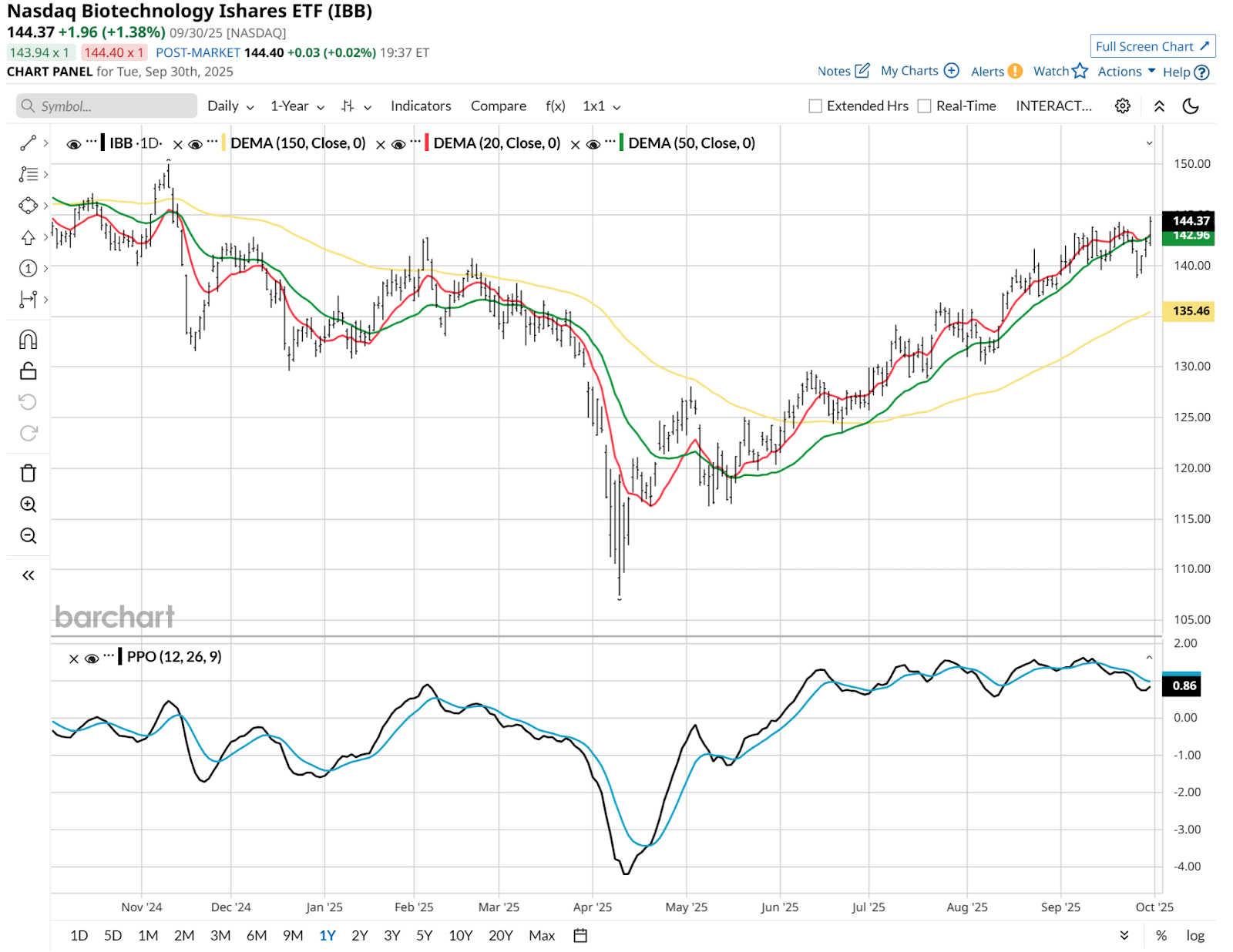

What’s the closest thing to investing in a private equity healthcare fund, where a few big winners can make us forget that the rest were even stocks we owned? I’d argue it is a pair of biotech ETFs that spread their risk, but not too much, while offering a piece of the next generation of medical advances. Here’s a summary table which includes that pair of forward-looking, upwardly mobile ETFs, as well as the largest ETF in the biotech industry.  Using that information above, and their top stock holdings by weight, let’s see what these ETFs offer. Starting with the Global X Genomics & Biotechnology ETF (GNOM), the smallest of the group at $48 million in assets. Chances are that GNOM isn’t on your dance card yet due to its small size. And you might not have heard of many of these stocks shown just below.  But the intrigue with GNOM, apart from its limited set of just 50 stocks, is that a major discovery by, or acquisition of, one of its constituents could prompt a huge jump in the ETF’s share price. It has lagged the other smaller-cap ETF in this short list but is starting to accelerate higher due a range of optimistic news flow. That includes the perception of a more accommodating U.S. government that is placing less emphasis on regulations. The Alps Medical Breakthroughs ETF (SBIO) has been a jackrabbit of a mover, up 31% since a few days before “Liberation Day” in early April. It has more ways to win in this industry, so to speak, with just over 100 stocks in its basket. And the top 10 holdings make up just under 30% of SBIO.  Compare those two small frys to the nearly $6 billion Nasdaq Biotechnology iShares ETF (IBB), and the biotech industry’s look totally changes. IBB is a top-heavy ETF, like so many large-cap funds now.  The 10 stocks we see above include a handful of well-established leaders in the space. These are some of the companies on the buy side of the mergers which are common in biotech. Finally, let’s chart them. We’d expect them to look similar, and they do. But every chart is a bit different. So we’ll explore. GNOM might have had a tough start to 2025, but it has finally recaptured that lost ground, as shown below. ETFs are a bit tougher to chart accurately versus single stocks, but this one is attempting to break out and there’s 10% up move potential to where it started this year.  As alluded to above, SBIO’s structure may offer it more octane in strong markets for biotech stocks. What is also worth pointing out is that this move since April happened amid an environment where the healthcare sector as a whole has been a big laggard. Not this part of healthcare space, however.  IBB follows the script, up to a point. These stocks tend to move less aggressively, as they are lower-beta and higher-quality. And that chart below hints of an increased chance of upside “exhaustion” in those biotech blue chips. That’s what the Percentage Price Oscillator (PPO) indicates, with its flattish appearance. The two smaller ETFs indicate potential PPO crossovers (bullish), while IBB looks more neutral from a momentum standpoint.  Biotech has been an intriguing area for investors for decades. There was a time when the entire sector was speculative. That’s no longer the case today, but it helps to know that for those looking for a little “juice” in the form of new scientific discoveries, mergers and acquisitions, and an innovation-driven modern economy, there’s a lot to offer in this industry. On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|