|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

What You Need to Know Ahead of Tyler Technologies’ Earnings Release/Tyler%20Technologies%2C%20Inc_%20logo%20on%20phone%20-by%20T_Schneider%20via%20Shutterstock.jpg)

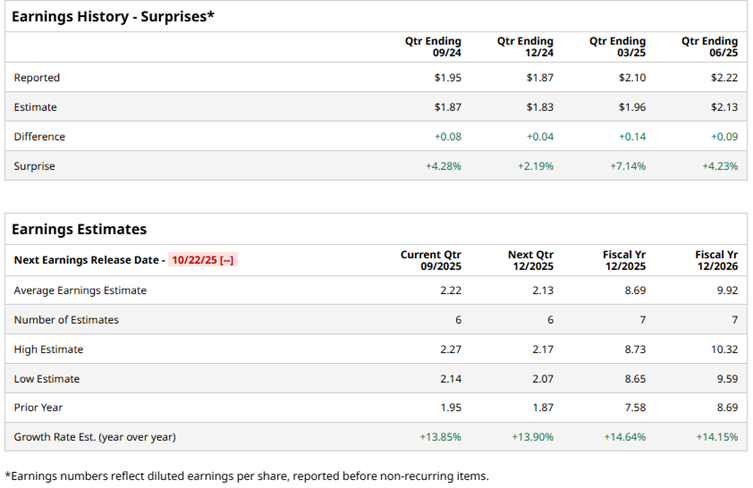

Texas-based Tyler Technologies, Inc. (TYL) is a leading provider of integrated software and technology solutions for the public sector. Its end-to-end platforms help local, state, and federal governments operate efficiently, transparently, and collaboratively with residents and across departments. By connecting data and processes across previously siloed systems, Tyler empowers clients to turn actionable insights into real-world solutions for their communities. With over 45,000 successful installations across 13,000 sites, including clients in all 50 U.S. states, Canada, the Caribbean, Australia, and beyond, Tyler’s footprint continues to grow globally. The company’s market capitalization currently stands at around $21.7 billion. Having reported its fiscal 2025 second-quarter results in July, the company is now preparing to roll out its third-quarter earnings soon. And ahead of this event, analysts are looking for Tyler Technologies to post earnings of $2.22 per share in the upcoming report, a 13.9% increase from the $1.95 per share it earned in the same quarter last year. The company has a proven track record of exceeding expectations, having topped Wall Street’s profit estimates in each of the past four quarters. For fiscal 2025, earnings are projected to rise 14.6% to $8.69 per share, up from $7.58 reported in fiscal 2024, followed by another 14.2% gain in fiscal 2026, lifting EPS to $9.92.

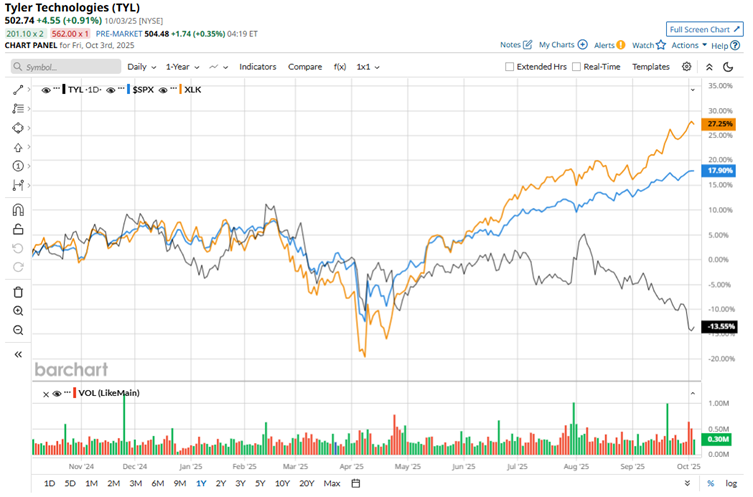

Tyler Technologies shares have lagged over the past year, dropping roughly 13.6% and underperforming both the broader market and tech peers. For comparison, the broader S&P 500 Index ($SPX) has climbed roughly 17.8% over the same period, while the Technology Select Sector SPDR Fund (XLK) surged an impressive 27.8%.

Tyler Technologies shares surged 5.4% after the company reported second quarter on July 30, comfortably beating Wall Street’s top and bottom-line estimates. Total revenue climbed 10.2% year-over-year (YOY), while adjusted EPS jumped a notable 21.2%. SaaS revenue soared 21.5%, marking 18 consecutive quarters SaaS growth of 20% or more. Transaction-based services also posted a 21.3% gain, fueled by higher volumes and new offerings. Strong gross and operating margin expansion reflected a favorable revenue mix, improved cloud efficiency, and disciplined expense management, underscoring Tyler’s ability to deliver both growth and profitability. Moreover, despite Tyler Technologies’ muted stock performance over the past year, Wall Street sentiment remains cautiously optimistic on the company. The stock holds an overall “Moderate Buy” rating, with 12 of 19 analysts recommending a “Strong Buy,” one suggesting a “Moderate Buy,” and six issuing a “Hold.” The mean price target for TYL is $679, which indicates about 35.2% potential upside from current levels. On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|