|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Rollins' Q3 2025 Earnings: What to Expect/Rollins%2C%20Inc_%20phone%20and%20website-%20by%20T_Schneider%20via%20Shutterstock.jpg)

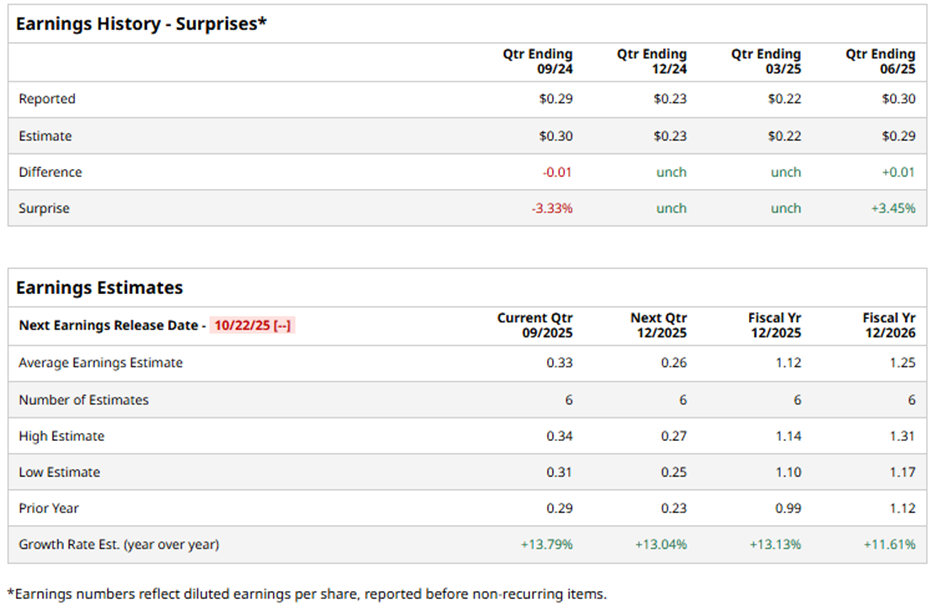

With a market cap of $28.5 billion, Rollins, Inc. (ROL) provides pest and wildlife control services to residential and commercial customers across the United States and internationally. Through its subsidiaries and franchise network, the company offers comprehensive pest, termite, and sanitation solutions to diverse industries, including foodservice, healthcare, and logistics. The Atlanta, Georgia-based is expected to announce its fiscal Q3 2025 results soon. Ahead of this event, analysts forecast Rollins to report an adjusted EPS of $0.33 for the quarter, up 13.8% from $0.29 in the year-ago quarter. It has exceeded or met Wall Street's earnings estimates in three of the last four quarters while missing on another occasion. For fiscal 2025, analysts predict ROL to report an adjusted EPS of $1.12, a 13.1% rise from $0.99 in fiscal 2024.

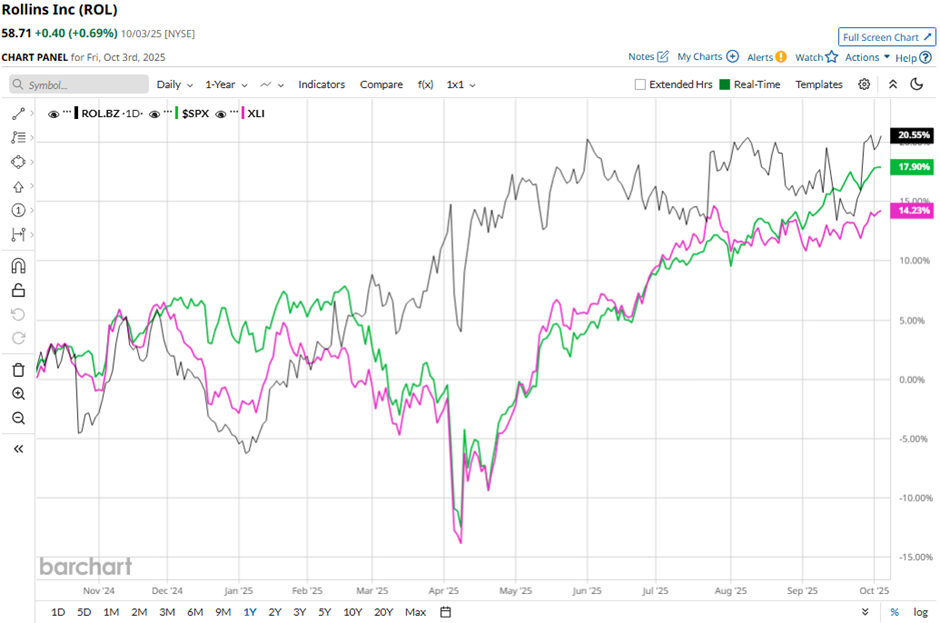

Shares of Rollins have returned 18.1% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 17.8% gain and the Industrial Select Sector SPDR Fund's (XLI) 14.7% rise over the same period.

Shares of Rollins climbed 5.2% following its Q2 2025 results on Jul. 23 as the company delivered strong financial performance, with revenue rising 12.1% year-over-year to $999.5 million, surpassing estimates. Adjusted EPS grew 11.1% to $0.30, topping expectations, reflecting solid operational execution and demand across all major service lines. Investors were also encouraged by the robust operating cash flow of $175 million, up 20.7%, and continued growth momentum supported by a healthy demand environment and disciplined capital allocation. Analysts' consensus view on ROL stock is moderately optimistic, with an overall "Moderate Buy" rating. Among 14 analysts covering the stock, seven suggest a "Strong Buy," one has a "Moderate Buy," and six give a "Hold." This configuration is slightly more bullish than three months ago, with six analysts suggesting a "Strong Buy." The average analyst price target for Rollins is $61.67, indicating a potential upside of 5% from the current levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|