|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

What You Need to Know Ahead of Allegion's Earnings Release/Allegion%20plc%20HQ%20sign-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

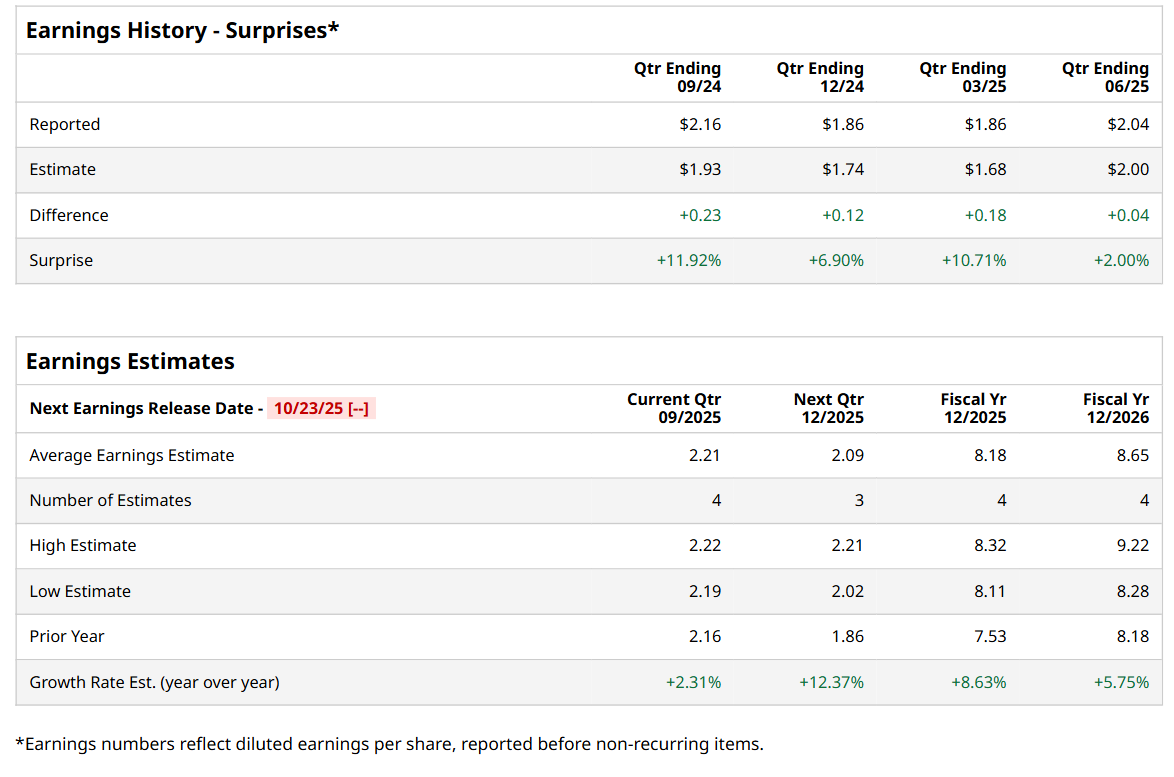

Dublin, Ireland-based Allegion plc (ALLE) is a security company that offers mechanical and electronic security products, including locks, hinges, door closers, exit devices, steel doors and frames, access control systems, smart locking, and related workforce security software & services. Valued at a market cap of $15.2 billion, the company is expected to announce its fiscal Q3 earnings for 2025 in the near future. Before this event, analysts expect this security company to report a profit of $2.21 per share, up 2.3% from $2.16 per share in the year-ago quarter. The company has a solid trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $2.04 per share in the previous quarter topped the consensus estimates by 2%. For the current fiscal year, analysts expect Allegion to report a profit of $8.18 per share, up 8.6% from $7.53 per share in fiscal 2024. Its EPS is expected to further grow 5.8% year-over-year to $8.65 in fiscal 2026.

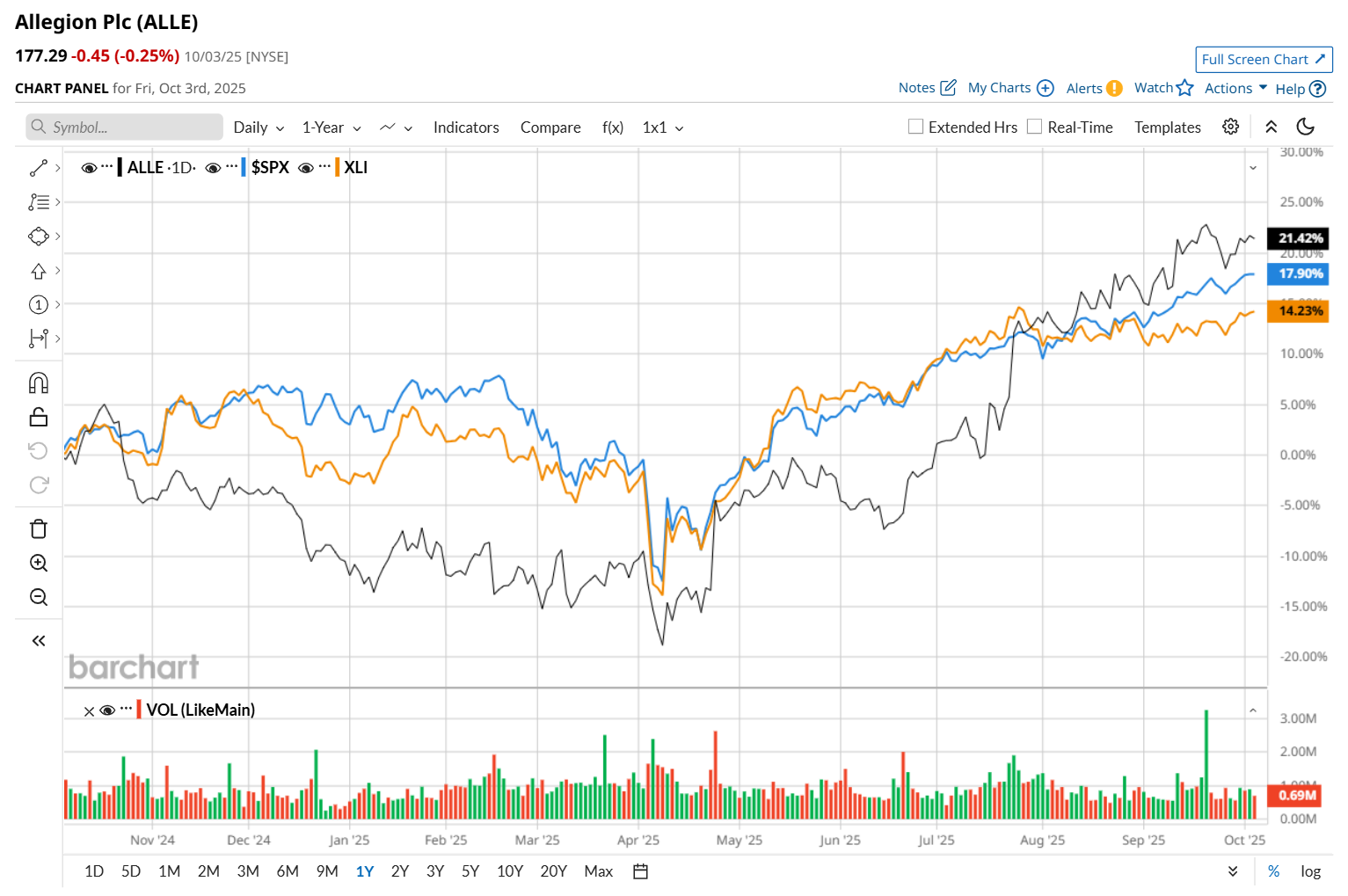

Allegion has rallied 21.5% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 17.8% uptick and the Industrial Select Sector SPDR Fund’s (XLI) 14.7% return over the same time frame.

On Jul. 24, shares of Allegion rose 6% after it delivered impressive Q2 results. The company posted revenue of $1 billion, up 5.8% on a reported basis and 3.2% on an organic basis. This top-line figure came in 2% ahead of the consensus estimates. Strong organic growth in its non-residential Americas business, along with positive impact from acquisitions, supported its performance. Moreover, on the earnings front, its adjusted EPS improved 4.1% year-over-year to $2.04, also exceeding analyst expectations by 2%. Wall Street analysts are moderately optimistic about ALLE’s stock, with a "Moderate Buy" rating overall. Among 11 analysts covering the stock, three recommend "Strong Buy," and eight suggest "Hold.” The mean price target for ALLE is $178.33, indicating a marginal potential upside from the current levels. On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|