|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

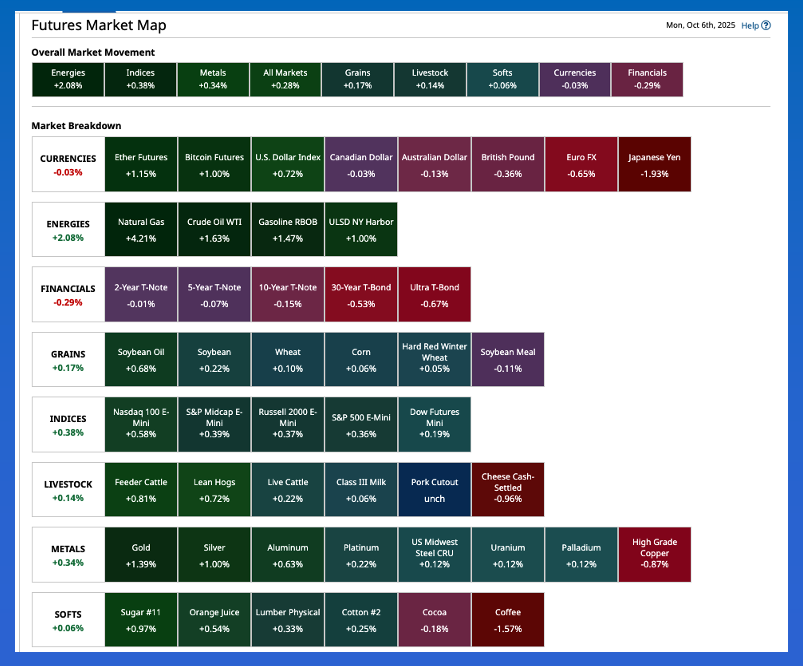

What Should We Expect from the Commodity Complex This Week?

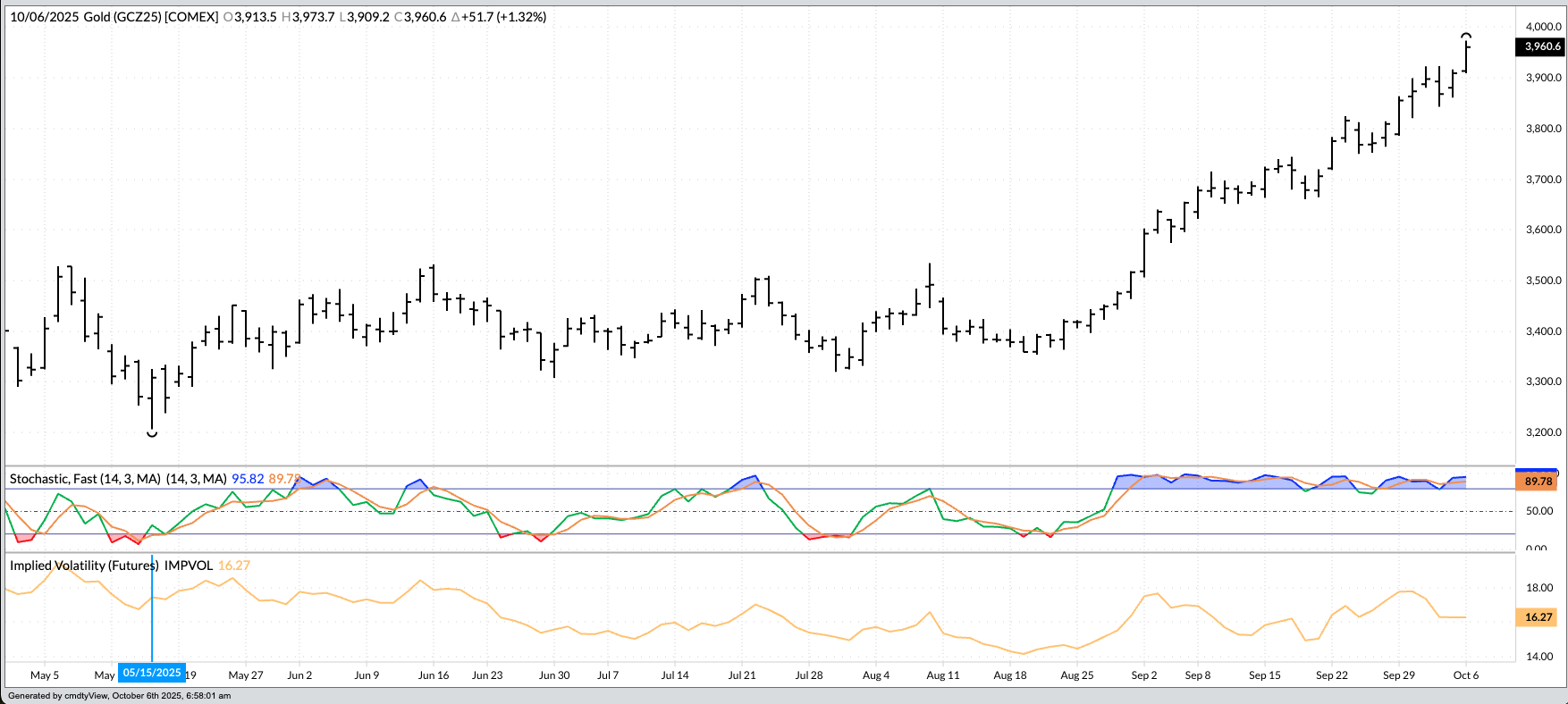

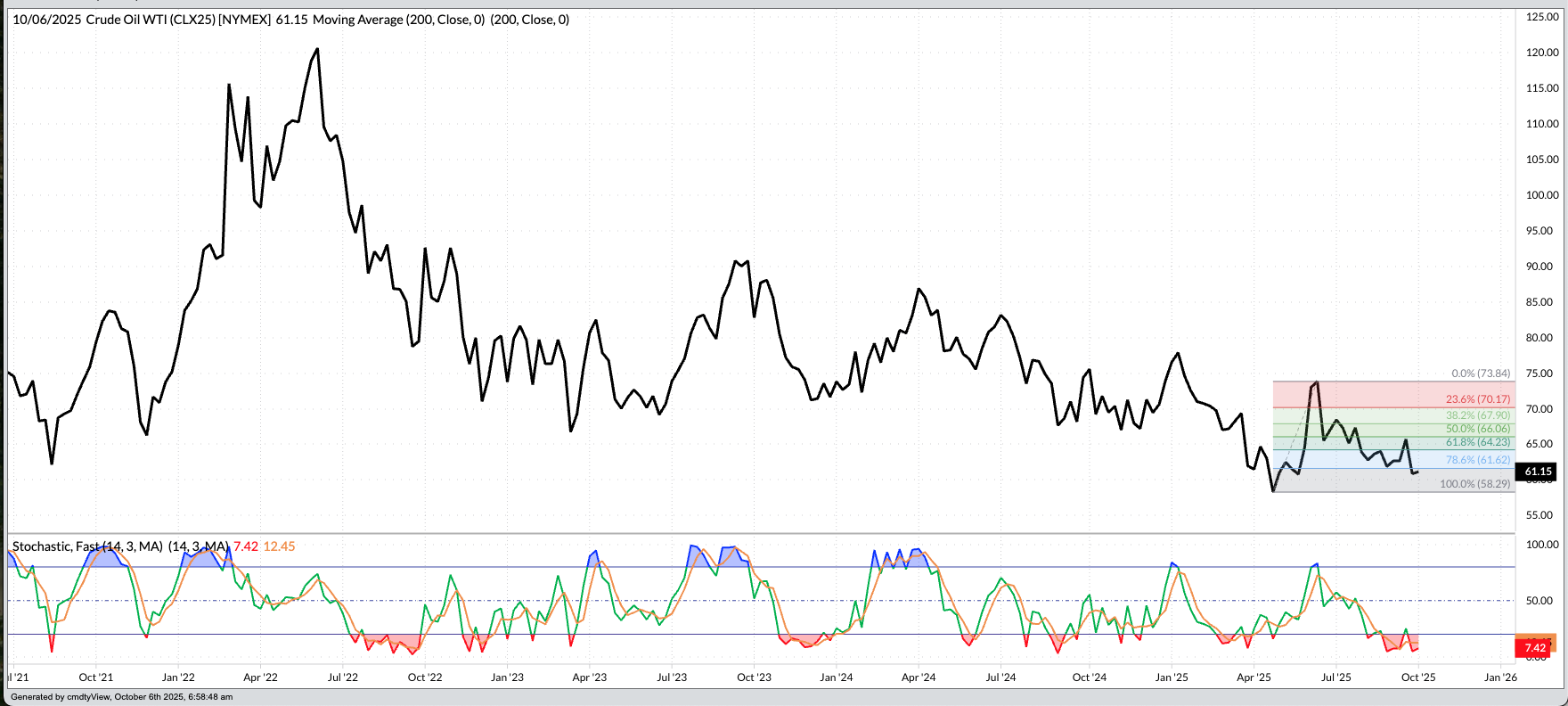

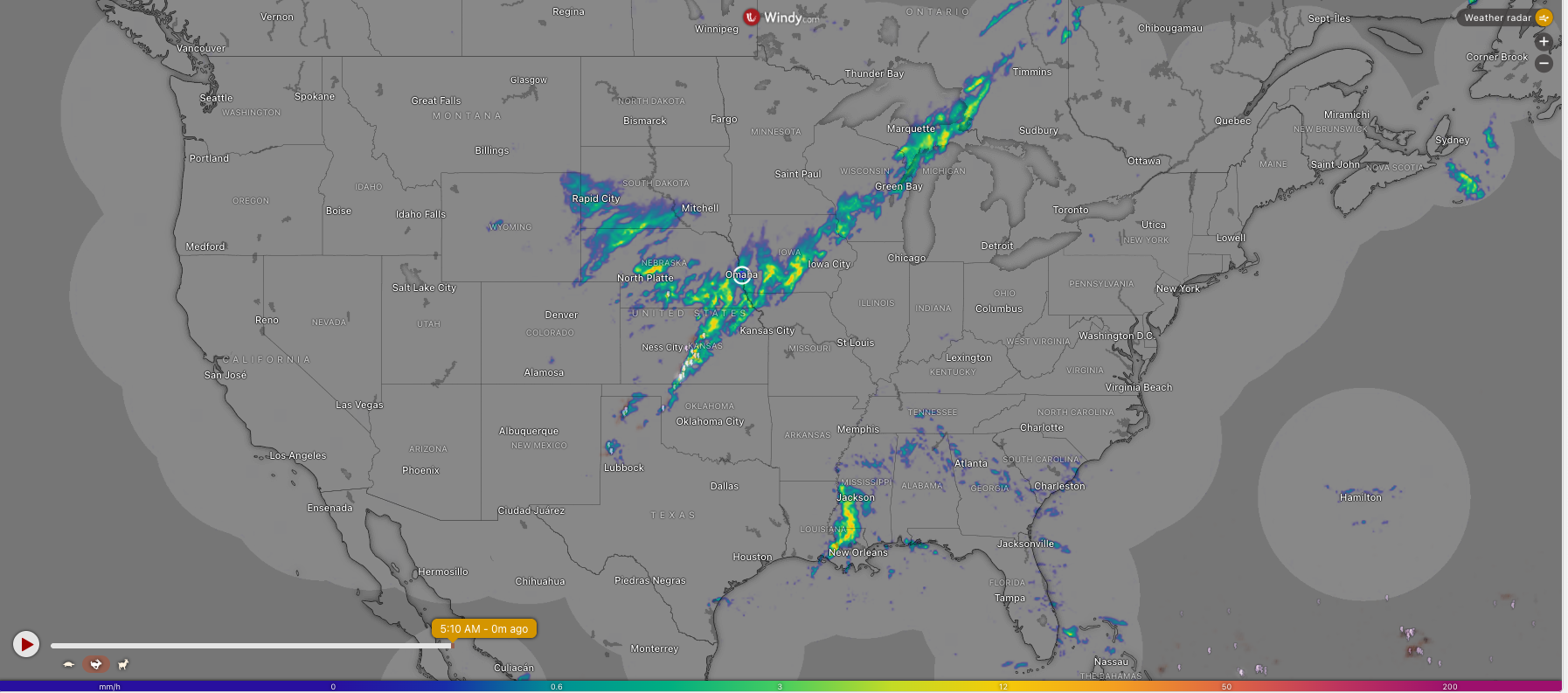

An initial running of the traps of the various sectors of the commodity complex early Monday morning makes one thing clear: It is going to be another fun week. As usual, I started with currencies and saw the US dollar index ($DXY) had strengthened as much as 0.77 and was sitting near its session high at this writing. Did the US government shutdown end while we were sleeping? A quick search of the subject showed conflicting headlines on progress between the two political parties. What a shock. In other news, the Financials sector, consisting of US Treasury futures, was in the red while yields continued to climb reflecting the ongoing uncertainty along with growing concern over inflation resulting in higher interest rates. With that as a background, let’s check in on what the Three Kings of the commodity complex, along with their respective kingdoms, are saying about the week ahead.  Let’s start with King Gold and the Metals sector. December gold (GCZ25) extended its record rally to an overnight high of $3,973.70, up another $64.80 (1.7%) despite the strength of the US dollar. King Gold confirms what we already knew: Global economics and politics remain clouded by uncertainty with the only certainty seemingly increased inflation. (Say that 10 times fast.) So much so, as mentioned above, the possibility of higher interest rates is growing stronger. Moving along with gold is its sidekick silver where the December contract added as much as $0.625 (1.3%) through Monday’s early morning hours. As I’ve said before, the only thing that matters in Metals at this point is trend, price direction over time, as it brings to mind Newton’s First Law of Motion applied to markets: A trending market will stay in that trend until acted upon by an outside force. The trend in Gold (and Silver) is up as central banks around the world continue to buy.  Over in the Energies sector, King Crude Oil (WTI) (CLX25) gained as much as $1.24 (2.0%) through early Monday morning. Additionally, futures spreads showed stronger backwardation across the board, though that and a crisp $5 bill might get you a cup of coffee from your local barista. (A side note: The December coffee futures contract (KCZ25) was showing the largest pre-dawn loss in the commodity complex, down 1.6% from last Friday’s close.) Why am I skeptical about what King Crude’s forward curve is showing us, from a fundamental point of view? Because the curve has been in backwardation, mostly, for at least the past 5 years. And if a forward curve in backwardation reflects a bullish supply and demand situation, then why has crude oil trended sideways to down for much of that same time? There seems to be a growing disconnect between the forward curve and the futures market. Why? I don’t know. But I can see the “what”, and I don’t think the dynamics of the market (sector) are going to change this coming week.  King Corn was quietly higher early Monday morning. The December issue (ZCZ25) posted a 2.5-cent trading range, 1.25 cents either side of unchanged, on trade volume of 14,300 contracts through the pre-dawn hours and was sitting 0.5 cent higher at this writing. I don’t think we can read much into this, though it is interesting to note a large rain system moving across the US Plains and Midwest to start the week, likely putting the brakes on what has been a fast-paced fall harvest to this point. A quick check of market fundamentals and we see the National Corn Index came in last Friday night at $3.78, down 2.25 cents for the week and putting national average basis at 41.0 cents under December futures as compared to the previous Friday’s final figure of 41.75 cents under December. Speaking of Dec25, it closed Friday at $4.19, down 3.0 cents for the week. The Dec-March futures spread closed at a carry of 16.75 cents and covered 54% calculated full commercial carry, both unchanged from the previous week’s settlement. This tells us Watson likely increased its net-short futures position last week, leaving the door open to possible short-covering activity. For now, market volatility remains low, so I’m expecting corn to stay quiet this week. On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|