|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

L3Harris Technologies Earnings Preview: What to Expect/L3Harris%20Technologies%20Inc%20logo%20and%20cash-by%20Ascannio%20via%20Shutterstock.jpg)

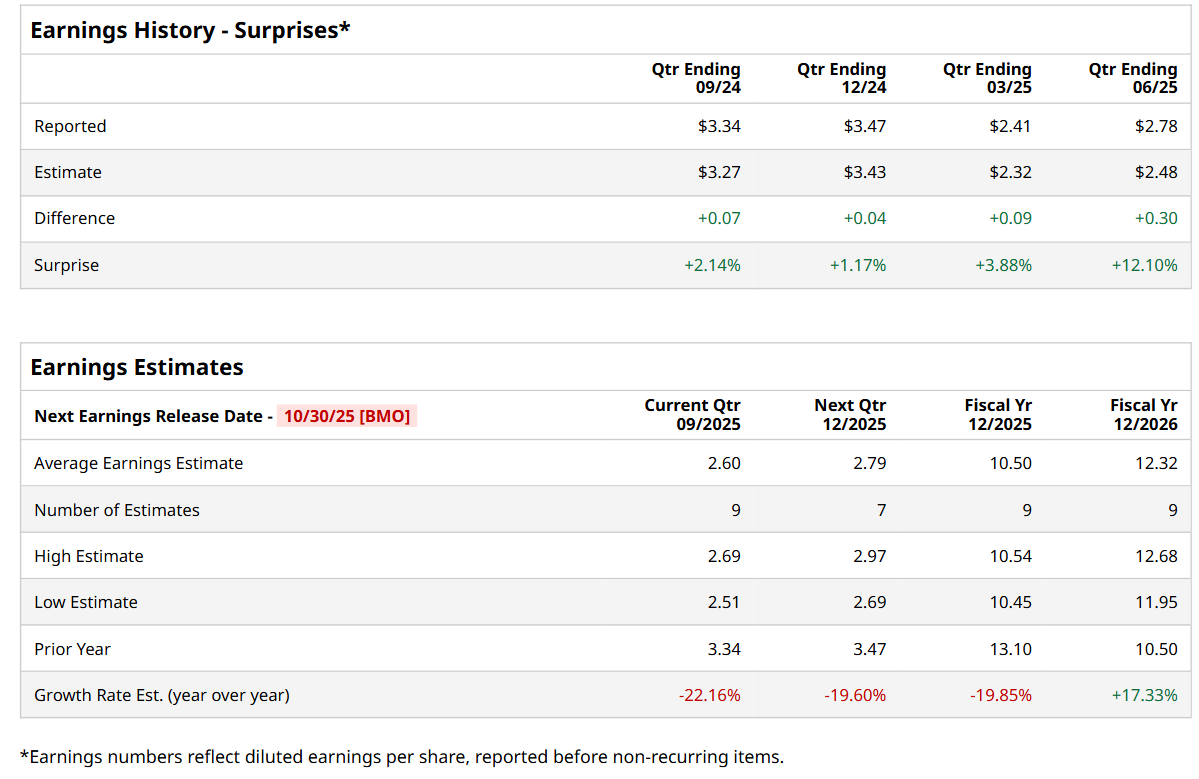

Valued at a market cap of $55.6 billion, L3Harris Technologies, Inc. (LHX) is an aerospace & defense technology company based in Melbourne, Florida. Its core offerings span communications systems, Intelligence, Surveillance & Reconnaissance (ISR), sensors and avionics, space & airborne systems, electronic warfare, and propulsion systems for both defense and commercial customers. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Thursday, Oct. 30. Ahead of this event, analysts expect this aerospace & defense company to report a profit of $2.60 per share, down 22.2% from $3.34 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s earnings estimates in each of the last four quarters. In Q2, LHX’s EPS of $2.78 exceeded the forecasted figure by 12.1%. For fiscal 2025, analysts expect LHX to report a profit of $10.50 per share, down 19.9% from $13.10 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 17.3% year-over-year to $12.32 in fiscal 2026.

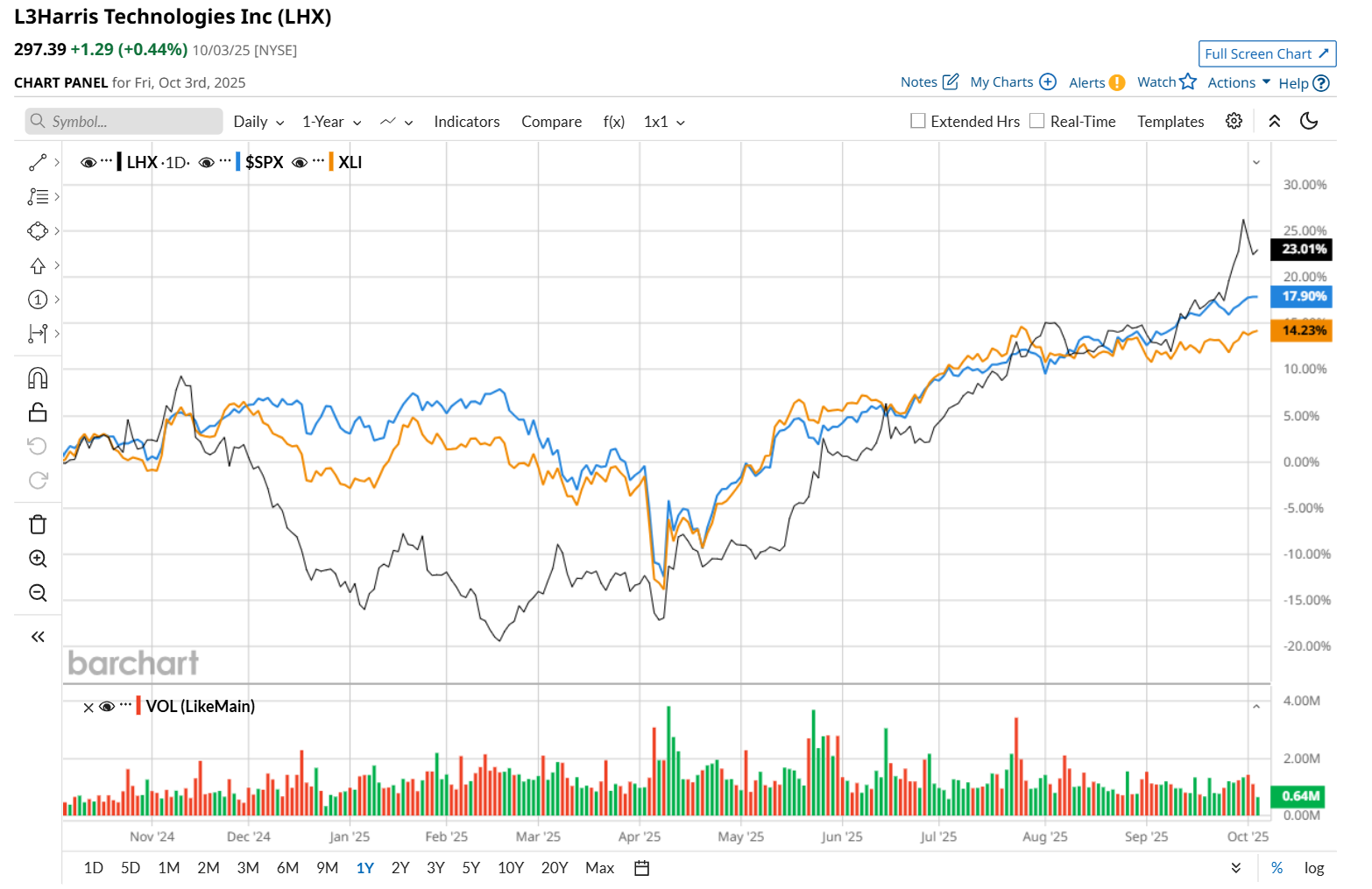

Shares of LHX have rallied 22.3% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 17.8% uptick and the Industrial Select Sector SPDR Fund’s (XLI) 14.7% return over the same time frame.

Shares of LHX rose 1.3% on Jul. 24, after delivering better-than-expected Q2 2025 earnings results. Both its revenue of $5.4 billion and adjusted EPS of $2.78 handily topped the consensus estimates. Moreover, compared to the year-ago quarter, its top line grew 2.4%, while its bottom line improved by an even more impressive 15.8%. A record book-to-bill ratio of 1.5x, robust organic growth, and the seventh consecutive quarter of year-over-year adjusted segment operating margin expansion aided its performance. Wall Street analysts are moderately optimistic about LHX’s stock, with a "Moderate Buy" rating overall. Among 18 analysts covering the stock, 12 recommend "Strong Buy," and six suggest "Hold.” The mean price target for LHX is $301.67, implying a 1.4% potential upside from the current levels. On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|