|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Teledyne Technologies’ Q3 2025 Earnings: What to Expect/Teledyne%20Technologies%20Inc%20logo%20on%20website-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

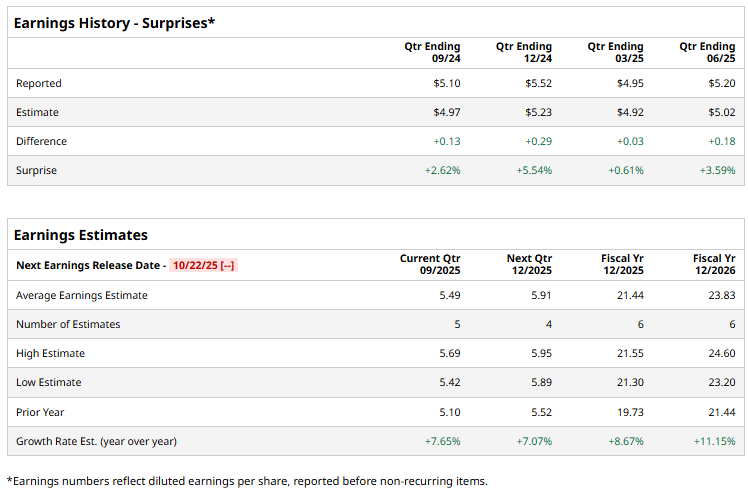

With a market cap of around $27.6 billion, Teledyne Technologies Incorporated (TDY) is a differentiated technology powerhouse operating at the intersection of defense, industrial monitoring, and high-end digital imaging. Far from a typical industrial conglomerate, Teledyne's portfolio is built around "enabling technologies," highly specialized sensors, electronics, and systems, that are critical to government, aerospace, and deepwater exploration customers. The Thousand Oaks, California-based company is expected to announce its fiscal Q3 2025 earnings results soon. Ahead of this event, analysts expect TDY to report an adjusted EPS of $5.49 per share, a 7.7% growth from $5.10 in the year-ago quarter. It has consistently exceeded Wall Street's earnings expectations in the past four quarters. For fiscal 2025, analysts expect the company to report adjusted EPS of $21.44, representing an 8.7% increase from $19.73 in fiscal 2024. Moreover, adjusted EPS is anticipated to grow 11.2% year-over-year to $23.83 in fiscal 2026.

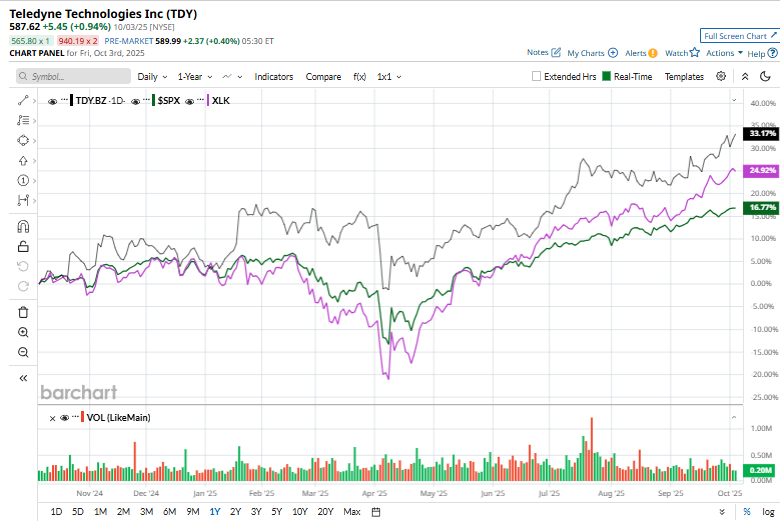

Shares of Teledyne Technologies have gained 33.7% over the past 52 weeks, outpacing the broader S&P 500 Index's ($SPX) 17.8% return and the Technology Select Sector SPDR Fund's (XLK) 27.8% rise over the same period.

On Jul. 23, TDY reported Q2 results, with revenue rising 10.2% year-over-year to a record $1.5 billion, surpassing consensus estimates by 2.7%. Moreover, its adjusted EPS of $5.20 grew 13.5% from the same period last year and came in 3.6% ahead of analyst expectations. Although the market initially pushed the stock to a new 52-week high of $570.56, it closed down by 1.7%. Analysts' consensus view on Teledyne Technologies stock remains very bullish, with a "Strong Buy" rating overall. Out of 11 analysts covering the stock, eight recommend a "Strong Buy," one "Moderate Buy," and two "Hold." TDY’s average analyst price target of $607.40 indicates a premium of 3.4% from the current market prices. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|