|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

What to Expect From Ameriprise Financial’s Q3 2024 Earnings Report/Ameriprise%20Financial%20Inc%20location-by%20APN%20Photography%20via%20Shutterstock.jpg)

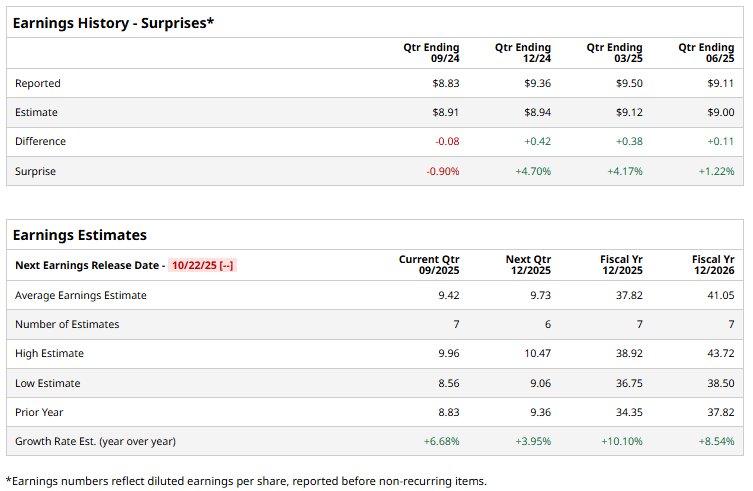

Valued at $46.4 billion by market cap, Ameriprise Financial, Inc. (AMP) is a leading diversified financial services company based in the U.S. that primarily focuses on providing comprehensive financial planning and advice to individual and institutional clients. The Minneapolis, Minnesota-based company is set to release its fiscal third-quarter earnings for 2025 later this month. Ahead of the event, analysts expect AMP to report a profit of $9.42 per share on a diluted basis, up 6.7% from $8.83 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion. For the current year, analysts expect AMP to report EPS of $37.82, up 10.1% from $34.35 in fiscal 2024. Its EPS is expected to rise 8.5% year over year to $41.05 in fiscal 2026.

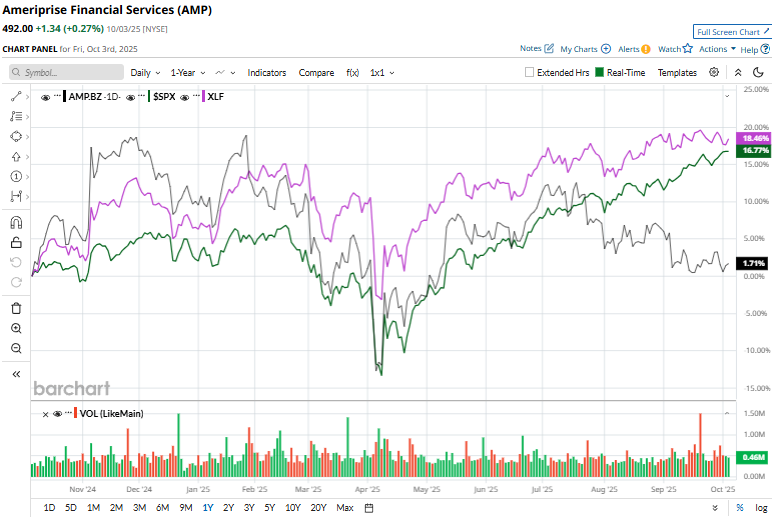

Over the past year, AMP stock has climbed 2.6%, underperforming the S&P 500 Index’s ($SPX) 17.8% gains and the Financial Select Sector SPDR Fund’s (XLF) 19.7% gains over the same time frame.  On Oct. 3, AMP shares soared marginally after the Bank of America Securities analyst Craig Siegenthaler reiterated a “Buy” rating on Ameriprise Financial and set an ambitious price target of $599. Analysts’ consensus opinion on AMP stock is neutral, with a “Hold” rating overall. Out of 15 analysts covering the stock, four advise a “Strong Buy” rating, two suggest a “Moderate Buy,” seven give a “Hold,” and two recommend a “Strong Sell.” Its mean target price of $554.92 suggests an upside potential of 12.8% from the current market prices. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|