|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Here's What to Expect From Old Dominion’s Next Earnings Report/Old%20Dominion%20Freight%20Line%2C%20Inc_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

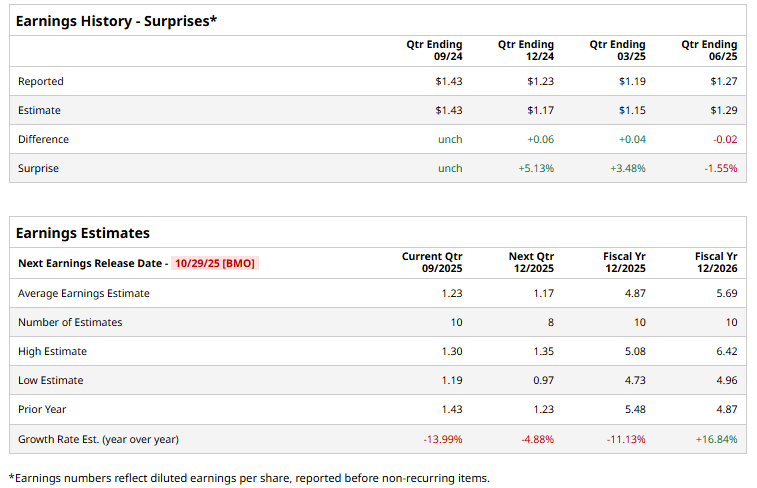

With a market cap of $29.7 billion, Old Dominion Freight Line, Inc. (ODFL) is a leading American transportation company specializing in regional, inter-regional, and national less-than-truckload (LTL) shipping, which involves combining smaller shipments from multiple customers onto a single truck. The company is highly regarded in the industry for its exceptional operational efficiency and premium service, consistently achieving high on-time delivery rates and an industry-low claims ratio through a single, integrated network of over 260 service centers. ODFL is set to release its third-quarter results before the markets open on Wednesday, Oct. 29. Ahead of the event, analysts expect ODFL to report a non-GAAP profit of $1.23 per share, down 14% from $1.43 per share reported in the year-ago quarter. The company has matched or surpassed the Street’s earnings estimates in three of the past four quarters, while missing the forecast in the most recent quarter. For FY2025, ODFL is expected to deliver a non-GAAP EPS of $4.87, down 11.1% from $5.48 in fiscal 2024. However, in fiscal 2026, ODFL’s earnings are expected to surge 16.8% year-over-year to $5.69 per share.  ODFL stock has declined 26% over the past 52 weeks, significantly underperforming the S&P 500 Index’s ($SPX) 17.8% rise and the Industrial Select Sector SPDR Fund’s (XLI) 14.7% gains during the same time frame.  On September 4th, Old Dominion Freight Line stock surged marginally, despite reporting a significant 9.2% year-over-year drop in its August less-than-truckload (LTL) shipment volume. The consensus opinion on ODFL stock is an overall “Hold” rating. Out of the 22 analysts covering the stock, six recommend “Strong Buy,” one advises “Moderate Buy,” 12 suggest “Hold,” and three advocate a “Strong Sell” rating. The mean price target of $161.15 implies a premium of 14% from the current market prices. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|