|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Here's What to Expect From Globe Life’s Next Earnings Report/Globe%20Life%20Inc%20field-by%20Dorti%20via%20Shutterstock.jpg)

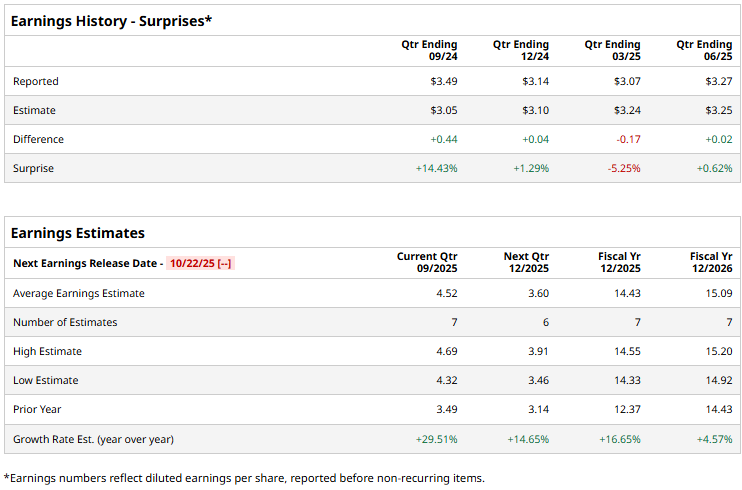

Valued at $11.1 billion by market cap, Globe Life Inc. (GL) is a financial services holding company specializing in providing life insurance, annuities, and supplemental health insurance products across the United States. Operating through wholly-owned subsidiaries like American Income Life and Liberty National Life, the Texas-based company primarily targets lower-middle-income to middle-income families with affordable, straightforward policies. The insurance giant is expected to announce its fiscal third-quarter earnings for 2025 soon. Ahead of the event, analysts expect GL to report a profit of $4.52 per share on a diluted basis, up 29.5% from $3.49 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion. For the current year, analysts expect GL to report EPS of $14.43, up 16.7% from $12.37 in fiscal 2024. Its EPS is expected to rise 4.6% year over year to $15.09 in fiscal 2026.

GL stock has gained 31.2% over the past year, outpacing the S&P 500 Index’s ($SPX) 17.8% gains and the Financial Select Sector SPDR Fund’s (XLF) 19.7% gains over the same time frame.

Globe Life stock surged 5.4% after its Q2 earnings release on July 23rd, primarily due to strong bottom-line growth. Although the company missed revenue estimates, reporting $1.5 billion in total revenue, the net operating income per share was robust, jumping 10.1% to $3.27, beating consensus estimates. This bottom-line performance was underpinned by solid 4.5% growth in total insurance premiums (including a 7.5% jump in health premiums), which offset a notable drop and deterioration in net investment income and realized losses. Analysts’ consensus opinion on GL stock is highly bullish, with a “Strong Buy” rating overall. Out of 14 analysts covering the stock, nine advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and three give a “Hold.” GL’s average analyst price target is $161, indicating a potential upside of 17% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|