|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

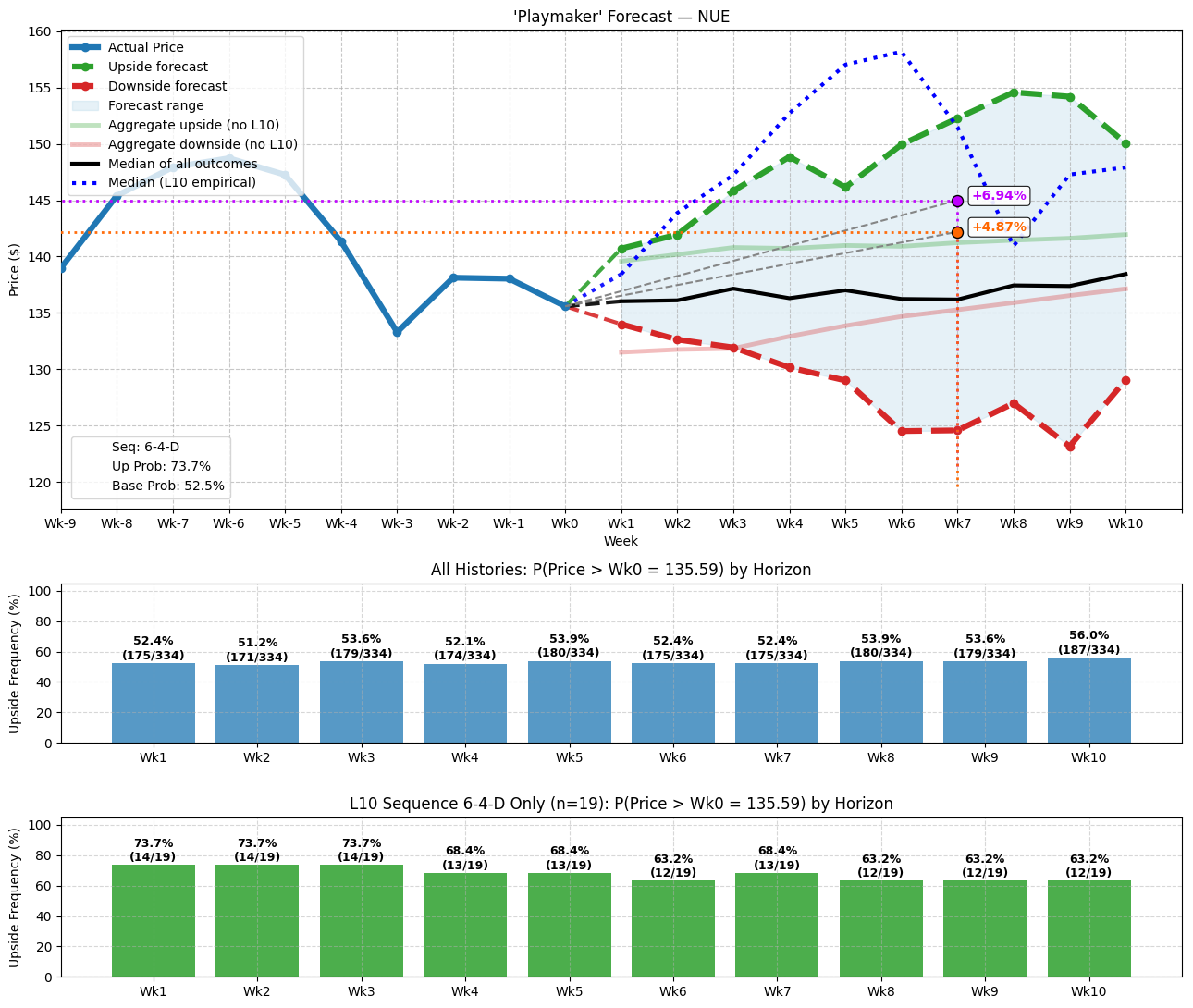

Why Trump’s American Revitalization Efforts Could Make Nucor (NUE) Great Again

When the Federal Reserve slashed the benchmark interest rate for the first time since December of last year, the usual suspects — gold, cryptocurrencies and other growth-centric sectors and enterprises — seemingly received most of the headlines. However, investors should really be paying close attention to the steel market, specifically Nucor (NUE). Amid all the hype in tech, NUE stock presents an underappreciated upside narrative. Fundamentally, lower interest rates reduce borrowing costs, which in turn should boost investments and other business activities. Obviously, this dynamic should help bolster the Trump administration’s broader revitalization efforts. However, this push to restore American greatness will necessarily involve infrastructure spending — and that should translate to a higher valuation for NUE stock. Even better, it’s not just empty posturing. Looking at Barchart’s options flow screener — which focuses exclusively on big block transactions likely placed by institutional investors — NUE stock options on the day of the Fed rate cut announcement saw net trade sentiment land at only $22,400. One day later, this metric soared to more than $2.41 million, firmly favoring the bulls. Since then, the flow has been choppy and has generally leaned toward the bearish side of the sentiment spectrum. Further, in the trailing month, NUE stock has lost about 6% of market value. Indeed, the equity seems to have been stuck in an extended consolidation pattern going back to the early summer period. Nevertheless, with so much capital chasing after heavily stretched tech names, foundational enterprises like Nucor are arguably discounted. Again, a revitalization drive will almost certainly involve an infrastructure upgrade — and that’s necessarily going to consume steel. Plus, with analysts giving NUE stock a consensus Strong Buy rating and with the technicals also aligned in a generally positive direction, Nucor deserves a closer look. Readjustment of Priors May Help Lift NUE Stock HigherSince the beginning of the year, NUE stock has gained over 16%, beating out the benchmark S&P 500’s return of 14.6% during the same period. From a bird’s-eye-perspective, Nucor represents a solid enterprise. It’s just that with the 5.85% loss in the trailing 30 days, NUE may offer a discounted opportunity. One of the key reasons why volatility in fundamentally sound companies warrants closer examination is the Bayesian nature of the equities market. Essentially, investors are constantly adjusting the expectations of the names in their portfolio — and this mass consensus is reflected in the target securities’ valuations. So, when a disruptive event materializes, there’s an even more robust readjustment of prior assumptions. It’s my hypothesis that we can measure these changes of assumptions to probabilistically determine what may happen next in the future. This is also the reason why I use sequencing logic in my analysis. By quantifying behavioral states, we can identify what that state is to better understand the likelihood of what the next behavioral state may be. In Nucor’s case, the last 10 weeks saw NUE stock print a 6-4-D sequence: six up weeks, four down weeks, with an overall downward trajectory. This sequence has materialized only 19 times on a rolling basis since January 2019. Interestingly, though, in most cases, NUE stock tends to enjoy an upward trajectory. Also, the median price of outcomes associated with the 6-4-D tends to shoot very high over the next several weeks. Now, what makes NUE stock appealing at this juncture is that under baseline conditions, the probability of upside is only modestly better than a coin toss. For example, under balanced sentiment sequences — when there aren’t as many intense adjustments of priors — NUE stock doesn’t usually generate kinetic fluctuations.  However, when the 6-4-D sequence flashes, traders for whatever reason are much more aggressive. We can use this intelligence to pick debit-based vertical spreads that most probabilistically align with conditionally expected outcomes. Putting the Numbers to Good UseSo, what is the “best” spread to consider? That’s going to depend on individual risk-reward tolerances. However, the hard empirical data of outcomes tied to the 6-4-D sequence shows that the median price at Week 7 stands above $150. Now, you could go for a banzai spread with a second leg strike of $150 — but the beautiful thing is that market makers will currently give you a 127% payout for the 140/145 bull call spread expiring Nov. 21. That means NUE stock only needs to rise through $145 at expiration for you to earn the full payout. Sure, it’s a narrow spread so NUE stock must rise — there’s no way of getting around that point. Again, though, the sequential data shows that the bulls are projected to be in control, both in terms of the exceedance ratio and magnitude of upside. I get it. Steel isn’t exactly the sexiest investment out there. But with the Trump administration poised to make infrastructure great again, NUE stock may be your ticket to probabilistically satisfying returns. On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|