|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Earnings Preview: What To Expect From Digital Realty Trust's Report

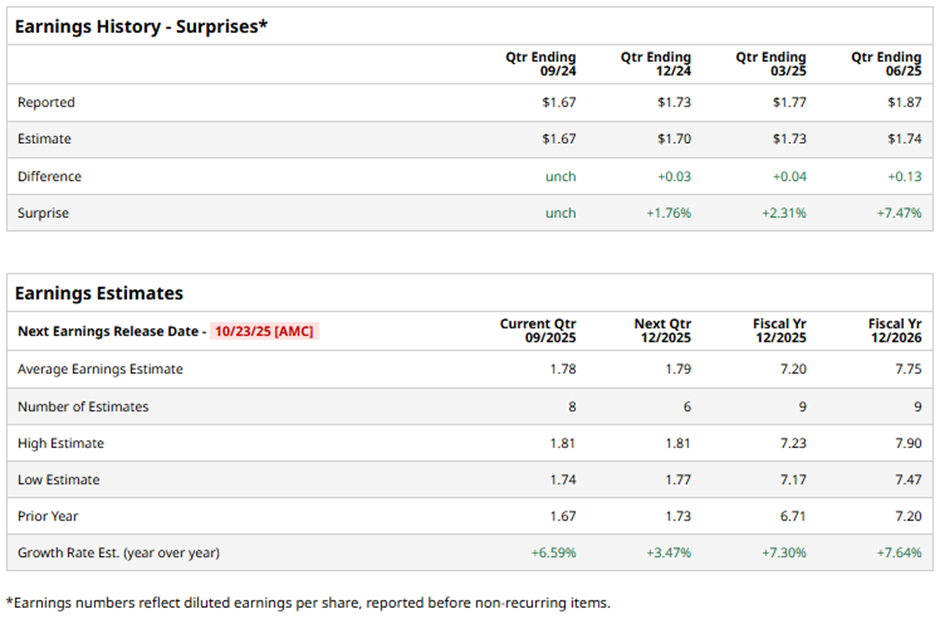

With a market cap of $60.4 billion, Digital Realty Trust, Inc. (DLR) is a leading global provider of data center, colocation, and interconnection solutions, serving a diverse range of industries including cloud services, financial institutions, healthcare, and manufacturing. As of June 30, 2025, the company owns and operates 310 data centers totaling approximately 42.5 million square feet across North America, Europe, South America, Asia, Australia, and Africa. The Dallas, Texas-based company is expected to release its fiscal Q3 2025 results after the market closes on Thursday, Oct. 23. Ahead of this event, analysts project Digital Realty Trust to report core FFO per share of $1.78, a 6.6% rise from $1.67 in the year-ago quarter. It has exceeded or met Wall Street's bottom-line estimates in the past four quarters. For fiscal 2025, analysts forecast DLR to report core FFO per share of $7.20, up 7.3% from $6.71 in fiscal 2024. In addition, core FFO per share is projected to grow 7.6% year-over-year to $7.75 in fiscal 2026.

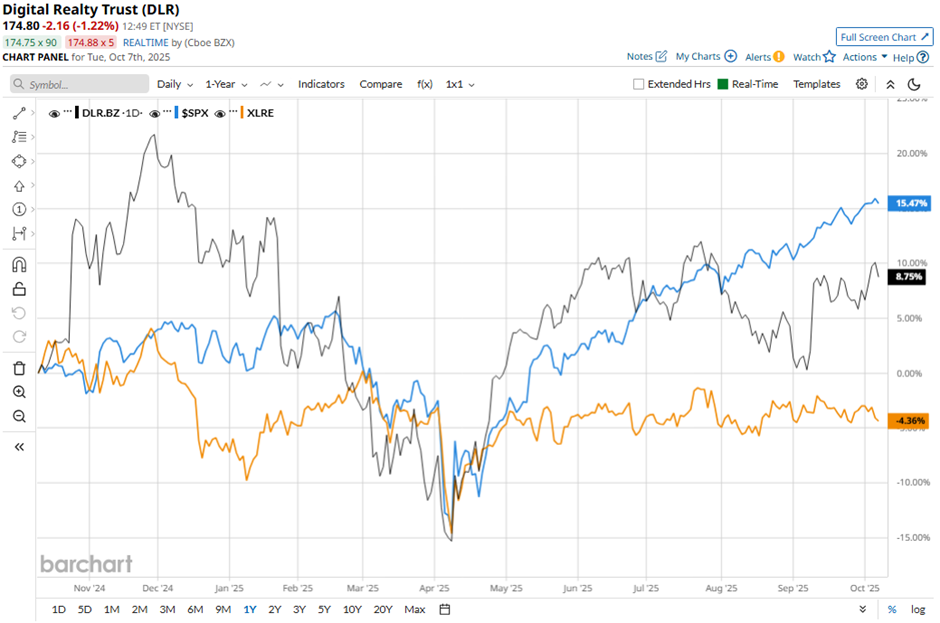

DLR stock has increased 11.5% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 17.7% gain. However, the stock has outpaced the Real Estate Select Sector SPDR Fund's (XLRE) 3.8% decrease over the same time frame.

Digital Realty reported strong Q2 2025 results on Jul. 24 and raised its full-year outlook. The REIT posted core funds from operations of $1.87 per share and revenue of $1.49 billion, surpassing forecasts. Additionally, Digital Realty increased its annual revenue guidance to $5.93 billion - $6.03 billion and its core FFO outlook to $7.15 per share - $7.25 per share, reflecting growing demand for data center services driven by AI and cloud infrastructure expansion. Despite these positive results, shares fell 1.2% the next day. Analysts' consensus view on DLR stock is moderately optimistic, with an overall "Moderate Buy" rating. Among 29 analysts covering the stock, 18 suggest a "Strong Buy," two give a "Moderate Buy," eight recommend a "Hold," and one has a "Strong Sell." The average analyst price target for Digital Realty Trust is $194.50, indicating a potential upside of 11.3% from the current levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|