|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

I Told You How to Trade AMD Stock to $200. Now That It’s an ‘AI Hero,’ Here’s 1 Way to Play Its Next Move./Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

Exactly two months ago, I wrote an article here on Advanced Micro Devices (AMD), which began as follows: “Imagine saying this to yourself in your best sinister voice: ‘That’s a nice profit you have on that stock there. It would be a shame if something happened to it.’” Then, as always, I wasn’t attempting to predict the future. I was trying to hedge the risk of taking risks. I’ve invested through every market calamity since the 1987 crash, and that’s enough to make “defense” even more important than “offense” in my book. That applies to my swing trades, long-term investments, and everything in between. Since that Aug. 6 article and through last Friday, Oct. 3, AMD has had something for everyone, except those who bought it that day and held it through Friday. As shown in this chart of 2-hour prices, the stock moved 10% in either direction but closed the period roughly flat. And then, we received Monday’s big news.  AMD announced that OpenAI will use its chips as part of its massive, historic investment in AI infrastructure. OpenAI even gets an option to buy up to 10% of AMD stock under certain conditions. For AMD, this is like having the Wizard of Oz select you to be his business partner. Chat AMD?This either has long-term implications or shorter-term disaster potential. Or both. That’s why, as I described in August, AMD sets up here as an ideal collar candidate. If you own it, or if you are thinking of owning it. As I see it, if I’m going to buy a stock that just went flying in a single day and has a penchant for, shall we say, excitement in both directions, I have two choices:

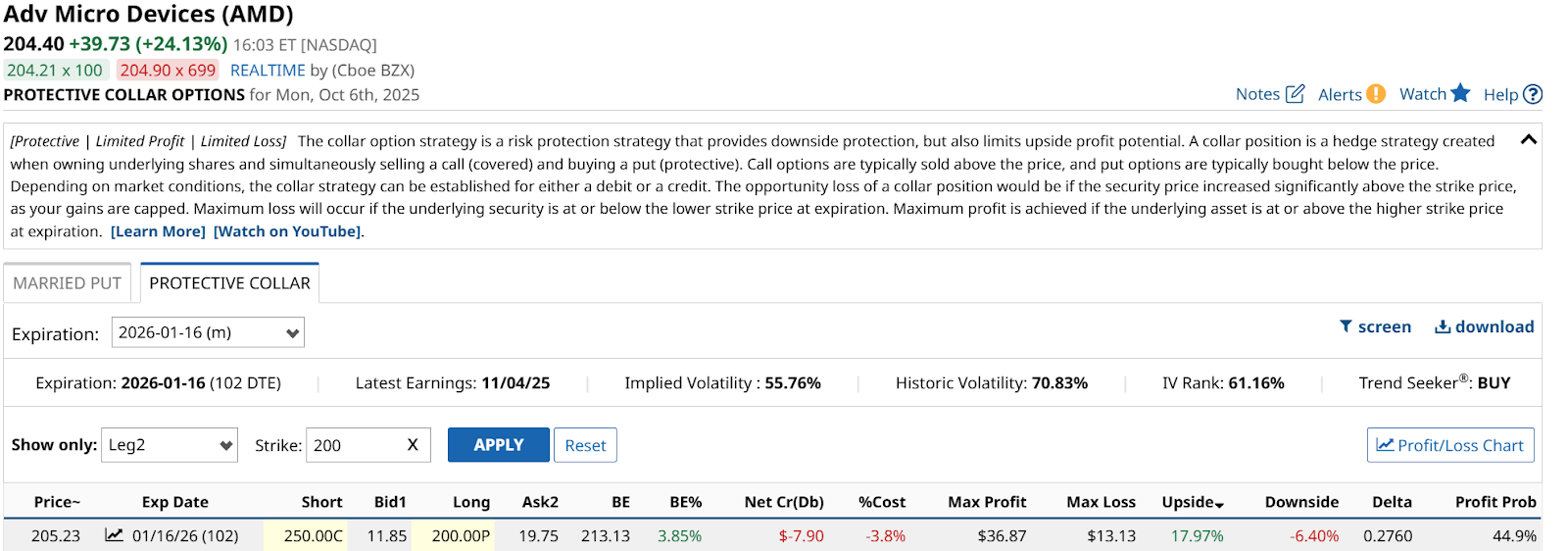

While some balk at selling the covered call option, I remind you that last I checked, if AMD hits my call strike price, there’s no law against my buying more stock. That’s a “high class problem” to me, as we’ll see in this updated collar example below. First, let’s chart AMD. For me, collaring any stock or ETF is not about those intense option analytics, as much as placing the put and call strike prices at strategic levels. That’s what the chart work helps me do. AMD’s Chart Shows Potential, Both WaysAMD’s daily picture obviously shows that vault higher Monday. And while the Percentage Price Oscillator (PPO) indicator at bottom is not through the proverbial roof yet, I don’t take a single day’s move like this lightly.  Especially when the weekly chart shows a potential double-top in the $227 area the stock opened near on Monday morning. AMD last saw that territory back about 19 months ago. Don’t think markets have a memory? Check this out!  The mission here is to see how to have access to further upside, but “name my price” on the downside, in terms of how much I can lose on, say 100 shares of AMD. Which would cost around $20,500 to buy. That’s worth protecting. Why an Option Collar Is Like a SnowflakeCollars are like snowflakes. Many look alike, but they are all unique. Every combination of put strike, call strike, expiration, and volatility level (current and versus the stock’s own history) are all variables that can be analyzed. As such, a collar strategy is truly as personalized as one wishes to make it. In the case of AMD, as of late in the trading day Monday, this one stood out to me. This collar setup goes out to January 2026, so more than 3 months from now.  The strike prices work out to be very clean, round numbers. The puts at $200, and the calls at $250. The cost is reasonable to me, at just 3.8%. And that produces a sharp 18% upside potential, versus just 6.4% downside. Or nearly a 3:1 ratio, which is quite good for this short time to expiration. This allows the collar investor to sit back and see what AMD does next, but with a line in the sand to the downside. And with an upside cap nearly 25% above where AMD closed Monday. It’s like melatonin for the restless investor. And given that this stock has shown the ability to move rapidly in a day, despite its large size, I think that’s worth considering. On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|