|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Trump Just Took a 10% Stake in Trilogy Metals. Should You Buy TMQ Stock Here?

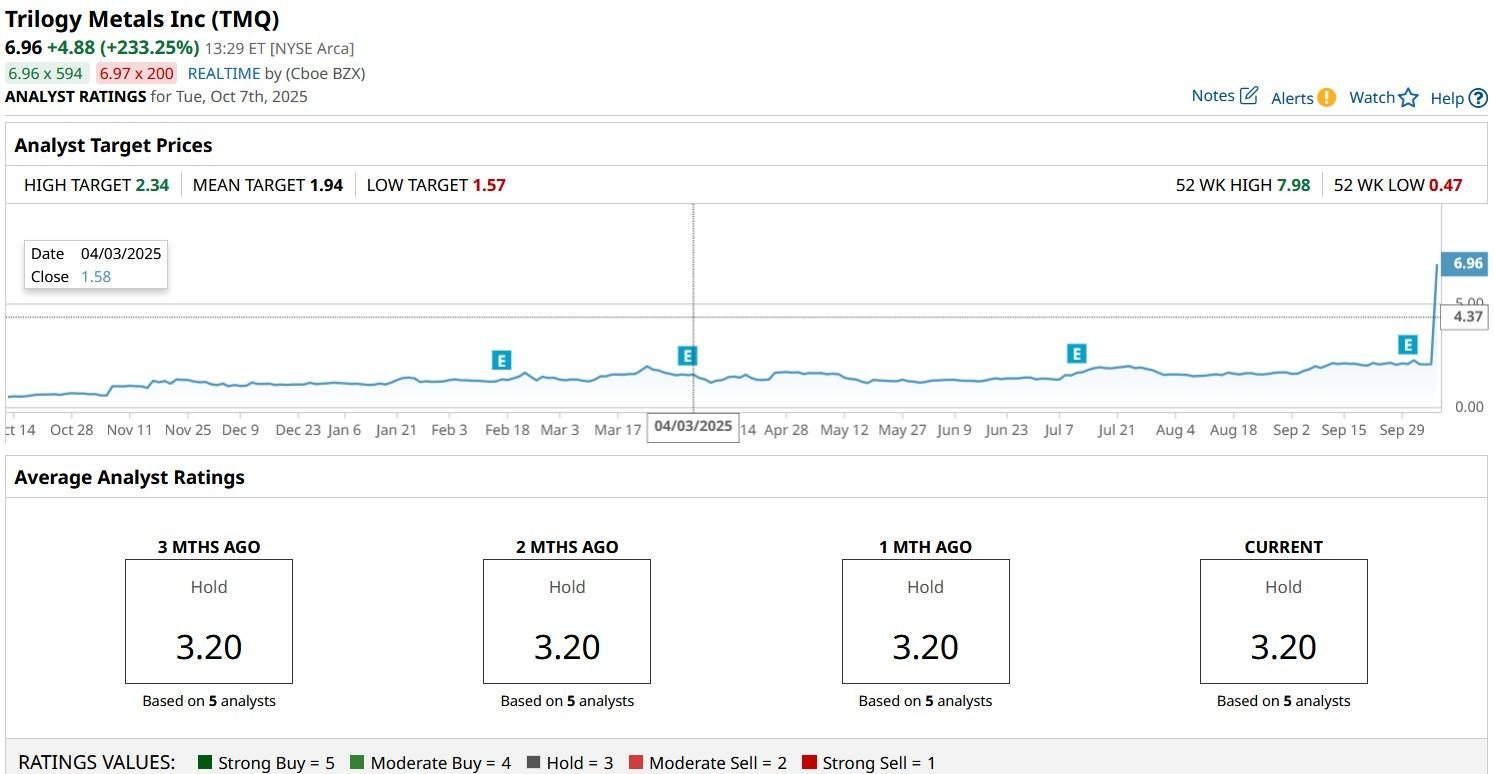

Trilogy Metals (TMQ) shares more than tripled today after President Donald Trump’s administration announced a sizable position in the mining firm based out of Vancouver, Canada. The U.S. government has agreed to invest nearly $36 million in TMQ in exchange for a 10% stake. Trilogy Metals focuses primarily on the Ambler mining district in Alaska, which, according to the company’s chief executive, Tony Giardini, is “home to some of the world’s richest known copper-dominant polymetallic deposits.” Following today’s explosive rally, TMG stock is trading more than 500% higher than its price at the start of this year.  What a Federal Stake Really Means for Trilogy Metals StockThe announced federal stake is meaningfully positive for Trilogy Metals stock primarily because it suggests potential alignment with federal priorities around domestic mineral security. TMQ assets include copper (HGZ25), cobalt, and zinc (ZAF26) – all of which are vital for clean energy, defense, and infrastructure. With Washington increasingly focused on reducing reliance on foreign supply chains, especially China, Trilogy projects could benefit from fast-tracked permitting, grants, or strategic partnerships. “This is a vote of confidence in American mining,” said a TMQ spokesperson. The Ambler Road project, long mired in environmental review, may now see renewed momentum. More importantly, the White House investment could attract institutional capital to TMQ shares as well, giving the firm the much-needed financial runway to advance exploration and development. Risks of Buying TMQ Shares at Current LevelsDespite the headline boost, investors should practice caution in initiating a position in TMQ stock as it remains a speculative bet at best. The mining company is yet to start generating any revenue. So far, it relies heavily on joint ventures and external funding. Therefore, its valuation – having surpassed $1.5 billion – is difficult to justify given the early stage nature of its assets and persistent permitting hurdles. Cash burn remains high, and dilution risk looms as the company seeks capital to fund exploration. Simply put, political involvement doesn’t guarantee project success. Until Trilogy Metals demonstrates tangible progress on its flagship Arctic deposit or secures long-term financing, TMQ shares may struggle to sustain its rally. Wall Street Warns of a Potential Crash in Trilogy MetalsInvestors should also note that Wall Street firms continue to see potential for a massive crash in Trilogy Metals stock from current levels. The consensus rating on TMQ shares sits at “Hold” only with the mean target of $1.94, suggesting they could lose as much as 70% in the coming months.  On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|