|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

What to Expect From HCA Healthcare's Q3 2025 Earnings Report/HCA%20Healthcare%20Inc%20billboard-by%20monticello%20via%20Shutterstock.jpg)

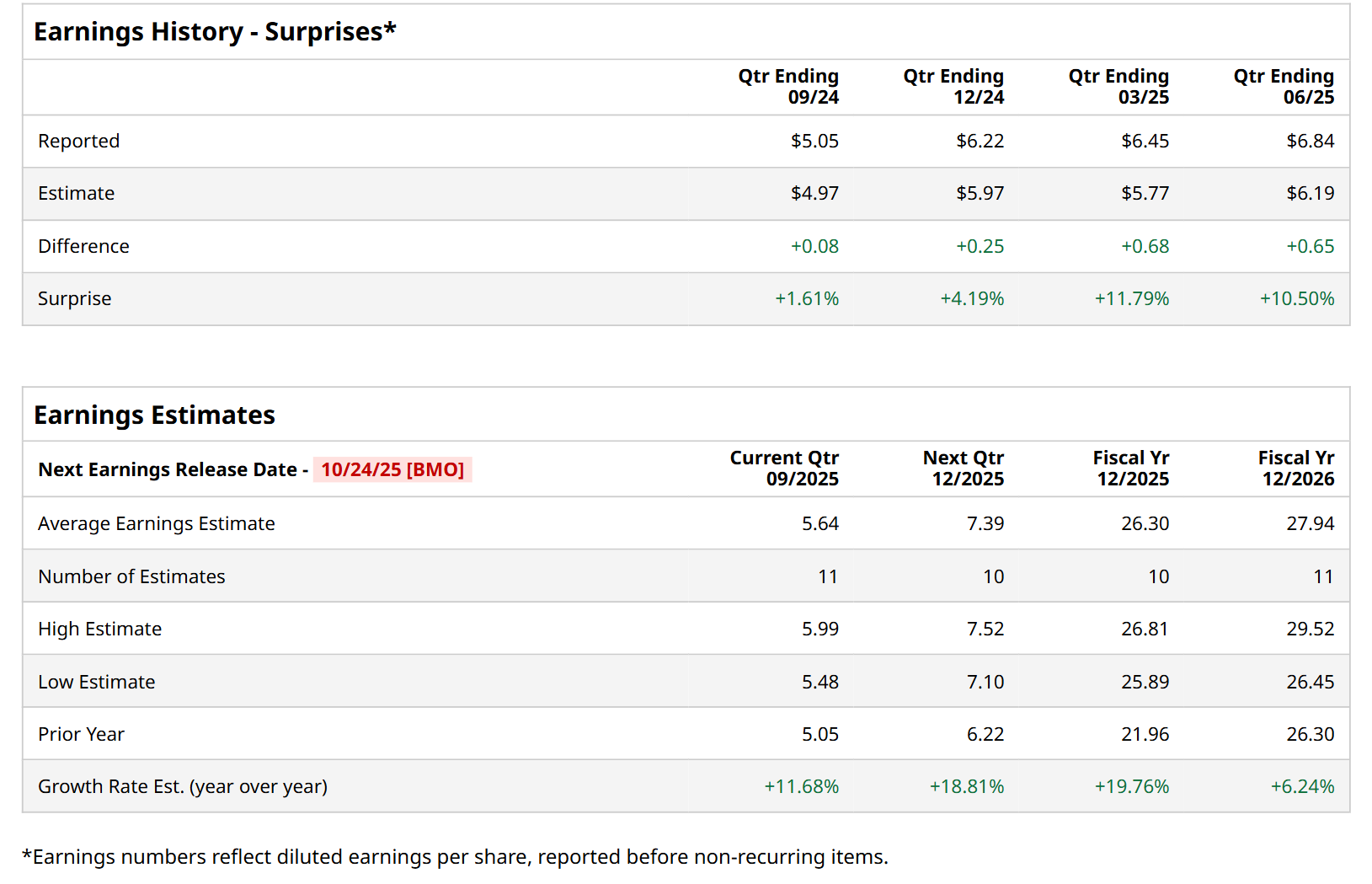

Valued at a market cap of $102.4 billion, HCA Healthcare, Inc. (HCA) owns and operates hospitals and related healthcare entities. The Nashville, Tennessee-based company operates general and acute care hospitals, outpatient healthcare facilities, and behavioral hospitals, which provide therapeutic programs comprising child, adolescent, and adult psychiatric care, adolescent and adult alcohol and drug abuse treatment, and counseling services. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Friday, Oct. 24. Ahead of this event, analysts expect this healthcare company to report a profit of $5.64 per share, up 11.7% from $5.05 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. In Q2, HCA’s EPS of $6.84 exceeded the forecasted figure by a notable margin of 10.5%. For fiscal 2025, analysts expect HCA to report a profit of $26.30 per share, representing a 19.8% increase from $21.96 per share in fiscal 2024. Furthermore, its EPS is expected to grow 6.2% year-over-year to $27.94 in fiscal 2026.

HCA has lagged behind the S&P 500 Index's ($SPX) 17.9% return over the past 52 weeks, with its shares up 14.4% over the same time frame. However, it has outpaced the Health Care Select Sector SPDR Fund’s (XLV) 4.5% loss over the same time period.

On Jul. 25, shares of HCA tumbled 2.1% after reporting its Q2 results. The company’s revenue improved 6.4% year over year to $18.6 billion, while its adjusted EPS of $6.84 grew 24.4% from the same period last year and came in 10.5% ahead of analyst estimates. However, its same-facility inpatient and outpatient surgery cases declined compared to the prior-year quarter, which might have made investors jittery. Wall Street analysts are moderately optimistic about HCA’s stock, with a "Moderate Buy" rating overall. Among 26 analysts covering the stock, 13 recommend "Strong Buy," two indicate "Moderate Buy," and 11 suggest "Hold.” While the company is trading above its mean price target of $409.77, its Street-high price target of $449 implies a 2.6% potential upside from the current levels. On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|