|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Here's What to Expect From Procter & Gamble's Next Earnings Report

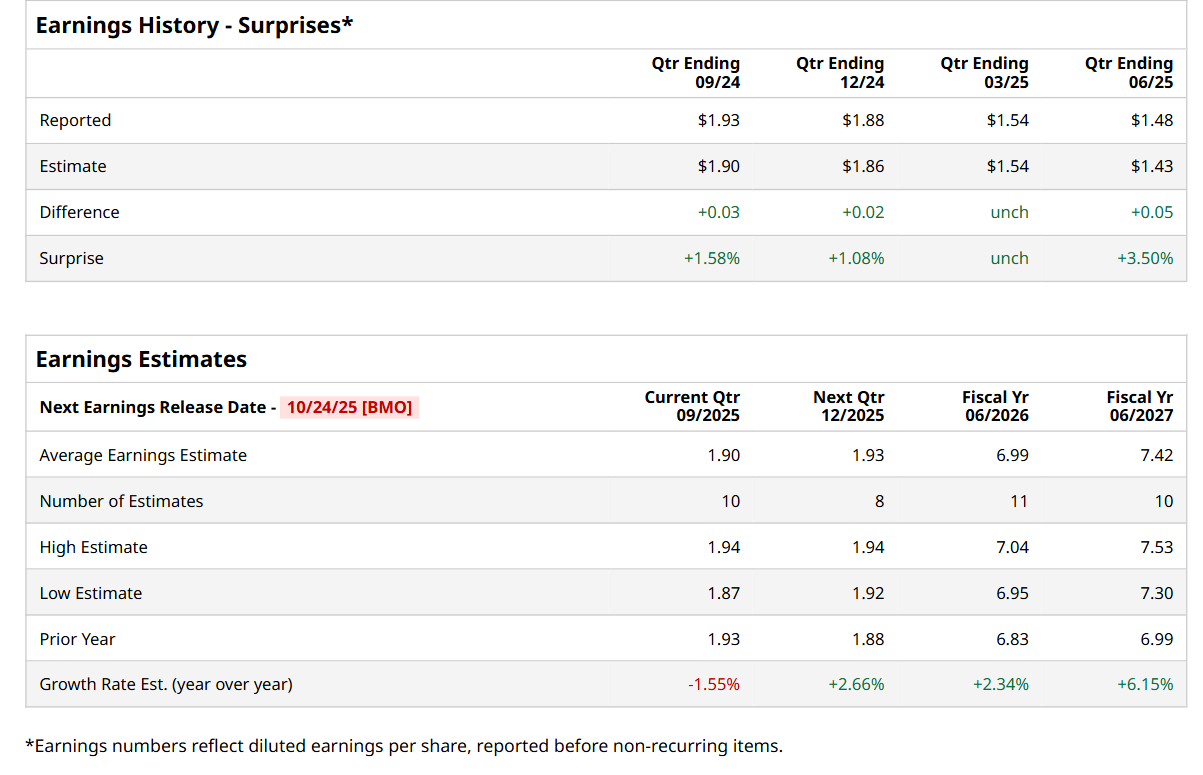

Cincinnati, Ohio-based The Procter & Gamble Company (PG) is a consumer goods company that produces and markets a wide array of branded products across several categories, including beauty, grooming, healthcare, fabric & home care, and baby, feminine & family care. Valued at a market cap of $357 billion, the company’s portfolio includes globally recognized brands, including Tide, Ariel, Pampers, Gillette, Olay, Crest, and Pantene. It is expected to announce its fiscal Q1 earnings for 2026 before the market opens on Friday, Oct. 24. Before this event, analysts expect this consumer goods giant to report a profit of $1.90 per share, down 1.6% from $1.93 per share in the year-ago quarter. The company has met or exceeded Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $1.48 per share in the previous quarter topped the consensus estimates by 3.5%. For fiscal 2026, analysts expect PG to report a profit of $6.99 per share, representing a 2.3% increase from $6.83 per share in fiscal 2025. Furthermore, its EPS is expected to grow 6.2% year-over-year to $7.42 in fiscal 2027.

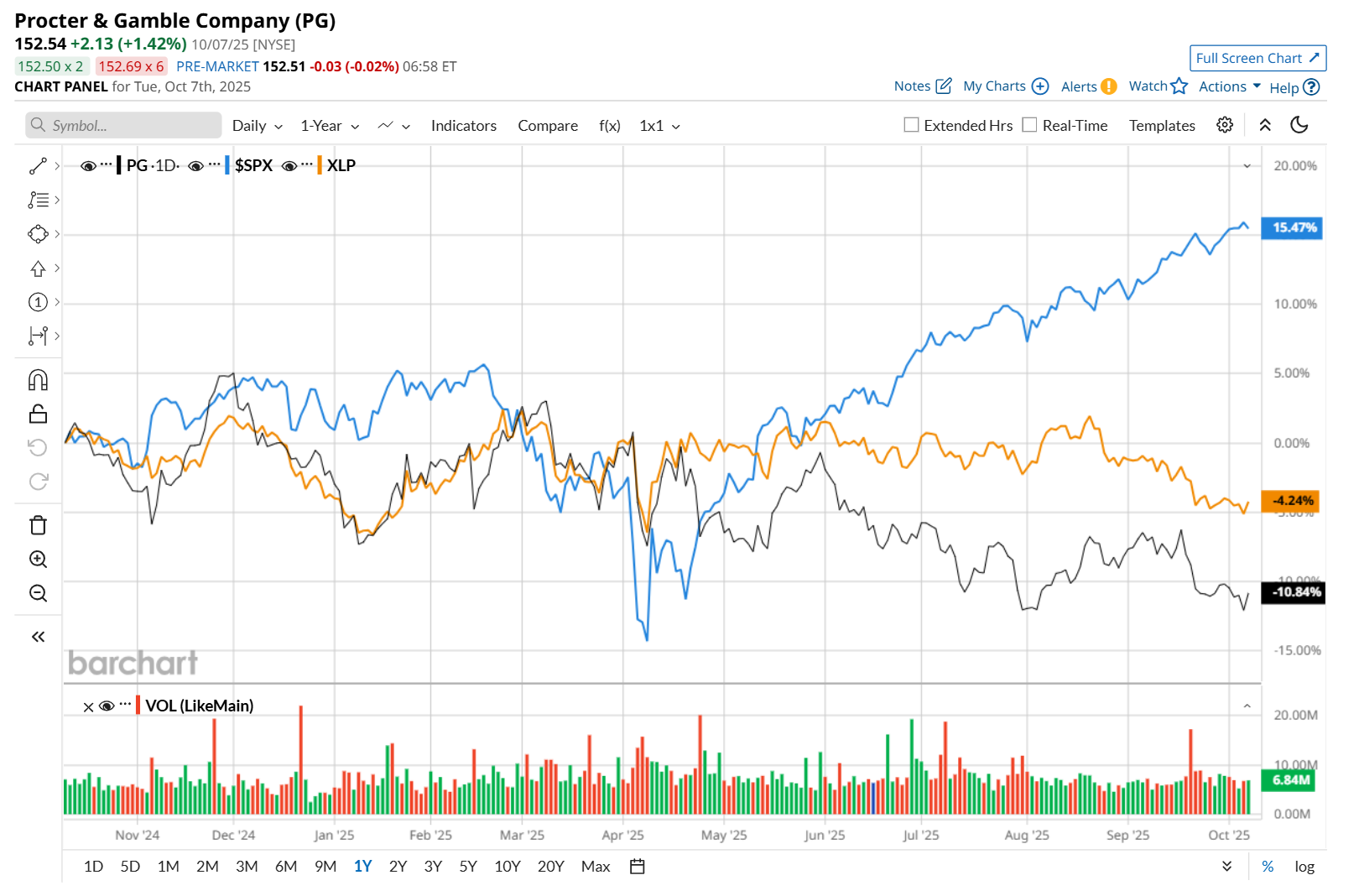

PG has declined 9.2% over the past 52 weeks, trailing behind both the S&P 500 Index's ($SPX) 17.9% return and the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.4% downtick over the same time frame.

On Jul. 29, PG reported better-than-expected Q4 results, yet its shares closed down marginally after the earnings release. The company’s net sales increased 1.7% year-over-year to $20.9 billion, marginally exceeding consensus estimates. Moreover, it managed to reduce its SG&A expenses, which in turn contributed to a 15.3% annual rise in its net earnings to $3.6 billion. Furthermore, its adjusted EPS advanced 5.7% from the same period last year to $1.48 and came in 3.5% ahead of analyst expectations. Wall Street analysts are moderately optimistic about PG’s stock, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, 11 recommend "Strong Buy," three indicate "Moderate Buy," and 11 suggest "Hold.” The mean price target for PG is $171, indicating a 12.1% potential upside from the current levels. On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|