|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

UnitedHealth's Quarterly Earnings Preview: What You Need to Know/Unitedhealth%20Group%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

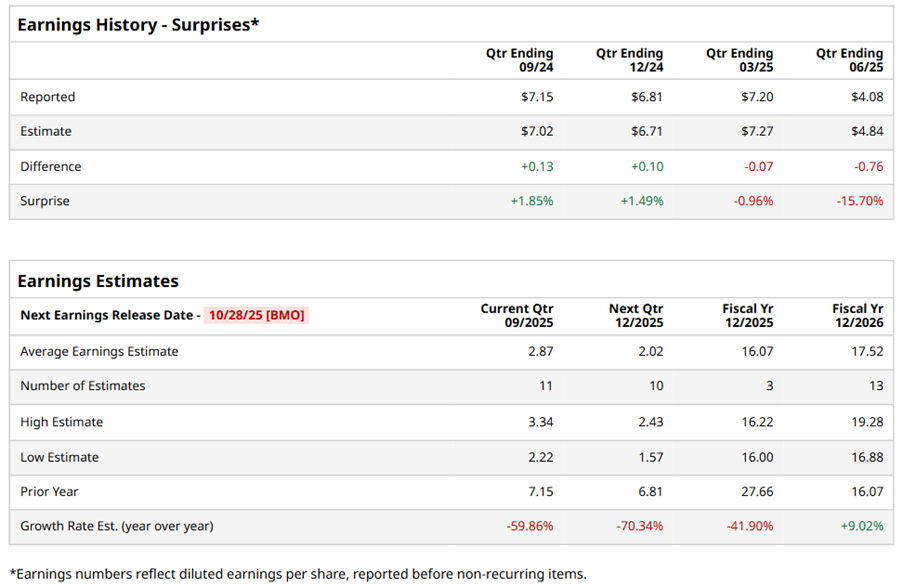

UnitedHealth Group Incorporated (UNH), headquartered in Minnetonka, Minnesota, owns and manages organized health systems. With a market cap of $324.9 billion, the company provides employers with products and resources to plan and administer employee benefit programs serving customers worldwide. The health insurance giant is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Tuesday, Oct. 28. Ahead of the event, analysts expect UNH to report a profit of $2.87 per share on a diluted basis, down 59.9% from $7.15 per share in the year-ago quarter. The company beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions. For the full year, analysts expect UNH to report EPS of $16.07, down 41.9% from $27.66 in fiscal 2024. However, its EPS is expected to rise 9% year-over-year to $17.52 in fiscal 2026.  UNH stock has significantly underperformed the S&P 500 Index’s ($SPX) 17.9% gains over the past 52 weeks, with shares down 37.7% during this period. Similarly, it notably underperformed the Health Care Select Sector SPDR Fund’s (XLV) 4.5% losses over the same time frame.  UNH's underperformance is attributed to ongoing challenges, including DOJ investigations into Medicare billing, the sudden departure of CEO Andrew Witty, and the suspension of earnings guidance amid rising medical costs. The company faces significant headwinds from regulatory issues, funding cuts, and increasing Medicare Advantage costs. On Jul. 29, UNH reported its Q2 results, and its shares closed down by 7.5% in the following trading session. Its adjusted EPS of $4.08 fell short of Wall Street expectations of $4.84. The company’s revenue was $111.62 billion, exceeding Wall Street forecasts of $111.55 billion. Analysts’ consensus opinion on UNH stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 25 analysts covering the stock, 15 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” six give a “Hold,” and two recommend a “Strong Sell.” While UNH currently trades above its mean price target of $324.48, the Street-high price target of $440 suggests an upside potential of 21%. On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|