|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

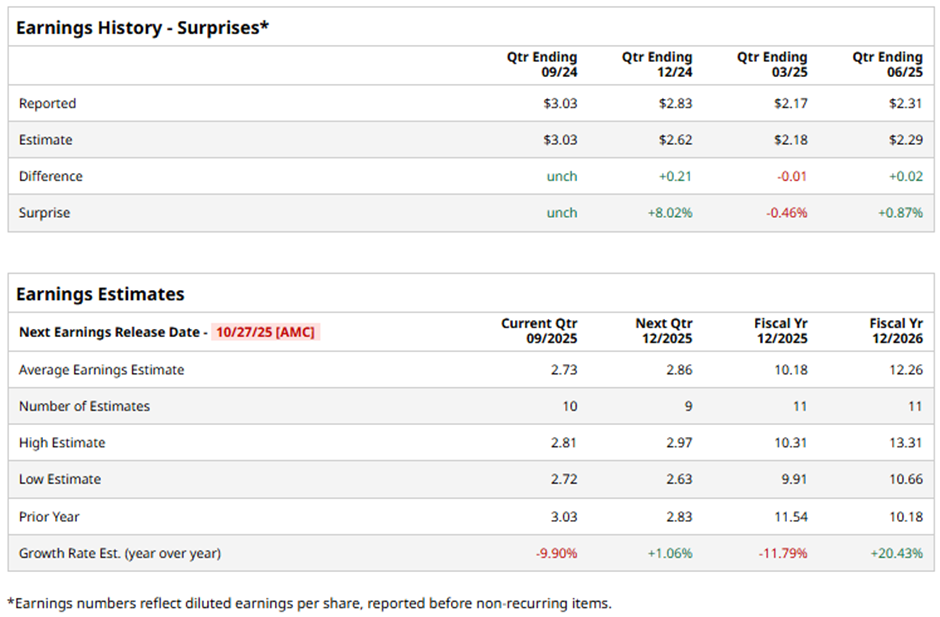

NXP Semiconductors' Quarterly Earnings Preview: What You Need to KnowWith a market cap of $55.4 billion, NXP Semiconductors N.V. (NXPI) is a global leader in high-performance mixed-signal and standard semiconductor solutions serving markets. Leveraging expertise in RF, analog, power management, security, and digital processing, it provides advanced technologies for applications ranging from autonomous driving and mobile payments to connected devices and wireless communications. The Eindhoven, the Netherlands-based company is slated to announce its fiscal Q3 2025 results after the market closes on Monday, Oct. 27. Ahead of this event, analysts expect NXP Semiconductors to report an EPS of $2.73, a 9.9% decrease from $3.03 in the year-ago quarter. It has exceeded or met Wall Street's earnings expectations in three of the past four quarters while missing on another occasion. For fiscal 2025, analysts expect the chipmaker to report EPS of $10.18, marking a decline of 11.8% from $11.54 in fiscal 2024. However, EPS is anticipated to grow 20.4% year-over-year to $12.26 in fiscal 2026.

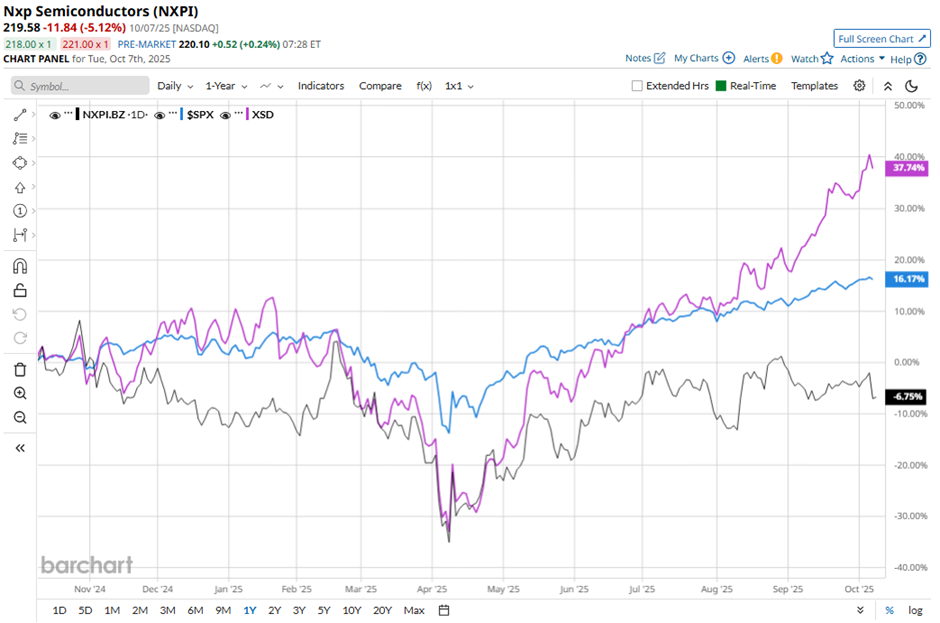

Shares of NXP Semiconductors have dipped 6.2% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 17.9% increase and the SPDR S&P Semiconductor ETF's (XSD) 39.4% surge over the same period.

Despite reporting better-than-expected Q2 2025 adjusted EPS of $2.72 and revenue of $2.93 billion on Jul. 21, NXP Semiconductors’ shares fell marginally the next day. Revenue declined 6% year-over-year, led by a sharp 27% drop in the Communication & Infrastructure segment and an 11% fall in Industrial & IoT, signaling softness in core end markets. Analysts' consensus view on NXPI stock remains bullish, with an overall "Strong Buy" rating. Out of 30 analysts covering the stock, 22 recommend a "Strong Buy," two "Moderate Buys," and six "Holds." The average analyst price target for NXP Semiconductors is $257.69, indicating a potential upside of 17.4% from the current levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|