|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Earnings Preview: What to Expect From KKR's Report

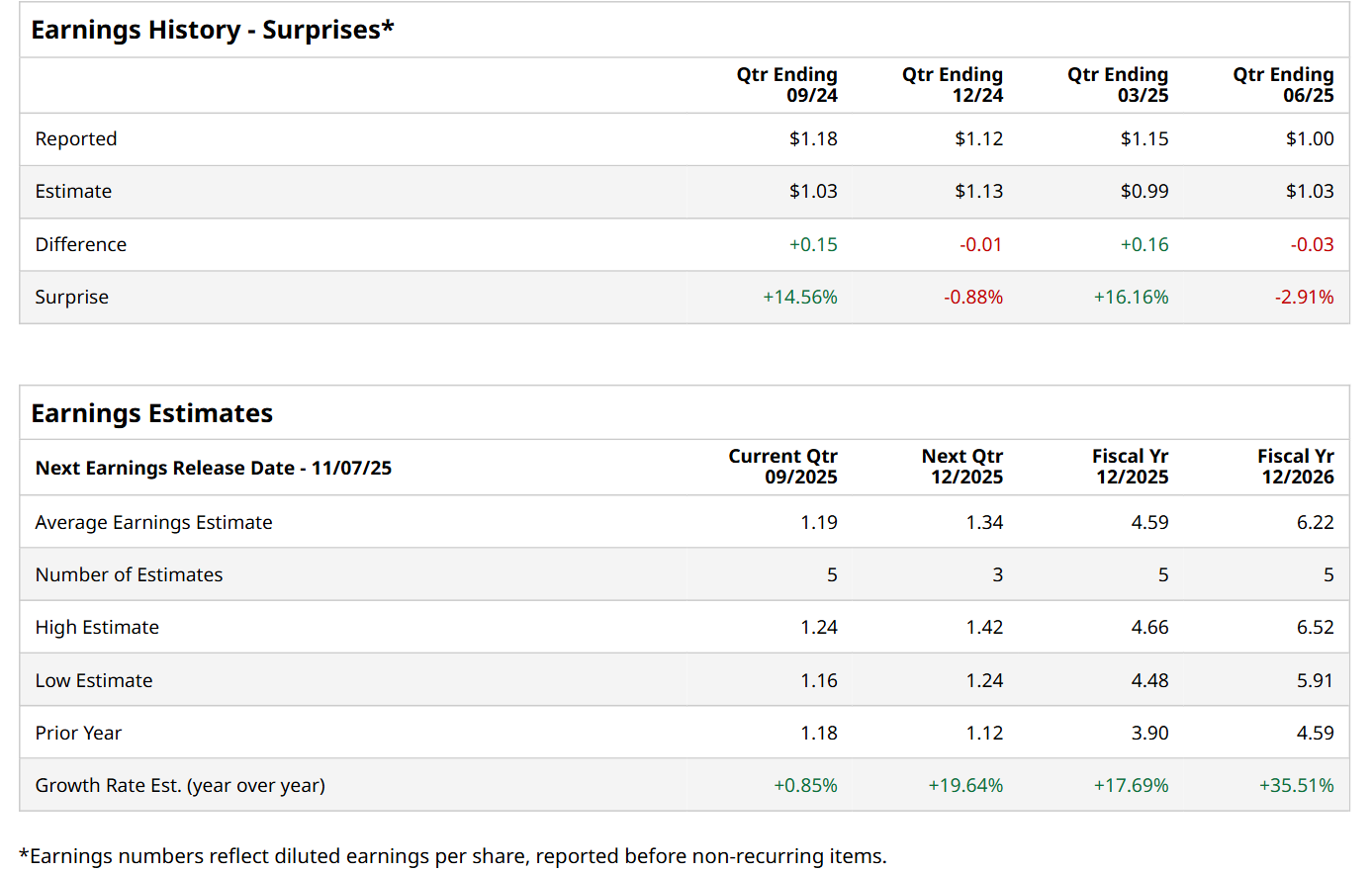

New York-based KKR & Co. Inc. (KKR) is a private equity and real estate investment firm with a market cap of $111.1 billion. The company specializes in acquisitions, leveraged buyouts, management buyouts, credit special situations, growth equity, mature, mezzanine, distressed, turnaround, lower middle market, and middle market investments. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Friday, Nov. 7. Before this event, analysts expect this private equity giant to report a profit of $1.19 per share, up marginally from $1.18 per share in the year-ago quarter. The company has exceeded Wall Street’s bottom-line estimates in two of the last four quarters, while missing on other two occasions. For the current fiscal year, ending in December, analysts expect KKR to report a profit of $4.59 per share, up 17.7% from $3.90 per share in fiscal 2024. Its EPS is expected to further grow 35.5% year-over-year to $6.22 in fiscal 2026.

KKR has declined 4.7% over the past 52 weeks, considerably lagging behind both the S&P 500 Index's ($SPX) 17.9% return and the Financial Select Sector SPDR Fund’s (XLF) 18.7% uptick over the same time frame.

On Jul. 31, KKR reported strong Q2 results, with its total revenue surging 22% year-over-year to $5.1 billion. Growth was broad-based, as asset management and strategic holdings revenue rose 17.6%, while insurance revenue jumped 24.6%. Moreover, on the earnings front, its adjusted EBITDA grew 11.2% from the year-ago quarter to $1.4 billion, while its adjusted net income per share advanced 8.3% annually to $1.18. However, despite the solid results, its shares plunged 2.6% that day. Wall Street analysts are highly optimistic about KKR’s stock, with a "Strong Buy" rating overall. Among 21 analysts covering the stock, 16 recommend "Strong Buy," two indicate "Moderate Buy," and three suggest "Hold.” The mean price target for KKR is $164.25, indicating a 31.7% potential upside from the current levels. On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|