|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

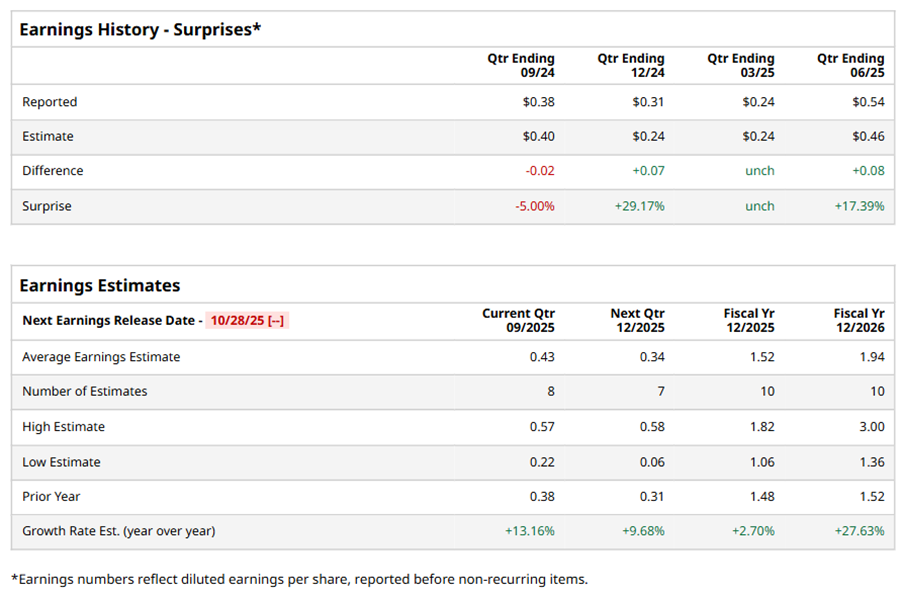

Freeport-McMoRan's Quarterly Earnings Preview: What You Need to Know

Freeport-McMoRan Inc. (FCX), headquartered in Phoenix, Arizona, is a leading international metals company with a focus on being the foremost producer of copper. With a market cap of $58.4 billion, the company mines mineral properties exploring copper, gold, molybdenum, silver, and other metals. The leading international metals company is expected to announce its fiscal third-quarter earnings for 2025 in the near term. Ahead of the event, analysts expect FCX to report a profit of $0.43 per share on a diluted basis, up 13.2% from $0.38 per share in the year-ago quarter. The company beat or matched the consensus estimates in three of the last four quarters while missing the forecast on another occasion. For the full year, analysts expect FCX to report EPS of $1.52, up 2.7% from $1.48 in fiscal 2024. Its EPS is expected to rise 27.6% year-over-year to $1.94 in fiscal 2026.  FCX stock has significantly underperformed the S&P 500 Index’s ($SPX) 17.9% gains over the past 52 weeks, with shares down 19.9% during this period. Similarly, it underperformed the Materials Select Sector SPDR Fund’s (XLB) 5.8% losses over the same time frame.  FCX's underperformance is attributed to production disruptions at its Grasberg mine, which are exacerbated by political risks in Indonesia. Copper production issues are expected to persist, potentially tightening supply and impacting the company's performance. On Jul. 23, FCX shares closed down more than 2% after reporting its Q2 results. Its adjusted EPS of $0.54 exceeded Wall Street expectations of $0.46. The company’s revenue was $7.6 billion, surpassing Wall Street forecasts of $7.1 billion. Analysts’ consensus opinion on FCX stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 19 analysts covering the stock, 10 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” and six give a “Hold.” FCX’s average analyst price target is $46.64, indicating a potential upside of 14.6% from the current levels. On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|