|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

This Analyst Just Hiked Their UnitedHealth Stock Price Target by 50%. Should You Buy UNH Now?/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

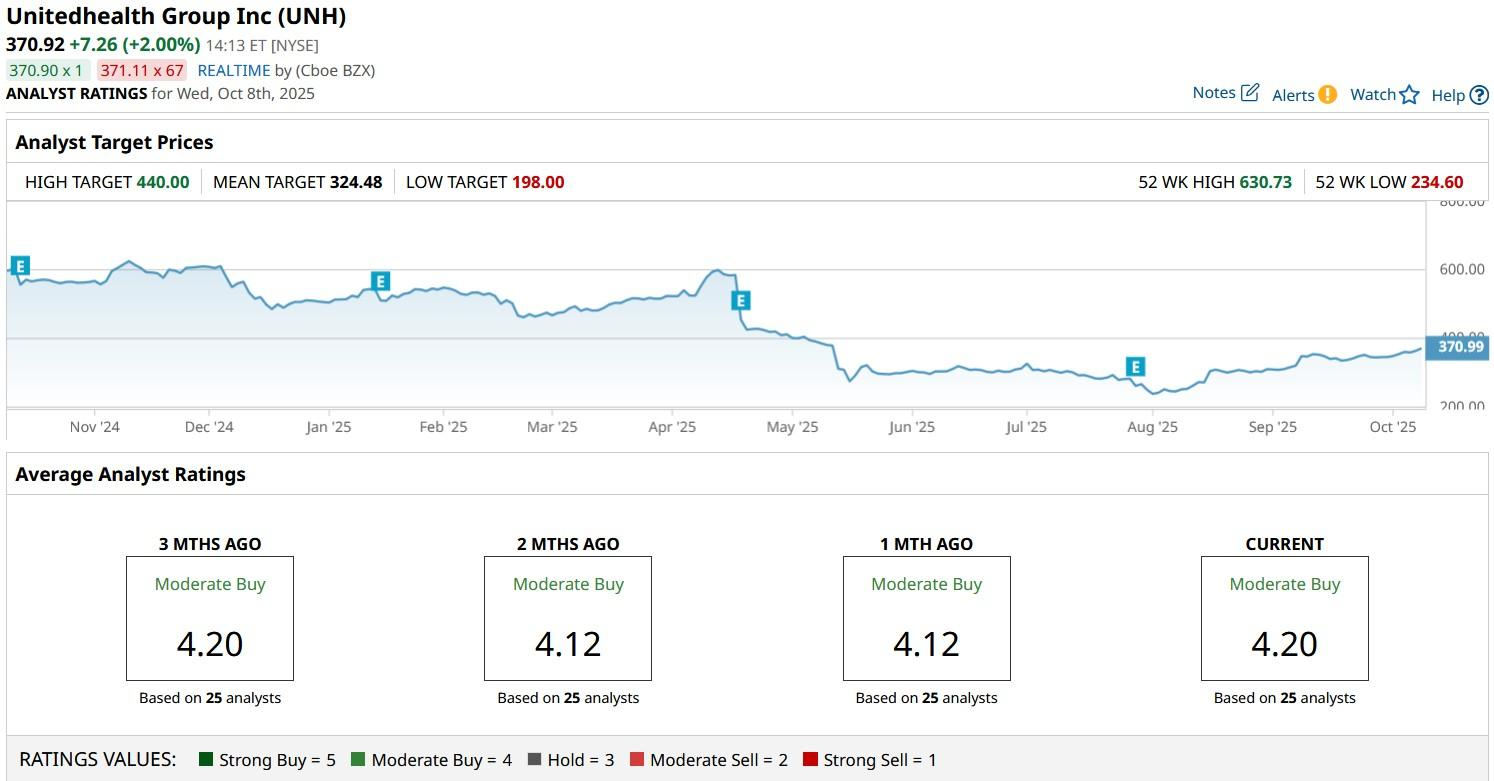

UnitedHealth (UNH) shares are inching higher on Wednesday after senior Wells Fargo analyst Stephen Baxter issued a positive note in favor of the world’s largest health insurance company. Baxter maintained his “Overweight” rating on UNH this morning and raised his price target to $400, indicating potential upside of another 8% from current levels. His bullish call is particularly significant given UnitedHealth stock has already soared more than 50% since early August.  Why Is Baxter Bullish on UnitedHealth Stock?Baxter’s research report arrives only days after UnitedHealth announced plans of scaling back its Medicare Advantage offerings, a decision that will likely affect some 180,000 beneficiaries. Still, the Wells Fargo analyst recommends owning UNH because it, nonetheless, remains dominant in employer-sponsored and government-backed insurance with over 50 million members globally. The investment firm raised its estimates for the insurance firm’s upcoming quarterly release today, citing the extension of increased subsidies as likely. A healthy dividend yield of 2.39% makes UNH stock even more attractive to own, at least for income-focused investors. UNH Shares May Not Be Out of Juice Just YetUNH’s care delivery and analytics unit, Optum, is gaining scale and margin resilience, which the Wells Fargo analyst dubbed a structural growth engine that offsets near-term utilization pressures. Despite a massive surge since early August, UnitedHealth shares are trading at a rather attractive valuation of less than 1x sales at the time of writing. Those interested in loading up on UNH stock may also take heart in the fact that legendary investor Warren Buffett has recently disclosed a sizable position in the health insurance giant, indicating confidence in its long-term growth and stability. All in all, Stephen Baxter believes the UnitedHealth selloff due to regulatory scrutiny and higher medical costs this year is largely overdone, creating compelling entry point for long-term investors. What’s the Consensus Rating on UnitedHealth Group?Wall Street firms more broadly remain bullish on UnitedHealth stock’s ability to retain momentum as well. The consensus rating on UNH shares currently sits at “Moderate Buy” with price targets going as high as $450, indicating potential upside of another 20% from here.  On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|