|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Gold, Silver, and U.S. Stocks Are All at Record Highs. What Gives?

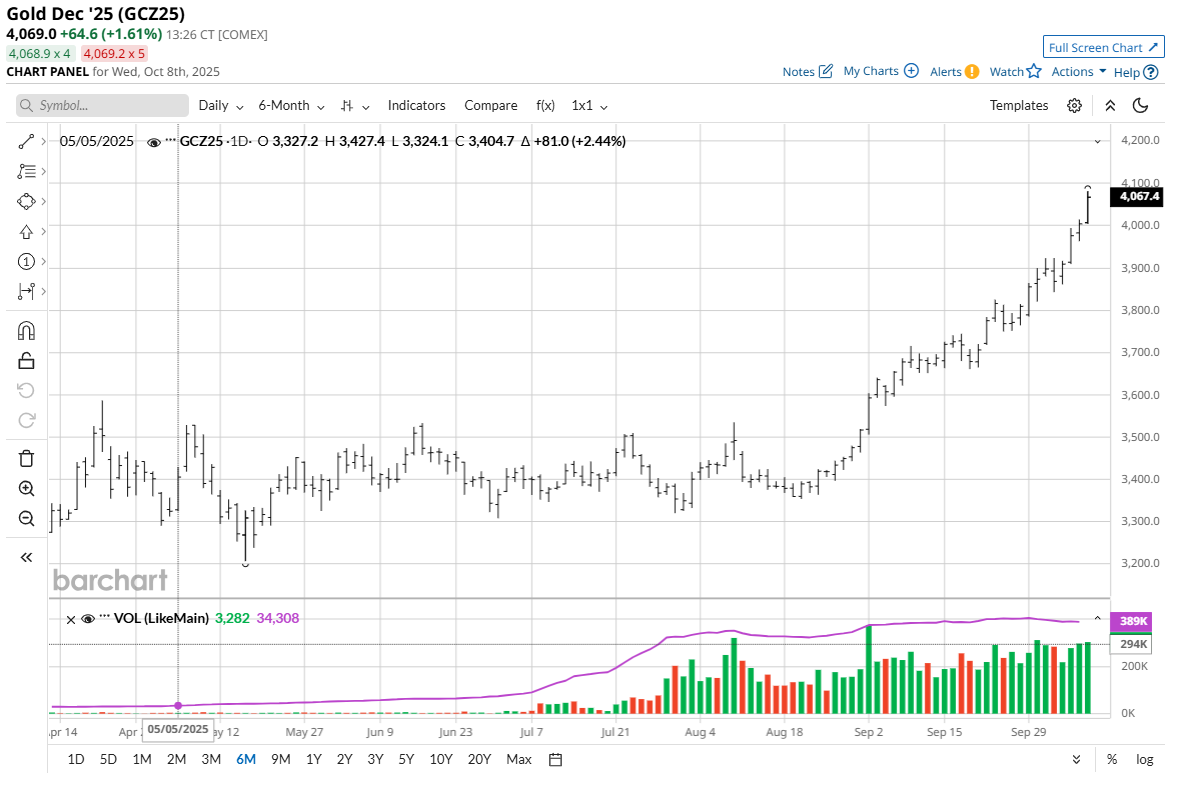

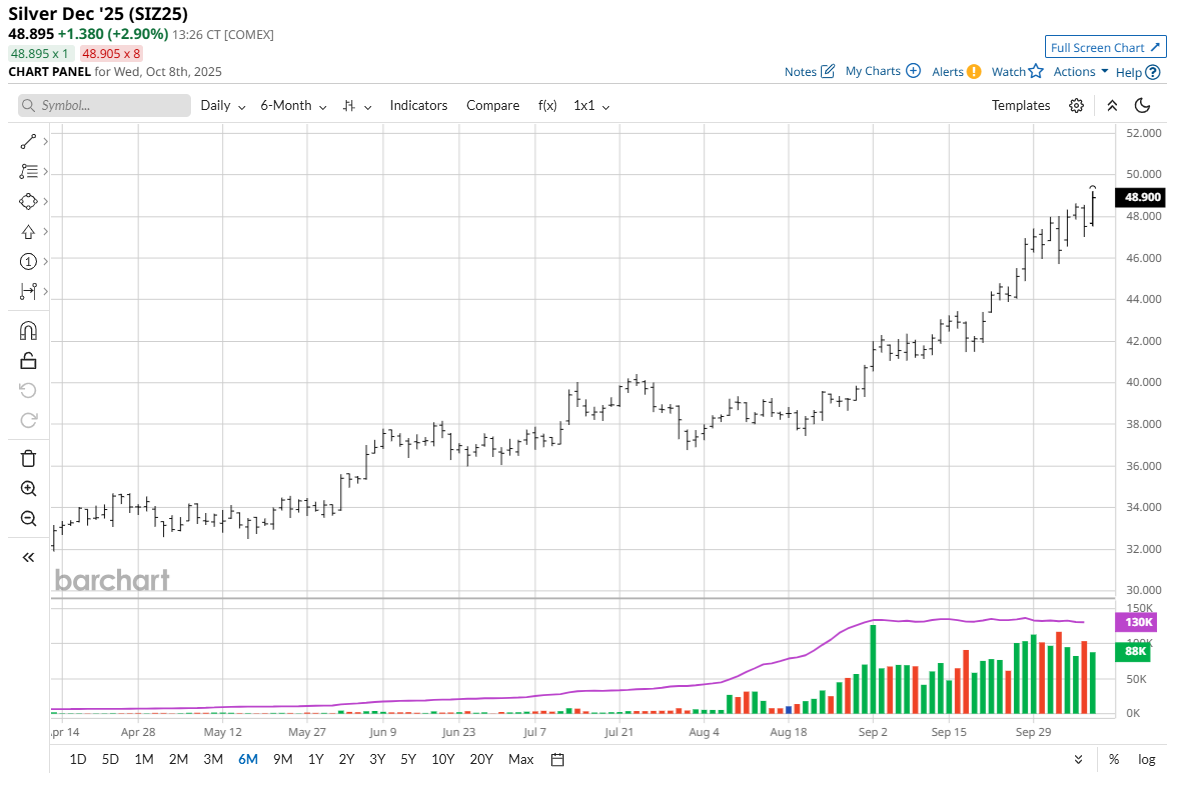

I was getting ready to write my weekly “Front Burner” feature today and I was bandying about ideas for a topic. I was surely going to write about precious metals as gold (GCZ25) today hit a record high of $4,072.00 an ounce basis December Comex futures. Silver (SIZ25) today hit an all-time high of $49.55 an ounce in December Comex futures.

Then, a Reuters metals reporter called me to ask about what’s driving the major bull runs in gold and silver. I was explaining to him all the fundamental elements driving safe-haven demand to the gold and silver markets, including marketplace uncertainty regarding the U.S. government shutdown that has left many markets devoid of fresh economic news to drive price action. Also, France’s political turmoil at present has unnerved European markets and European Union leadership. The Russia-Ukraine war is presently running hotter. There are financial troubles in Argentina as its currency is losing value. Japan’s political and economic woes are creating anxiety in the currency markets. Furthermore, I told the Reuters reporter that most major central banks are leaning easier on monetary policy, which supports better demand for precious metals in the months ahead. And the central banks, themselves, are starting to stockpile more gold. That’s partly due to “de-dollarization” that has developed as countries push to move away from holding greenbacks in their sovereign reserves. These are bullish elements for the gold market that will likely continue to drive better demand for gold in the longer term.

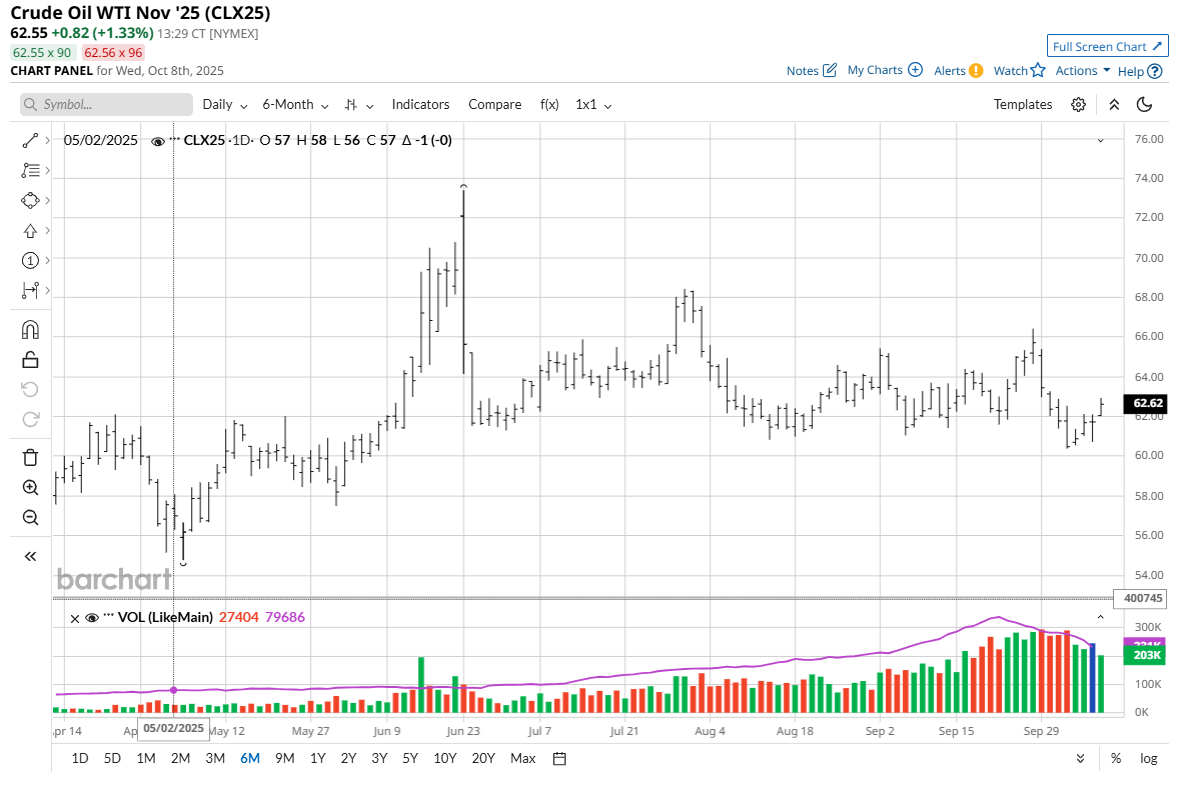

Also, gold and silver prices are in short-term and long-term price uptrends on the technical charts. That’s been driving chart-based speculator buying in both metals. The Reuters reporter then asked me what I thought might derail the major bull market runs in gold and silver. I proceeded to tell him that a calmer geopolitical scene would be bearish for safe-haven gold and silver. A Russia-Ukraine cease-fire or Middle East peace accord would be two calming elements. Falling crude oil prices are also bearish for metals markets. Crude oil (CLX25) is the leader of the raw commodity sector. Nymex crude oil prices last week hit a nearly four-month low. If oil continues to trend lower, that would be a bearish anchor on most raw commodities, including metals.

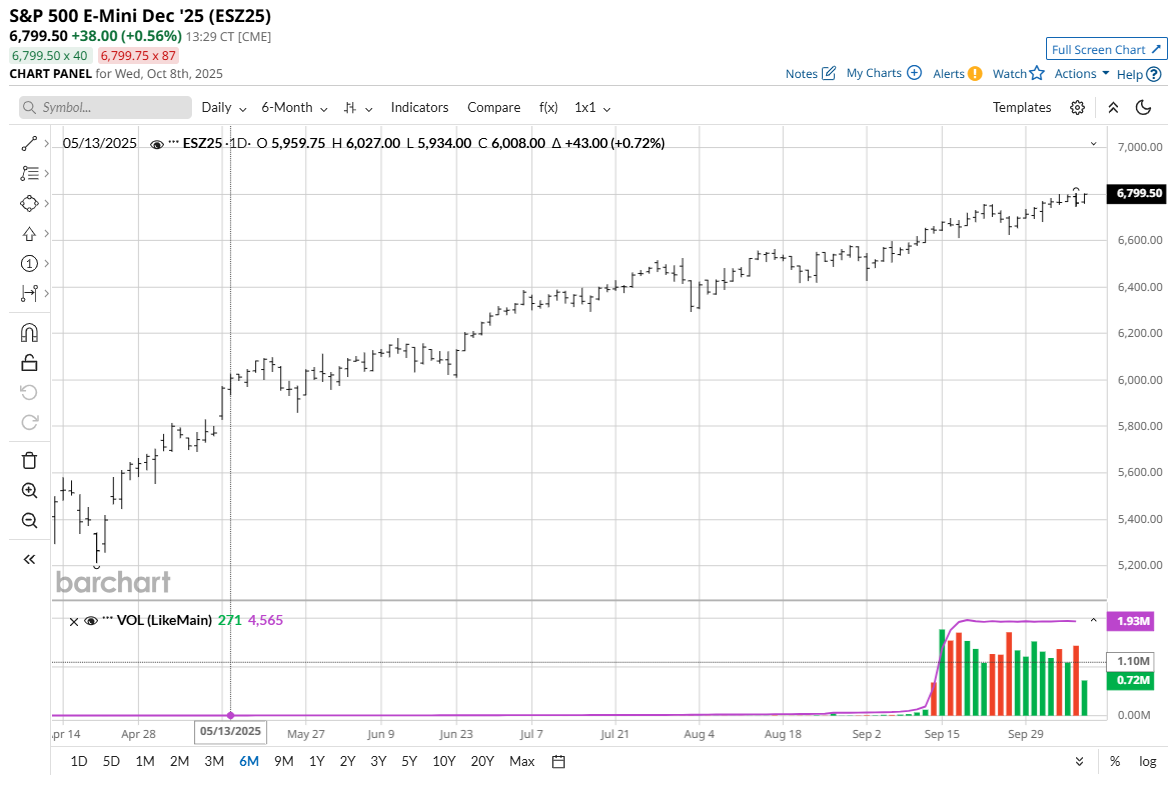

An end to the easier monetary policy cycle from the major central banks would be a significantly bearish development for the gold and silver markets. Rising interest rates mean higher borrowing costs for consumers and businesses, and in turn, less demand for goods. Then the Reuters reporter asked me what I thought was a very compelling question: “What do you think record-high U.S. stock index prices mean for the gold and silver markets?” I had to think a little bit about that one. After my brief pause, I told the reporter that precious metals are a competing asset class with stocks. Money flowing into the stock market and pushing it to record highs (due to better risk appetite) should mean less money flowing into safe-haven metals. Yet, gold and silver are rallying on safe-haven demand (keener risk aversion). It’s not in the scope of this story to fully explain how the general marketplace can presently be showing better appetite to drive the stock market higher, while at the same time showing safe-haven demand to drive gold and silver to record highs. Suffice it to say I’ve always said the markets and traders are fickle, and this is one example.

The reporter’s question on stocks and gold led me to a conclusion that I had not previously thought about. And that is that I believe part of the safe-haven bidding driving gold and silver prices still higher is a belief by more than a few traders and investors that the U.S. stock market is way overvalued, especially the artificial intelligence sector, and it may soon experience a blow-off top. That’s exactly what respected veteran commodity trader Paul Tudor Jones said this week. That scenario, if it plays out, could mean a big drop in the stock market at some point sooner rather than later. That would also likely include higher volatility in other markets. That’s fully bullish for safe-haven gold and silver markets. Remember, history shows that the month of October can be very unkind to stock market bulls. Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com. On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|