|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Nvidia Stock Got Rocked by AMD’s OpenAI Deal, But Wall Street Still Loves NVDA/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

The market is brutal. It does not care for reputations, at least in the short term. The latest instance of that was seen in Nvidia's (NVDA) stock. Notwithstanding its current status as the most valuable company in the world and a hegemonic 90% market share in the GPU market, or its status as perhaps the most critical company of the AI revolution, its shares witnessed a selloff (albeit muted) after rival AMD (AMD) secured a partnership with ChatGPT-maker OpenAI. Good for AMD, as this is also a healthy sign for the entire chip industry, with this development signaling that the hyperscalers are not solely dependent on Nvidia to fuel their AI ambitions. However, the market's reaction to Nvidia was an overkill, as absolutely nothing has altered the long-term growth prospects of Nvidia, with analysts remaining bullish about the company. Why so? Let's find out. Rocking FinancialsDespite the recent decline, NVDA stock is still up 40.5% on a year-to-date (YTD) basis, outperforming the S&P 500's ($SPX) rise of 14.7%. And Nvidia's financials remain as suave as CEO Jensen Huang's bevy of leather jackets.

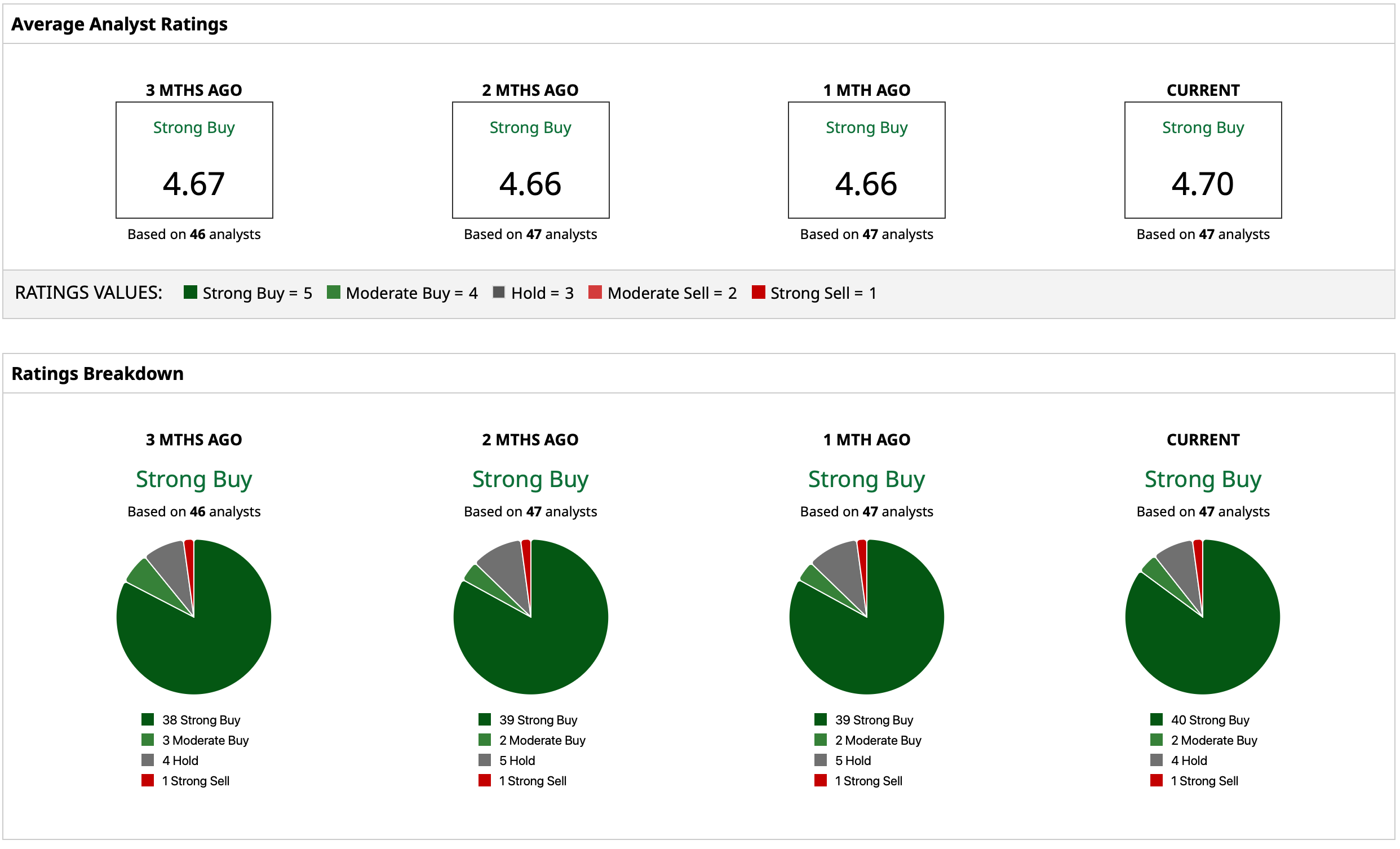

A long-term analysis of the company's performance over the last ten years reveals remarkably strong expansion, with compounded annual growth rates (CAGRs) for sales and earnings per share (EPS) reaching an impressive 42.52% and 66.59%, respectively. Looking forward, market experts anticipate this accelerating trend will continue, projecting future revenue growth at 65.33% and EPS growth at 72.11%. These projected figures dramatically surpass the industry medians of around 7.53% and earnings growth of 11.03%, respectively. The latest quarterly results underscore this momentum, as the company decisively exceeded expectations. Total revenue for the period reached $46.7 billion, representing a significant 56% jump when contrasted with revenue from the comparable quarter of the prior year. Similarly, EPS came in at $1.05, comfortably surpassing the Wall Street consensus of $1.01 and marking a 54% year-over-year (YoY) increase. The primary driver of these outstanding results remains the data center segment, which generated $41.1 billion in sales, up 5% quarter-over-quarter (QoQ) and a staggering 56% from the year-ago period. On the balance sheet, the firm’s net cash from operating activities increased to $15.4 billion from the previous year’s $14.5 billion. With no short-term liabilities in the debt category and a substantial cash reserve totaling $56.8 billion, the company finished the quarter in an exceptionally robust financial position concerning its immediate liquidity needs. Moving ahead, the corporation has issued its financial outlook for the subsequent quarter, forecasting revenues to be about $54 billion. This guidance is above the current consensus estimate of analysts, which predicts a revenue figure of $53.14 billion. While the valuations may seem elevated with the company's forward P/E (41.21), forward P/S (21.83), and forward P/CF (42.67) all being higher than the sector medians of 25.78, 3.57, and 20.13, respectively, the forward PEG, or the P/E to growth ratio, at 1.15 still remains lower than the sector median of 1.83. It Will Be Difficult to Stop NvidiaAs highlighted in my recent piece, Nvidia has multiple avenues of growth, even though it remains the preferred choice among hyperscalers for their AI applications. The latest endorsement of that came from Elon Musk's xAI. Moreover, Nvidia is poised to realize over $20 billion in revenue this year from sovereign AI, signaling robust market demand and representing a doubling of the income generated in the prior year. The chipmaker also demonstrates broad operational strength, with its networking division alone registering a 98% surge in YoY growth. Additionally, often overlooked but deserving of attention are the company’s efforts to enhance shareholder value. During the most recently concluded fiscal quarter, Nvidia committed about $10 billion to capital return initiatives through a combination of share repurchases and distributions. This total was comprised of a substantial $9.7 billion in stock buybacks alongside $244 million in dividend payouts. Should this pattern persist, the ongoing share buyback program is expected to materially boost earnings per share, thereby helping to justify an expansion of the stock's valuation multiple. Meanwhile, the firm also possesses stakes in several strategic investments, including ARM Holdings (ARM), Nebius (NBIS), and Applied Digital Corporation (APLD), among others, which serve to solidify its competitive advantage within the fast-moving AI ecosystem. Notably, these holdings provide Nvidia with considerable influence when compared to its rivals. This particular semiconductor giant not only commands market leadership but also benefits from substantial ties to diverse sectors heavily engaged with AI technology. Lastly, a key differentiator for Nvidia in the competitive AI landscape is its extensive repository of more than 900 specialized, industry-focused models. These models are meticulously trained on proprietary, industry-specific data, making them significantly more valuable to organizations seeking AI solutions with specialized domain expertise. Importantly, GPU owners have the capability to create tailored AI tools and language models specific to their products or services. This vast library has seen rapid growth, increasing from just 400 libraries recorded twelve months ago. Analyst Opinion on NVDA StockConsidering this, analysts are still upbeat about the NVDA stock, with an overall rating of “Strong Buy” with a mean target price of $217.14. This indicates upside potential of about 15% from current levels. Out of 47 analysts covering the stock, 40 have a “Strong Buy” rating, two have a “Moderate Buy” rating, four have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|