|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Pentair’s Quarterly Earnings Preview: What You Need to Know/Pentair%20plc%20logo%20on%20phone-by%20nikkimeel%20via%20Shutterstock.jpg)

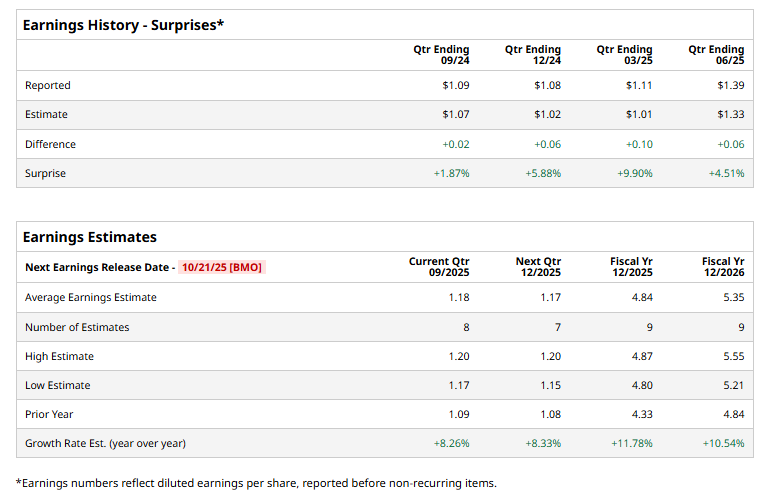

London-based Pentair plc (PNR) is a global leader in water treatment and sustainable fluid management solutions. The company, valued at a market cap of $18.1 billion, designs and manufactures a wide range of products that help move, treat, store, and enjoy water efficiently and responsibly. Its offerings span residential, commercial, industrial, and infrastructure markets, including pool equipment, filtration systems, pumps, and water purification technologies. The company is set to unveil its third-quarter results before the markets open on Tuesday, Oct. 21. Ahead of the event, analysts expect PNR to report non-GAAP earnings of $1.18 per share, up 8.3% from the profit of $1.09 per share reported in the year-ago quarter. Additionally, the company has surpassed the Street’s bottom-line projections in each of the past four quarters, which is impressive. For the current year, its earnings are expected to come in at $4.84 per share, up 11.8% from $4.33 per share reported in the year-ago quarter. Moreover, in fiscal 2026, its earnings are expected to rise 10.5% year-over-year to $5.35 per share.

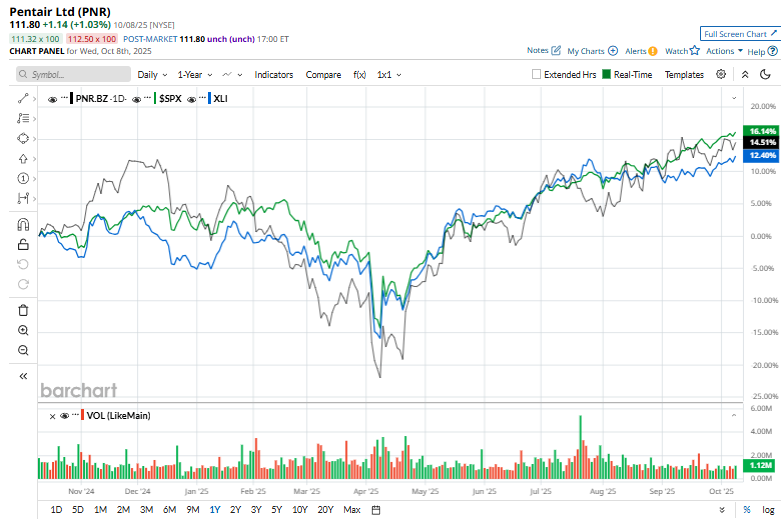

PNR stock has surged 16% over the past 52 weeks, outperforming the Industrial Select Sector SPDR Fund’s (XLI) 14.8% surge. However, the stock has trailed the S&P 500 Index’s ($SPX) 17.4% uptick during the same time frame.

Pentair shares climbed marginally on July 22 following robust Q2 2025 results, with adjusted EPS of $1.39 surpassing both consensus estimates and company guidance, representing a 14% year-over-year increase. Net sales rose 2% to $1.123 billion, exceeding expectations, while adjusted segment operating margin expanded 170 basis points to 26.4%. Management also raised full-year adjusted EPS guidance to $4.75–$4.85 and projected 2025 sales growth of 1%–2%. The consensus opinion on PNR is fairly upbeat, with a “Moderate Buy” rating overall. Of the 20 analysts covering the stock, opinions include 12 “Strong Buys,” one “Moderate Buy,” six “Holds,” and one “Moderate Sell.” Its mean price target of $116.28 suggests a 4% upside potential from current price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|