|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Monolithic Power Systems Earnings Preview: What to Expect/Monolithic%20Power%20System%20Inc%20logo%20and%20stock%20chart-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

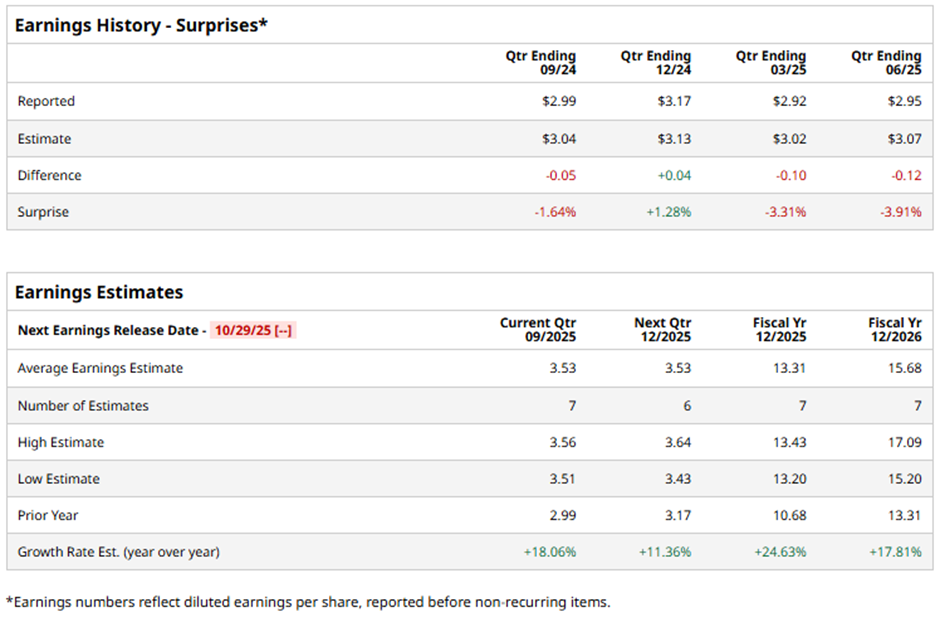

With a market cap of $46.9 billion, Monolithic Power Systems, Inc. (MPWR) is a fabless semiconductor company that designs, develops, and markets high-performance analog and mixed-signal power solutions for industrial, automotive, cloud computing, and consumer electronics. The company focuses on innovative power management technologies while partnering with third-party manufacturers for production and assembly. The Kirkland, Washington-based company is slated to announce its fiscal Q3 2025 results soon. Ahead of the release, analysts predict Monolithic Power Systems to report EPS of $3.53, an 18.1% increase from $2.99 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in one of the past four quarters while missing on three other occasions. For fiscal 2025, analysts expect the chipmaker to report EPS of $13.31, marking a surge of 24.6% from $10.68 in fiscal 2024.

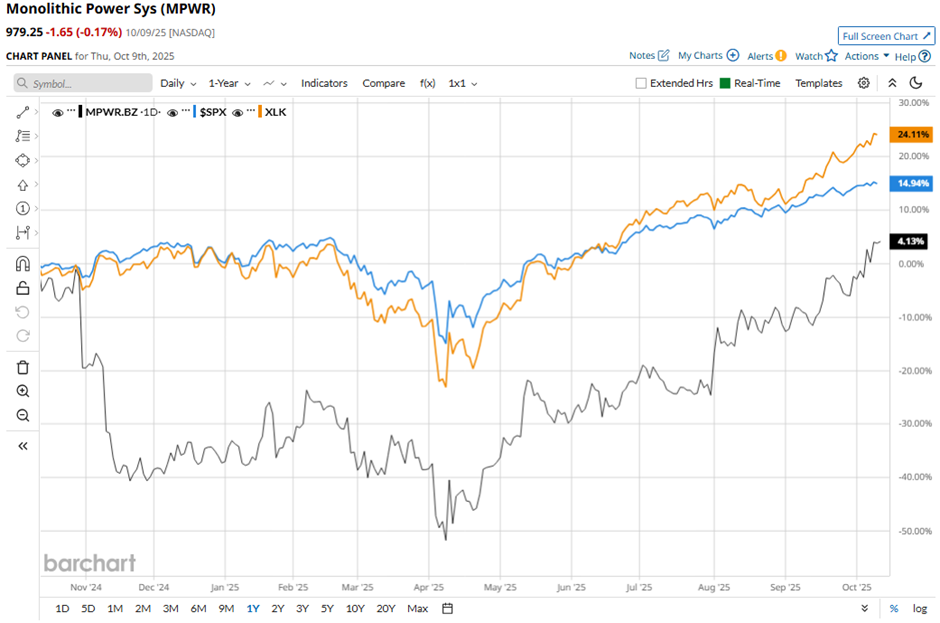

Shares of Monolithic Power Systems have risen 4.6% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 16.3% gain and the Technology Select Sector SPDR Fund's (XLK) 26.4% increase over the same period.

Shares of Monolithic Power Systems climbed 10.5% following its Q2 2025 results on Jul. 31, as adjusted EPS of $4.21 and revenue of $664.6 million, topping forecasts. The company also guided Q3 revenue to $710 million - $730 million, well above the consensus, reflecting strong demand for its power management solutions in AI and server applications. Analysts' consensus view on MPWR stock remains moderately optimistic, with an overall "Moderate Buy" rating. Out of 16 analysts covering the stock, 10 recommend a "Strong Buy," two "Moderate Buys," and four "Holds." This configuration is slightly more bullish than three months ago, with nine analysts suggesting a "Strong Buy." As of writing, the stock is trading above the average analyst price target of $892.67. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|