|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

TE Connectivity's Quarterly Earnings Preview: What You Need to Know/TE%20Connectivity%20Ltd%20HQ%20photo-by%20Michael%20Vi%20via%20Shutterstock.jpg)

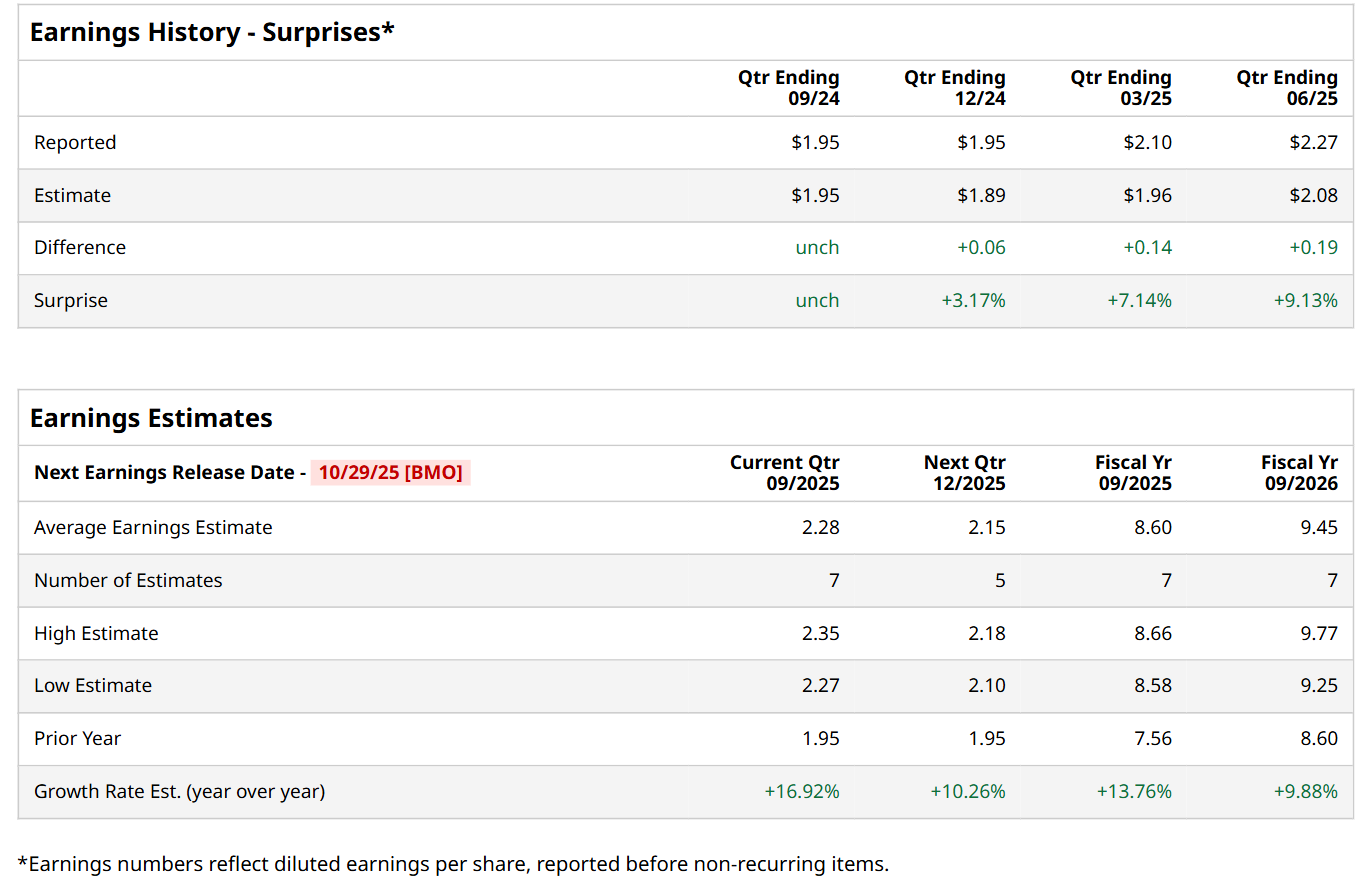

Valued at a market cap of $65.7 billion, TE Connectivity plc (TEL) is a global industrial technology leader that designs and manufactures advanced connectivity and sensor solutions for critical applications across a wide range of industries, including automotive, industrial automation, aerospace, defense, energy, and healthcare. The Ballybrit, Ireland-based company is scheduled to announce its fiscal Q4 earnings for 2025 before the market opens on Wednesday, Oct. 29. Ahead of this event, analysts expect this tech company to report a profit of $2.28 per share, up 16.9% from $1.95 per share in the year-ago quarter. The company has met or surpassed Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, TEL’s EPS of $2.27 exceeded the forecasted figure by a notable margin of 9.1%. For fiscal 2025, analysts expect TEL to report a profit of $8.60 per share, representing a 13.8% increase from $7.56 per share in fiscal 2024. Furthermore, its EPS is expected to grow 9.9% year-over-year to $9.45 in fiscal 2026.

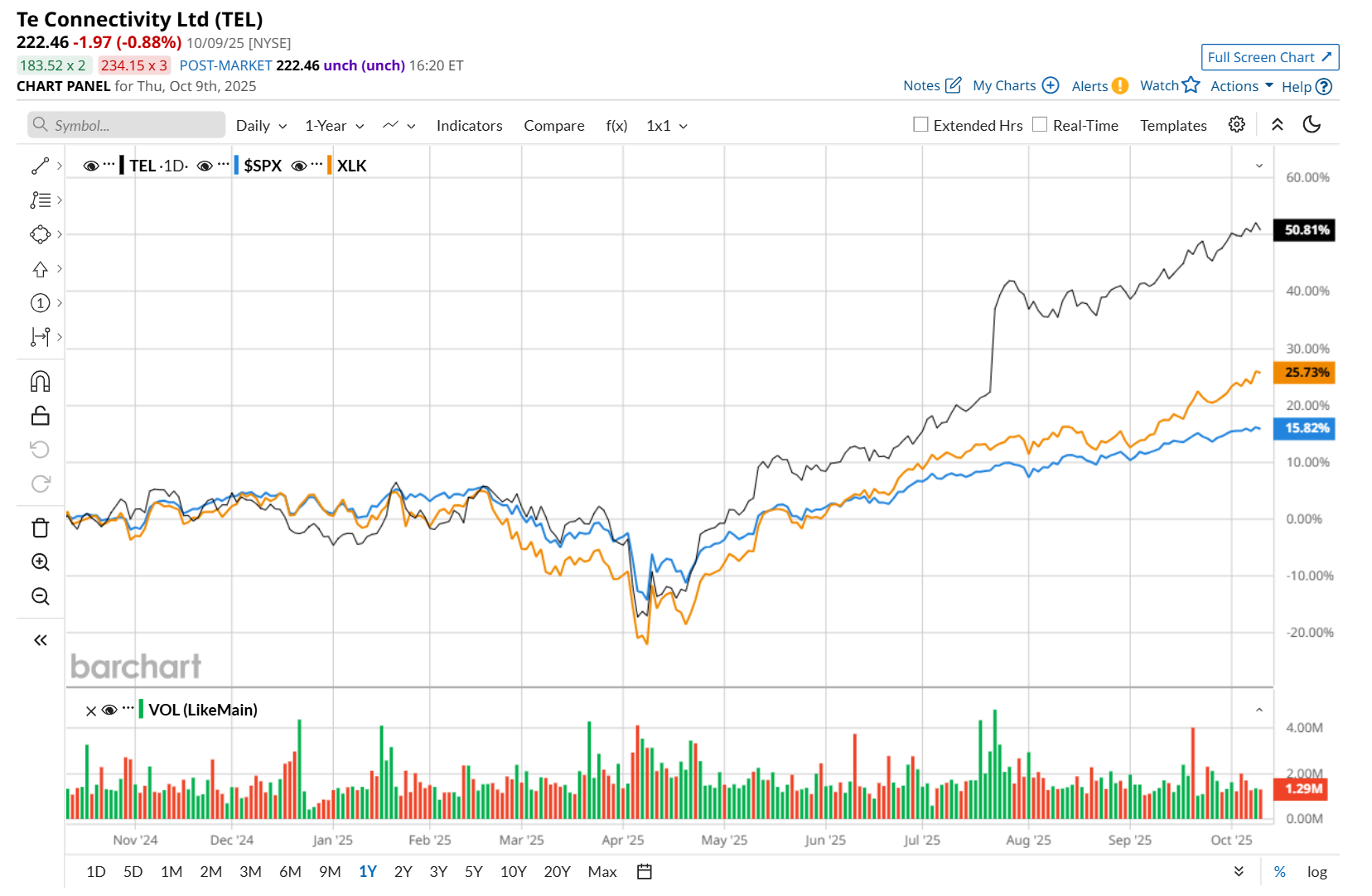

TEL has rallied 50.9% over the past 52 weeks, considerably outpacing both the S&P 500 Index's ($SPX) 16.3% return and the Technology Select Sector SPDR Fund’s (XLK) 26.3% uptick over the same time frame.

On Jul. 23, shares of TE Connectivity surged 12% after it delivered an impressive Q3 performance. Strong revenue growth across both its business segments, particularly a 30% surge in its industrial solutions division, fueled a 13.9% year-over-year rise in its total revenue to a record $4.5 billion, surpassing consensus estimates by 5.1%. Profitability also reached new highs, with adjusted EPS climbing 18.8% from the prior-year quarter to $2.27, beating Wall Street expectations by 9.1%. Wall Street analysts are moderately optimistic about TEL’s stock, with a "Moderate Buy" rating overall. Among 18 analysts covering the stock, 12 recommend "Strong Buy," and six suggest "Hold.” The mean price target for TEL is $222.47, implying a marginal potential upside from the current levels. On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|