|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Ventas’ Q3 2025 Earnings: What to Expect

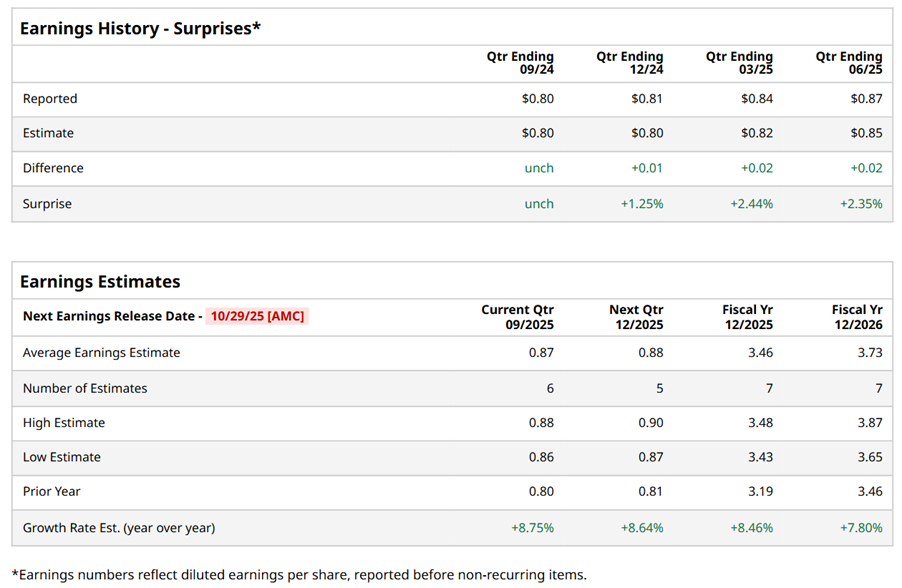

Ventas, Inc. (VTR), headquartered in Chicago, Illinois, is a leading real estate investment trust (REIT) enabling exceptional environments that benefit a large and growing aging population. Valued at $30.8 billion by market cap, the company owns seniors housing communities, skilled nursing facilities, hospitals, and medical office buildings in the U.S. and Canada. The leading healthcare REIT is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Wednesday, Oct. 29. Ahead of the event, analysts expect VTR to report an FFO of $0.87 per share on a diluted basis, up 8.8% from $0.80 per share in the year-ago quarter. The company has beat or matched Wall Street’s FFO estimates in its last four quarterly reports. For the full year, analysts expect VTR to report FFO of $3.46 per share, up 8.5% from $3.19 in fiscal 2024. Its FFO is expected to rise 7.8% year over year to $3.73 per share in fiscal 2026.

VTR stock has underperformed the S&P 500 Index’s ($SPX) 16.3% gains over the past 52 weeks, with shares up 8% during this period. However, it outperformed the Real Estate Select Sector SPDR Fund’s (XLRE) 5.1% downtick over the same time frame.

VTR's Q2 results exceeded expectations on Jul. 30, boosting its share price by 1.1% in the next trading session. The company's revenue rose 18.3% year-over-year to $1.4 billion, driven by higher outpatient medical and research revenues, as well as growth in resident fees and services. Key highlights include a 6.6% increase in adjusted same-store cash NOI to $485.3 million, and an 8.8% rise in normalized FFO per share to $0.87, beating analyst forecasts. Analysts’ consensus opinion on VTR stock is bullish, with a “Strong Buy” rating overall. Out of 22 analysts covering the stock, 15 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and five give a “Hold.” VTR’s average analyst price target is $77.15, indicating a potential upside of 14% from the current levels. On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|