|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

Netflix Stock Still Looks 15% Too Cheap, Especially If It Keeps Producing 20% FCF Margins/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

If Netflix, Inc. (NFLX) produces strong Q3 results on Oct. 21 with at least a 20% free cash flow (FCF) margin, NFLX stock could still be almost 15% undervalued. This article will explain this strategy and its rationale. I will highlight why buying in-the-money, longer-dated (ITM) calls and shorting near-expiry, out-of-the-money (OTM) puts is a sound approach. NFLX closed at $1,220.08 on Friday, Oct. 10, down less than 1% in a down market. It's off from a recent peak of $1,263.25 on Sept. 9, but still up from a recent low of $1,143.22 on Oct. 3.

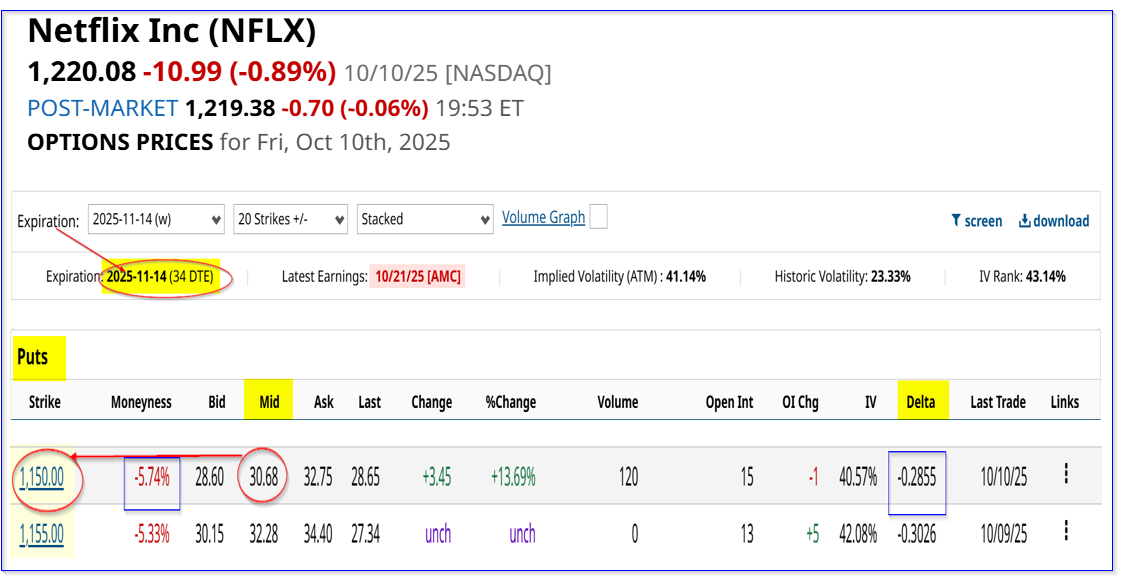

I discussed Netflix's strong FCF, FCF margins, and a target price of $1,382.56 after its Q2 results on July 18 ("Netflix Produces Strong Q2 FCF, But NFLX Stock Dips - Is It a Buy Here?). This article will update that analysis and my new price target of $1,400, or +14.7% higher than Friday's close. Expect Strong Free Cash Flow and FCF MarginsLast quarter, Netflix's revenue rose by +15.9% YoY to $11.079 billion, and management forecasted a+17.3% increase for Q3 to $11.526 billion. Analysts have been raising their revenue forecasts. For example, the average of 44 analysts surveyed by Seeking Alpha for the 2025 full-year revenue forecast is $45.05 billion (up from $44.84 billion shown in my July 18 Barchart article). For 2026, their average is $50.87 billion (up from $50.37 billion), i.e., up +11.8% for 2026. The bottom line is that Netflix's subscription and ad revenue is expected to stay strong. Moreover, its free cash flow (FCF) and FCF margins are also likely to be consistently high. For example, last quarter, the FCF margin was 20.5% and in Q1 it was 25.2%, for a H1 average of 22.85%. And for the past year, it has been 20.39%, according to Stock Analysis. As a result, and to be conservative, let's assume that the next 12 months (NTM) FCF margin will be at least 20.4%. What is the expected FCF? To project the NTM FCF, let's use a weighted average revenue forecast since the Q3 numbers are already likely discounted in the stock price: (0.25 x $45.05 billion 2025 rev.) + (0.75 x $50.87 billion 2026) = $11.2625b + $35.1525b = $49.415 billion NTM revenue Using a 20.4% x $49.415 NTM revenue = $10.08 billion FCF over the next 12 months That would be +17.6% higher than the trailing 12 months (TTM) $8.5 billion in FCF it made as of Q2. And compared to the Q2 FCF on a run rate basis (i.e., $2.267 billion FCF in Q2 x 4 = $9.068 billion), it's +11.1% higher. This could lead to a higher market value for Netflix. NFLX Stock Price TargetOne way to value a stock is to assume that 100% of its FCF is paid out to shareholders. What is the market assuming now that the dividend yield would be? Well, let's use the $9.068 billion run-rate FCF. That represents a 1.75% yield: $9.068 billion run rate FCF / $518.444 billion market cap (Yahoo! Finance) = 0.01749 = 1.75% FCF yield And using its trailing 12-month (TTM) FCF of $8.5 billion works out to a 1.64% yield (i.e., $8.5b /$518.44b = 0.016395 = 1.64%). So, on average, we could expect Netflix could end up with a 1.695% FCF yield. This is the same as multiplying the NTM FCF by 59x (i.e., 1/0.01695 = 59). Therefore, multiplying the NTM FCF by 59 produces a forecasted market value of almost $595 billion: $10.08b NTM FCF x 59 = $594.72 billion market cap forecast That is almost 15% higher than its present market cap: $595b / $518.4 billion = 1.147 -1 = +14.7% upside In other words, NFLX stock is worth 14.7% more than its price today, or about $1,400 per share: $1,220.08 x 1.147 = $1,399.43 target price, i.e., +14.7% Analysts Agree NFLX Is UndervaluedYahoo! Finance reports that 47 analysts have an average price target of $1,358.61, and Barchart's survey is $1,388.55. These average an upside of +12.6% in NFLX stock. So, between my 14.7% upside target and other analysts' +12.6%, the consensus is that NFLX is +13.65% undervalued. One way to play this is to both sell short near-term puts in out-of-the-money (OTM) strike prices, and to buy and hold longer-dated in-the-money (ITM) calls. That way, the investor can make money shorting the puts and potentially set a lower buy-in point as well as gain upside from the ITM calls. Shorting OTM Puts and Buying ITM CallsFor example, the $1,150 put option expiring on Nov. 14 (one month away) has a midpoint premium of $30.58. That is over 5.7% below Friday's close (i.e., 5.74% out-of-the-money), and the short put yield is attractive at 2.668%: $30.68 premium / $1,150 = 0.02668/100 = 2.668% one-month yield Moreover, the potential buy-in breakeven point (i.e., if NFLX falls 5.74% to $1,150 over the next month) is $1,119.32. That's -$100.76 per share lower than Friday's close, providing 8.3% downside protection.

Moreover, to gain from any upside in NFLX, the investor might consider buying the $1,160 calls expiring in 6 months on April 17, 2026, for a midpoint premium of $171.75. That means an investor has to only outlay $17,175 for 1 call contract that controls 100 NFLX shares - a lot less than paying $122K for 100 NFLX shares. In addition, if NFLX reaches my $1,400 price target by April, the intrinsic value of these calls is almost 46% higher than the cost: $1,400 - $1,150 = $250.00 $250 / $171.75 cost = 1.4556 -1 = +45.56% upside Moreover, if the investor can repeat the short put yield play for 6 months, the cumulative total of $184.08 (i.e., $30.68 x 6) would more than cover the $171.75 cost of the 6-month calls. That way, the investor can maximize the upside potential if NFLX continues to rise. In fact, it's possible that an enterprising investor could also short out-of-the-money calls in one-month out expiry periods (i.e., a poor-man's covered call play). These three option plays allow an investor to lower the downside risks and upside potential when investing in NFLX options. On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|