|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

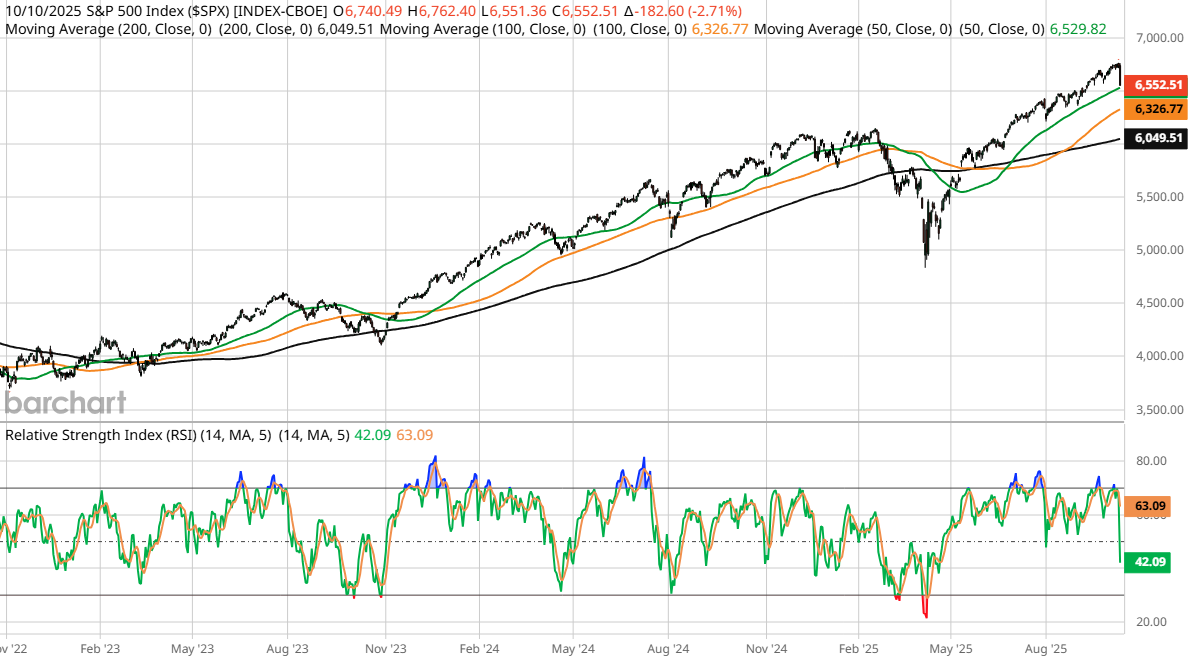

When The Market Structure Breaks: How To Survive The Next Phase

What looked like a routine pullback is turning into something much larger. The tone of the market has shifted, and this time it feels different. I warned this would happen, not because I predicted the market, but because structure always sends a signal before price does. You could see it building in the data, in sentiment, and in the way investors stopped asking why and started asking how much higher. The rally we just lived through was not built on fundamentals. It was built on liquidity, narrative, and AI-driven optimism. It was momentum disguised as stability. Now the test has begun. The market is asking its usual question: who knows what they own, and who has been renting? The Structural Shift We have moved from momentum to mean reversion. For nearly a year, the market rewarded speed, story, and scale. Investors could buy anything connected to AI or growth and feel brilliant by week’s end. Liquidity was abundant, and passive flows kept feeding the same narrow group of stocks. What looked like innovation was often just concentration risk disguised as progress. Now the structure has changed. Interest rates, credit conditions, and valuation discipline have re-entered the picture. Companies that relied on cheap capital and loose expectations are starting to crack under real cost pressure. The market is punishing weak balance sheets and speculative multiples again while rewarding cash flow and discipline. The illusion of stability is fading. Passive flows and blind optimism have suppressed volatility, which is now surfacing across sectors. The leaders who carried this rally are starting to underperform, and investors who mistook liquidity for safety are learning what structural risk really means. The easy money phase is over. What comes next will reward patience and preparation. The Current Pullback: Why It Feels Different We saw this pattern before. In 2021, the tech unwind punished growth without cash flow. In 2018, liquidity dried up and exposed leverage that had been ignored. The same dynamic is playing out again. Unprofitable tech, over-leveraged consumer names, and small caps dependent on cheap debt are leading the decline. These are the early casualties of tightening conditions that are now real, not theoretical. Higher real rates, a strong dollar, and risk repricing are amplifying the selling. This is structural pressure, not sentiment noise. Investors are being forced to reevaluate what survives when liquidity is no longer free. It is not the time to blindly buy the dip. It is the time to watch what bends and what breaks. Only then will the next real opportunity appear.  Behavioral Divide: Who Wins And Who Panics This is the point in the cycle where behavior separates professionals from the crowd. Institutions have already started to rotate quietly, trimming risk while liquidity is still available. Retail investors are still clinging to the same narratives that worked during the run-up, hoping for a return. Smart money sells liquidity. Emotional money sells panic. That difference determines who survives the reset and who gets trapped by it. Professional investors take profits into strength and hold cash as optionality. They do not see cash as weakness. They see it as power. The crowd reacts after the fact, turning confidence into fear only when prices confirm it. In moments like this, discipline beats conviction. Process beats opinion. The market rewards patience and punishes reaction, and right now most investors are still reacting. Portfolio Framework What To Do Now This is the time to act with structure, not emotion. Every investor needs a clear plan for navigating the next phase of the market.

What Comes Next The path ahead will not be smooth. Liquidity is tightening, and that alone creates the conditions for sharper, faster moves. A short-term crash is possible because leverage and optimism often unwind together. The market needs a cleansing phase, where excess positioning is forced out and the structure resets. The real opportunity will appear after that happens. This occurs after the forced liquidation, during which selling becomes indiscriminate and quality companies are traded as if they are broken. That is the point where fear overtakes logic and where patient capital finds value. This will follow a two-stage reset. First, valuations compress. Then, business models are repriced for a world with real costs, slower growth, and tighter money. The bottom will not be marked by headlines. It will be marked by exhaustion. Investors need both financial and mental liquidity to take advantage of what comes next. The market will test both. Those who can stay clear-headed will own the next cycle. The Edge Insight At The Edge, our focus has always been structure, catalysts, and behavior. Markets reward those who anticipate structural shifts, not those who chase performance after the fact. We have seen this movie before—the GE breakup, the Intel reset, and the Boeing dislocation. Each followed the same pattern. Structure broke long before sentiment changed. In every cycle, most investors react. Those who prepare will own the next opportunity. The difference is not intelligence; it is discipline. This period of volatility is not a warning; it is the price of opportunity. Every shakeout clears the field for those who can stay patient, think independently, and act with structure. Do not confuse noise with change. Volatility is how markets reset and transfer advantage. The goal is not to avoid it but to use it. When others are trapped by emotion, you should be guided by preparation. If this turns into a crash, it is not the end. It is the transfer of wealth from those who guessed to those who understood. The next cycle is already forming. The question is who will be ready for it. Takeaway The structural shift is here. The market is resetting. This is the moment to respect risk and prepare for opportunity. Taking profits now is not retreating; it is buying flexibility for what comes next. The best investors are those who are ready when the turn happens, not those who predict it. Cash is not fear. It is readiness. Every cycle begins with belief and ends with truth. The truth is showing up now. Make sure you are on the right side of it. On the date of publication, Jim Osman did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|